The Math of Pairs Trading Execution – Part I

Post on: 10 Апрель, 2015 No Comment

As developers of pairs trading execution software for the past 17 years, we found that the term ‘pairs’ is a somewhat nebulous catchall phrase for many different trading strategies. These include risk (or merger) arbitrage, statistical arbitrage, cross border arbitrage, dual share class arbitrage, leveraged ETF arbitrage, inverse ETF arbitrage, multi-legged spinoff arbitrage, various ‘long/short’ strategies and others. Developing tools for all of these strategies has been interesting and fun, with plenty of challenges. We thought it might be interesting to address some of the math behind the execution of the various strategies.

Because these trading strategies evolved as separate disciplines, it is not surprising that most of them have their own way of looking at the strategy along with separate terminology. The distinction is so great, that some of our customers don’t even consider themselves ‘pairs’ traders.

When developing software for similar but different strategies, one must try to understand the commonality of the strategies and design an underlying model that accommodates as much of it as possible. Having a good underlying model as a base makes a huge difference in a whole lot of ways that are critically important to building dynamic software products.

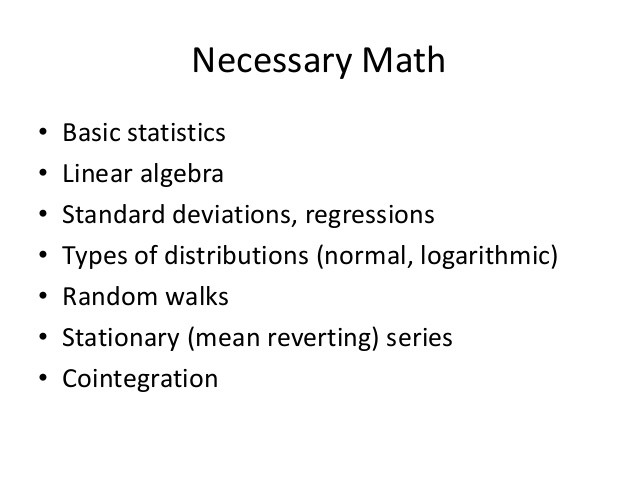

Although there is much more to a pairs trading execution platform than the underlying math, it is an important component and the subject of this multi-part article. None of the math is complex, but some of the scenarios make things a bit complicated. In this first article, we’ll focus on basic pricing for a couple of simple strategies, then address specific strategies more thoroughly in subsequent articles.

Let’s look at a couple of examples of basic pairs trading strategies and then try to see what they have in common.

Risk arb involves one company acquiring another company, often by exchanging its own shares for those of the target company at a specified ratio with some sort of cash component. (Deals can be lots more complicated, but we will use a simple one for our purposes.) The trader wants to execute the appropriate amount of the two securities at the correct relative prices, so the execution platform will need to know the correct relative prices of the two securities at any given point in time.

Typically a trader would short the acquirer (Company A) and buy the target (Company B) at some discount to the ‘fair value’ represented by the terms of the deal. So, let’s say company A will acquire company B. Company B will receive .44 shares of Company A plus $4.50 in cash. Let’s say the trade wants to make .50. So, the general formula would be:

Target Company price = (Acquirer Company Price * Share Ratio) + (Cash Component – Trader’s Profit).

So in this example, the formula becomes:

Company B Price = (Company A price *.44) + ($4.50 — .50).

Let’s throw these into a spreadsheet and calculate the price we would be willing to pay for Company B for a range of prices for Company A.