The Power of Compounding Wells Fargo Advantage Funds

Post on: 7 Апрель, 2015 No Comment

The Power of Compounding

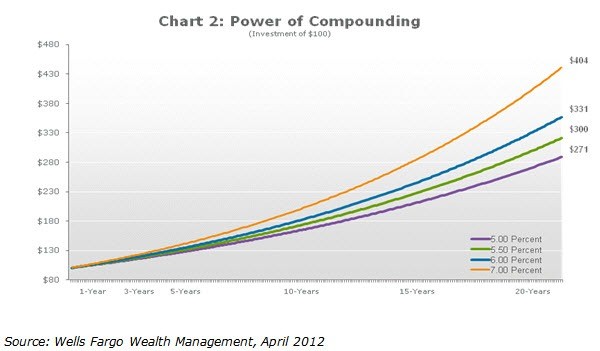

Compound returns offer one of the most powerful ways to build wealth. Compounding means earning interest on interest. Over time, the more interest (or returns) you reinvest, the more money you have working for you, and the more you can earn. Mutual funds offer an ideal way to capture compound returns.

Simple interest means you earn the same return on your investment every year. Suppose you invest $1,000 and expect to earn a 5 percent rate of return. At the end of one year, you earn $50 ($1,000 investment multiplied by 5 percent rate of return). Now you have $1,050 ($1000 initial investment plus $50 in income). Under simple interest, you would earn a 5 percent return in year two on $1,000, or another $50. But remember that your principal balance grew to $1,050 at the end of the first year. In effect, you would want to earn a return on your entire investment balance of $1,050 in year two, not just $1,000. That’s where compound returns come into play.

With compound returns, you earn interest on interest, or returns on your returns from prior periods. While the rate of return may be the same every year (or vary from year to year), since you reinvest the returns (interest or yield) every year, your investment balance grows and you earn more interest income. Of course, when you select investments such as equities, which fluctuate in value, you could lose more money as your investment balance grows.

Following the example above, suppose you invest $1,000 and expect to earn an annual return of 5 percent. At the end of the year, you would earn $50 ($1,000 investment multiplied by 5 percent rate of return). Then you decide to reinvest your initial investment of $1,000 and your year one return of $50. In year two, you have $1,050 working for you. Assuming you earn a 5 percent return in year two, with compound returns you would earn $52.50 ($1,050 multiplied by 5 percent). In year two, by reinvesting the income you earned in year one, you earn an extra $2.50.

Let’s repeat the example above, but now, you expect to earn a 10 percent return. At the end of the year, you would earn $100 ($1,000 investment multiplied by 10 percent rate of return). Then you decide to reinvest your initial investment of $1,000 along with your year one return of $100. In year two, you have $1,100 working for you. Assuming you earn a 10 percent return in year two, with compound returns you would earn $110.00 ($1,100 multiplied by 10 percent). In year two, by reinvesting the income you earned in year one, you earn an extra $10.

If you followed this strategy over the long term, your wealth could really multiply. If you invest $1,000 for 30 years, earn a hypothetical return of 10 percent, and reinvest all pf your earnings, you would accumulate more than $17,000. In year 30, your return would be $1,586.31; this is almost sixteen times that $100 return you earned in year one. And what’s so nice is that all you had to do was leave your money in your account. Remember, though, this calculation assumes you pay no income taxes on these earnings.

Mutual funds are designed to help you capture the power of compound returns. Every year mutual funds are required to distribute their income to their shareholders. These distributions come in two general forms: income and capital gains. Generally, the income distributed is your stake in the total amount of interest and dividend income generated by the fund’s holdings in that year. Capital gains represent net gains from securities the fund sold in that year.

To take advantage of compound returns through mutual funds, make an election to reinvest all distributions in the fund. In other words, instruct the fund to buy additional shares in the mutual fund in an amount equal to your distributions. Be sure to maintain complete records of all your reinvestments so you can compute your tax basis when you sell your mutual fund shares; this will help you minimize the amount of tax you’ll have to pay. By purchasing additional shares in the mutual fund, you have more money working for you, which helps you capture the power of compound returns.

While you’re at it, try to avoid selling mutual fund shares to pay your tax bill. To accomplish this strategy, you’ll have to accumulate cash/funds from other sources.

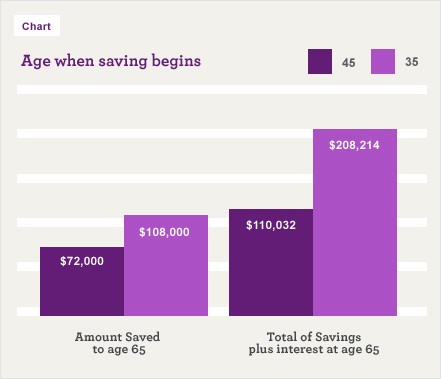

And another way to maximize the benefits of compound returns is to use mutual funds to accumulate wealth for retirement. When you invest through qualified retirement plans, including 401(k) and 403(b) plans and IRAs, your money accumulates tax-deferred until you make withdrawals. By reinvesting the distributions, you capture compound returns, and because your money accumulates tax-deferred until you make withdrawals, you don’t have to worry about income taxes along the way.

Be sure to structure your finances to capture the power of compounding. And in particular, consider using mutual funds to gain maximum benefit from compound returns. Keep in mind: The math shows this benefits long-term investors the most. Get started early, and have patience.

A program of regular investment cannot assure a profit or protect against a loss in a declining market. Since such a program involves continuous investments regardless of fluctuating share values, investors should consider their financial ability to continue purchases through periods of low price levels.

The writer, Joseph Gelb, is a CPA and attorney who co-authored the Personal Budget Planner – A Guide for Financial Success and authored How to Build a Million Dollar Service Business (Small Business Advisors, www.smallbusinessadvice.com).

2015 Wells Fargo Funds Management, LLC. All rights reserved. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services and Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo Funds Distributor, LLC. Member FINRA /SIPC. an affiliate of Wells Fargo & Company.