The Morningstar Mutual Fund Style Box Explained

Post on: 16 Март, 2015 No Comment

Almost twenty years ago, Morningstar created a way for investors to quickly understand what type of mutual fund or stock they were considering buying. Most investors understand the importance of diversification across asset classes and the Morningstar Style Box allows you to easily classify stocks and spread your risk around different asset classes and investing styles.

Morningstar is the leading research company that provides independent research and analysis on over 350,000 stocks, mutual funds, commodities, futures, options and other investments to both individual and institutional investors.

What Is the Morningstar Style Box?

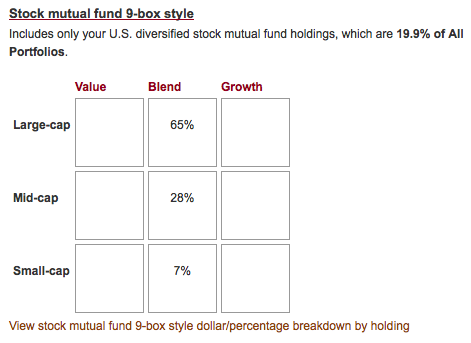

The Morningstar Style Box a graphic way of breaking down stocks and mutual funds into asset classes and styles. The box is a nine square grid, in which each square represents a certain type of stock based on investing styles and capitalizations.

The box divides stocks and mutual funds into either growth or value classifications along the vertical axis, then the style box further dissects the investments by their market capitalization on the horizontal axis. Where the two lines meet in the middle is the type of stock you have.

The Difference Between Large-, Mid- and Small-Cap Stocks

The capitalization of a company, or market capitalization, is almost always referred to simply as the market cap. It is a measurement of the size of a company based on its stock price and the number of shares that are traded.

Market capitalization is measured by multiplying the number of outstanding shares of a company by the current stock price of that company. There are many different benchmarks and definitions of what exactly the cut off scores are that makes a stock specifically a large-cap or small-cap (or somewhere in the middle). Morningstar defines the 250 largest companies (approximately 70 percent) in the United States as large-cap, the next 750 largest as mid-cap (20 percent of all stocks) and the remaining stocks as small-caps (over 4,000).

Understanding Growth Versus Value Stocks

Once again, the investing community has not established hard, fast and concrete rules dividing stocks into growth and value categories. In fact, Morningstar uses a combination of a proprietary growth and value score to rate stocks. They use criteria such as long-term projected earnings growth when compared to other stocks in the same market cap category, historical earnings growth, sales growth, cash-flow growth and book-value growth.

Those are just the factors dealing with the growth rate of a company that Morningstar uses to determine whether a stock is a growth or value stock. Value scores of a stock are based on certain criteria such as price-to-book, price-to-sales, price-to-cash flow and dividend yield.

In the simplest of terms, growth stocks have a potentially high future returns while the company grows, and value stocks have a low price-to-book ratio and are the prey of bargain hunters searching for good stocks that trade at a value less than what people think they are intrinsically worth. Seventy percent of all stocks are considered growth stocks and the rest are considered value.

Why You Should Care About the Style Box

Owning stocks in each of the boxes will help you build a better investment portfolio. If you have a majority of your nest egg in one box, you might not be as diversified as you think. The style box shows you an easy to read representation of your mutual fund or stocks characteristics. It allows you to easily compare one stock to another.

Another great use of the Morningstar Style Box is to double check the mutual fund manager of your investment fund. You bought your mutual fund with the understanding that it invested in, for example, large capitalization growth stocks. Morningstar does the work for you and plots all of the stocks in that mutual fund and determines if that fund manager is indeed following his or her investing style and philosophy.

Whether you want a balanced portfolio or you want to ensure the mutual fund you invest in is following the investing style they promised you, you need to understand the types of stocks and mutual funds you own. The Morningstar Style Box is a simple way for investors to quickly classify their investments on a graphic diagram. Using the style box will help you be a more well-rounded investor with more diversification .