The Next Time the Market Sells Off This is What Traders Should Buy

Post on: 16 Март, 2015 No Comment

By Jim Woods on October 31, 2013

During bull markets, Wall Street traders like to buy the dips. This mantra was the order of the day, literally, when I was a hedge fund trader during the tech bull of the 1990s. Over the past year, the buy-the-dip philosophy has served traders well, as stocks have largely rebounded from every minor incursion into the red.

Now, however, the market is experiencing much more than mere dips. Today, we are getting something akin to air pockets, meaning we are seeing some very sharp sell-offs in stocks in reaction to the news.

The latest of these air pockets came during Wednesdays post-Fed-meeting trade, as the market dropped sharply before rebounding off the session lows. The culprit here was fear that the Federal Reserve still hadnt ruled out the possibility of a December tapering of its current $85-billion-per-month bond-buying program.

Basically, I think traders got a little too complacent over the prospect of the Fed holding off tapering until 2014. The possibility, however remote, of a taper in December caused some skittish money to cash in.

Still, there are a lot of underinvested money managers and other professional investors that are essentially being forced into this 2013 market rally so they dont look incompetent in front of their clients. What this means is that if the markets hit an air pocket such as the one caused by the Fed Wednesday, it can — and most likely will — be seen as a green light to get long stocks at an attractive price.

As my colleague Tom Essaye of The 7:00s Report put it: Like weve seen so many times this year, the creation of air pockets in stocks, where they can drop sharply and violently as weak longs jump ship at the first sign of trouble, has been a nice buying opportunity. And, based on recent history, we should expect more of these short-lived, sharp drops.

For traders looking to make money buying these air pockets without picking individual stocks, buying leveraged ETFs pegged to two of the markets major indices may be the way to go. Be careful here, though, as both of the following funds come with a lot of potential volatility and downside if youre wrong. So, make sure you place firm stop-loss orders in each along with your buy orders.

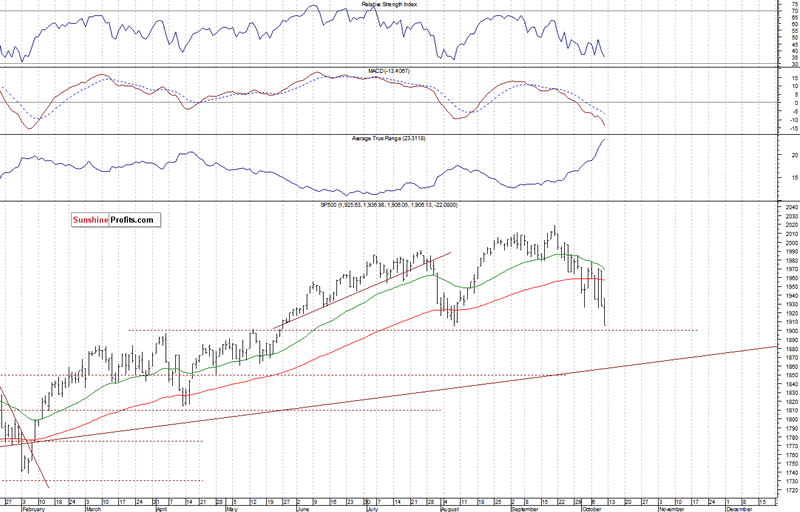

ProShares Ultra S&P 500 (NYSE: SSO )

This fund is designed to deliver twice the upside price performance of the benchmark measure of the domestic equity market, the S&P 500 index. SSO is trading just below its 52-week high, and the next air pocket could be another fantastic buying opportunity. That was the case in June, August and early October, and its likely to be the case again.

Recommended Trade Setup:

— Buy SSO on the next market sell-off

— Set stop-loss 10% below buy price

— Set initial price target 10% above buy price

Keep in mind that leveraged ETFs often work well as shorter-term trades, but they are not meant to be long-term holds.

ProShares Ultra Russell 2000 (NYSE: UWM )

This fund is designed to deliver twice the upside price performance of the small-cap Russell 2000 index. Like SSO, UWM has rewarded traders who bought the air pockets this year, a trend that can clearly be seen in the 52-week chart below.

If market history repeats itself, as it so often does, then the next air pocket will likely result in some nice trading profits for those who get long UWM.

Recommended Trade Setup:

— Buy UWM on the next market sell-off

— Set stop-loss 10% below buy price

— Set initial price target 10% above buy price