The iron condor_1

Post on: 19 Июнь, 2015 No Comment

by Ryan Barr on March 11, 2006

Ive been looking through my logs and stats and noticed that quite a few people have stumbled across this site in search of the iron condor. As a result, Im going to dive into my favorite little option trade and talk about the iron condor!

Lets start by defining what on earth this crazy iron condor really is. Basically, its 4 options put together to create what some folks call a wing spread. The condor is composed of two strangles or two vertical spreads depending on how you want to look at it. Im going to talk about the iron condor as though you are selling them, mainly because that is what I do!

Typically, you want to use an iron condor when you are directionally neutral for a given security or index. The goal is to sell the condor, take in a bit of money for the time remaining on the trade and then watch it decay.

Constructing an Iron Condor

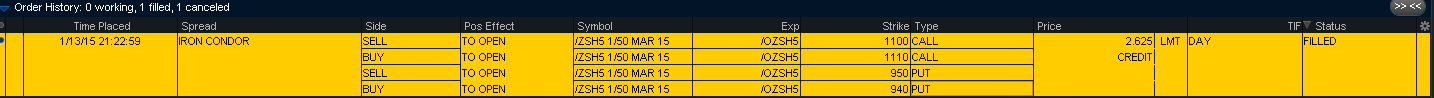

As stated earlier, the iron condor is made up of 4 different options, each with a different strike price. In order to setup a condor, you will need 2 put options and 2 call options. The calls will be at the top of the condor and the puts will be at the bottom of the condor. The put side, or bottom of the condor will be created using a bull put spread and the call side will be created using a bear call spread .

Here is an example Let pretend that you are neutral on the SPX for the next month and a half or so. Given that, it may be a good idea to put a condor on! So using the current scenario for the SPX lets find a trade

Finding the Strikes

Given the current prices of the value of the SPX $1281.58 and its recent history, Im pretty comfortable saying that the SPX wont break the 1360 mark in the next 45 days. Im also comfortable saying that the SPX wont go below the 1180 mark in the next 45 days. Given those two numbers, lets see whats out there.

- 1360/1375 Bear Call Spread

- Entry target of $0.40 Credit

- 1180/1164 Bull Put Spread

- Entry target of $0.40 Credit

- Margin: $1,500 Per Contract as my buddy Mike Parnos at the CTPI says, if you have the right broker!

- Credit: $80 Per Contract

- Return: 5.33% over about 40 days

- Risk: According to my trusty tools from thinkorswim its about 92.62% likely to succeed!

Now, this isnt a trade that I would normally put on its just not a big enough return for me over that period of time. Very likely, I would take a look at closer strikes and see if I can find another trade. But you can see how a condor can come together!

Review

Lets take a look once more Iron condors are directionally neutral positions In theory you could use the condor as a volatility play hoping that a stock/index will move dramatically in either direction I like to use them as a box of sorts, picking to strike prices I think are far enough away from the current price of a security to be safe and then sell the condor, take the cash, earn some interest and watch time decay!

So, thats an iron condor Feel free to leave your comments and thoughts, Id be happy to discuss this awesome little tool with you!