The Permanent Portfolio Allocation

Post on: 30 Март, 2015 No Comment

by Craig Rowland 18 December, 2008

Harry Browne and Terry Coxon formally introduced the Permanent Portfolio in their 1981 book entitled: Inflation Proofing Your Investments . Like most great ideas, the Permanent Portfolio was simple. but was not simplistic .

The Permanent Portfolio investment strategy is the first one Ive seen that developed an allocation based on economic cycle analysis. The Permanent Portfolio idea separated these economic cycles into four basic categories:

At any one time the economy will be in one of these phases or transitioning from one phase to another. This is the secret of the strategy and why it works. The strategy does not attempt to predict when these things happen or guess how long they may last. Instead, it holds specifically chosen asset classes that respond well to these cycles no matter when they happen or for how long.

By 1987, Harry Browne took the more complicated asset allocation presented in his and Coxons first book above and refined it to make it easier to implement. This version of the allocation was presented in his book Why The Best Laid Investment Plans Usually Go Wrong (Find a used copy if you can. Like all of Brownes books, its a must read.). The allocation remained the same in all his investing books that followed. Here it is (Preferred investment vehicle in parentheses):

- 25% Stocks (S&P 500 Stock Index Fund)

- 25% Long Term Bonds (US Treasury 30 Year Bonds)

- 25% Gold (Physical Gold Bullion)

- 25% Cash (Treasury Money Market Fund)

These assets are always present in the portfolio in a balanced way no matter what is going on in the economy. Why were these assets chosen? Because they respond to the four economic cycles listed above:

- Stocks During prosperity, s tock Index funds capture the full market returns available.

- Long Term Bonds During times of deflation, US Treasury long term bond prices will go up quickly in value. Bonds also do reasonably well during prosperity.

- Gold During bad inflation . gold bullion is the only asset that provides strong protection against a falling currency.

- Cash During a recession, no particular asset class is going to do well. The cash in a Treasury Money Market Fund acts as a buffer for losses while the markets adjust during these relatively short times of underperformance. It also does well during deflation.

Remarkably, these four asset classes are all you need to handle good and bad markets. Again, its simple but not simplistic.

Even better, this allocation provides safe growth of your money. This means you wont have to worry about the crazy swings in the stock market that may cause large losses of your life savings.

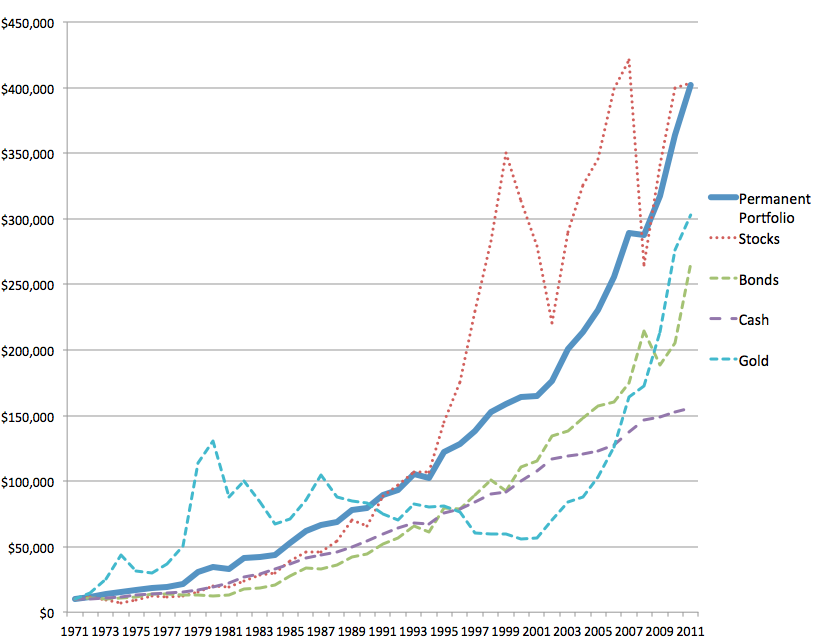

In fact, over the 30+ year history of this portfolio strategy the worst loss it ever had was about 4-6% in 1981 with an annual growth of 9-10% since 1972. The portfolio has prospered and protected its money through bear and bull markets alike.

What this means is the Permanent Portfolio strategy will move along through the years providing stable and secure growth.

How stable and secure? Well talk about that in my next post. But I feel if you combine the Permanent Portfolio with the 16 Golden Rules of Financial Safety you will have a very solid investing foundation that will get you to your ultimate destination in one piece.

In the meantime, if you havent purchased a copy of Fail-Safe Investing you should really consider doing so. This book explains the method to the strategy in a very easy to read and understand form. My postings here will clarify some common questions, provide you with insight into ways to implement the ideas, and delve deeper into the economic mechanisms that make the portfolio work.

Harry Browne also discussed the Permanent Portfolio Allocation in this radio show link.