The Perfect Technology ETF for Dividend Investing

Post on: 1 Август, 2015 No Comment

Recent Posts:

The Perfect Technology ETF for Dividend Investing

The world of dividend investing has traditionally been dominated by companies in the utility, financial and consumer goods spaces. These stalwart sectors are known to offer strong and consistent cash flow models that bode well for returning value to shareholders through quarterly dividend payments.

However, a new theme is emerging in the dividend world that is combining promising growth potential with cash-rich balance sheets. Large and mid-cap technology companies have been increasingly turning their profits towards stock buybacks and income streams with the intent of enticing fresh capital to their stock.

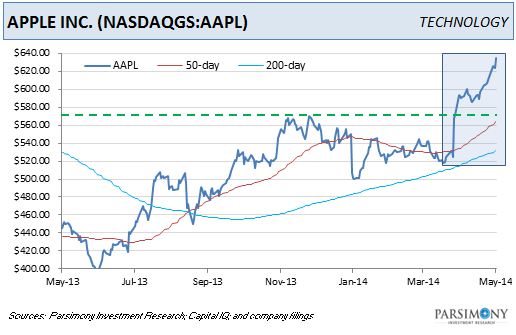

Companies such as Apple (AAPL ) and Microsoft (MSFT ) have undergone a transformation from growth-oriented powerhouses to value-added income names. While picking a few well-known dividend paying stocks within the technology sector is one way to play this theme, several ETFs offer exposure to this opportunity as well.

The First Trust NASDAQ Technology Dividend Index Fund ETF (TDIV ) is a specialized ETF that focuses exclusively on technology and telecommunication related companies that have paid a dividend in the last 12 months. Both AAPL and MSFT are in the top five holdings of TDIV, which calculates the weightings of the underlying stocks based on a modified dividend weighting methodology. This allows for a fundamental distribution of capital based on yield and sector makeup rather than market cap.

TDIV currently has over $700 million in total assets spread amongst a diverse group of nearly 100 dividend paying technology companies. The 30-day SEC yield of this ETF is currently listed at 2.66% and income is paid quarterly to shareholders. In addition, the expense ratio of TDIV is listed at a modest 0.50% annually.

This ETF can potentially be used within the context of a diversified income portfolio as a tactical allocation that over weights the large-cap technology sector. Many of the underlying companies in TDIV are stable, global growth stories that have continued to offer strong momentum as well.

So far this year, TDIV has gained 10% in total return and has been closely mirroring the strength of the sector benchmark Technology Select Sector SPDR (XLK ). In addition, TDIV offers a dividend yield 50% higher than the current 1.72% yield on XLK.

Interestingly enough, many broad-based dividend ETFs are also starting to include larger allocations to technology companies as well. The Vanguard High Dividend Yield ETF (VYM ) is one example of an ETF that tracks nearly 400 income stocks across all sectors that has its largest allocation to the technology sector at 17.60%. In addition to significant exposure to AAPL and MSFT, VYM also has benefitted from the strength in Intel (INTC ) and Cisco Systems (CSCO ).

VYM currently has over $9 billion in total assets and offers a current 30-day SEC yield of 2.98%. In addition, this ETF charges an ultra-low 0.10% expense ratio that makes it an attractive proposition for fee-conscious investors .

Those seeking to increase the yield of their portfolio while still maintaining an eye towards capital appreciation may find that these ETFs meet their criterias for equity income. Furthermore, the changing landscape of interest rates may further increase the value of these technology enterprises as they are less sensitive to fluctuations in bond yields than alternative sectors such as utilities.

Ultimately, these dividend vehicles add another tool in your income arsenal to successfully navigate the markets’ fickle machinations.

Download our latest special report on dividend paying ETFs: The Ultimate ETF Income Guide .