The IRON CONDOR

Post on: 19 Июнь, 2015 No Comment

Behold! The Iron Condor! :

- Iron Condor, What’s the Big Deal?

At some brokers, an Iron Condor position can generate more bang for the buck, as they allow the margin required for the Iron Condor to be the maximum of the margin required for the bull-put or bear-call position, instead of the sum of the margins. Some brokers allow this special margin consideration for the Iron Condor since for an Iron Condor, both spread positions (bull or bear) cannot suffer a loss simultaneously. For example, an Iron Condor position consisting of a bull-put position and a bear-call position with each position separately requiring $10,000 of margin and having a potential return of 5% would have a joint potential return of 10% for trades with brokers allowing for the special margin consideration, potentially doubling the return of an investment. Additionally, the Iron Condor position aids in alleviating losses because even when one of the spread positions (bull or bear) incurs a loss, the remaining position generally remains profitable and helps reduce the overall loss and occasionally the profitable position can even overcome the loss of the other position producing an overall profit.

What if the Market is not Neutral?

Large market movements do happen occasionally, causing potential problems for Iron Condor positions, however, the Iron Condor position has some flexibility for managing volatile market conditions through the judicious closing of positions with a high likelihood of experiencing a loss.

Example :

For example, suppose the bear-call position of an Iron Condor on an index has a short option strike price of 1000 and a long option strike price of 1100, as long as the underlying index closes below 1000 at expiration, the bear-call position will be profitable. But, after initially entering the Iron Condor position the market moves higher and appears it is going to continue to move higher, and the index price is getting close to the short strike price of 1000. At this point, totally exiting the bear-call position (closing the short and long call option positions) will most likely incur a loss. However, closing only the short option position has the potential to alleviate a loss, because if the market continues moving higher the long position may increase in value, reducing the loss and possibly even resulting in a profit. The drawback to the strategy of only closing the short option is that a market reversal could result in an even bigger loss due to the decrease in the value of the open long position, but many times in a stop-loss situation the long position is small in value and the additional loss incurred by a market reversal is small and worth the gamble.

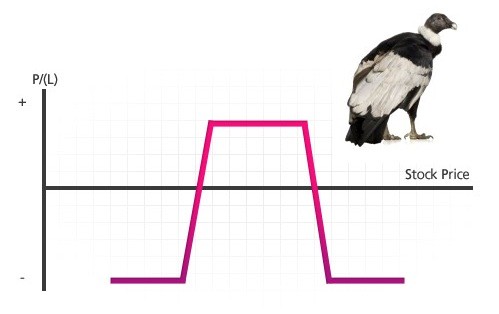

The Iron Condor Spread strategy is a neutral strategy similar to the Iron Butterfly. In the Iron Condor, an investor will combine a Bear-Call Credit Spread and a Bull-Put Credit Spread on the same underlying security. By doing this, an investor will potentially be able to double the credit obtained over a single spread position. Since there are two spreads involved in the strategy (four options), there is an upper break even and a lower break even. A profit is made if the stock remains above the lower break even point or below the upper break even point.

Enter a Bear-Call Credit Spread (Sell a Call at or out-of-the-money. Buy a Call one or more strikes above sold Call in the same target month).

Enter a Bull-Put Credit Spread in the same month, on the same stock (Sell a Put at or out-of-the-money. Buy a Put one or more strikes lower than Sold Put in the same target month).

An investor will receive a net credit from both positions. The total net credit is the maximum profit. The maximum profit is earned if the stock price remains above the sold put strike and below the sold call strike.

The upper break even is the sold call strike price plus the total net credit.

The lower break even is the sold put strike price minus the total net credit.

A profit is realized at any price above the lower break even or below the upper break even.

The max. risk is the difference in strike prices on either spread minus the net credit.

Advantages of this strategy :

This is a NEUTRAL strategy. A profit can be realized anywhere above the lower break even or above the upper break even.

The double credit achieved helps lower the potential risk.

The risk can be controlled by setting your spreads further OTM.

Potential returns are increased over a single Bear-Call or Bull-Put spread.

Losses are limited if the stock goes against you one way or the other.

If you are facing a large gain or drop in the underlying you could only close one leg of the four legs in the position.

No stock is actually owned (uncovered position).

Cautions with this strategy :

Commission costs to open the position are higher since there are four trades; might be cost prohibitive to trade iron condors that are low net credits.

BUY CONDOR .

The condor takes the body of the butterfly—two options at the middle strike—and splits it between two middle strikes rather than just one. In this sense, the condor is basically a butterfly stretched over four strike prices instead of three. Call option with low strike bought and two call options with two medium strikes sold and call option with high strike bought. The same position can be created with puts.

WHEN TO USE. you believe that the stock price will fluctuate in a trading range.

PROFIT. limited, reaching maximum between medium strikes.

LOSS. maximum loss realized if stock ends below low strike or above high strike and limited to net credit paid. For each point above low strike or below high strike, loss decreases by additional point.

RISK. limited to the difference between strike prices [multiplied by] the amount of shares [minus] the net credit received.

REWARD. limited to net credits.

TIME DECAY. This position is a combined asset. As time passes, value of position increases/erodes toward expiration value. If volatility increases, increase/erosion slows; if volatility decreases, increase/erosion speeds up.

________________________________________________________________

SELL CONDOR .

The condor takes the body of the butterfly—two options at the middle strike—and splits it between two middle strikes rather than just one. In this sense, the condor is basically a butterfly stretched over four strike prices instead of three. Call option with low strike sold and two call options with medium strikes bought and call option with high strike sold. The same position can be created with puts.

WHEN TO USE. you believe that the stock price will move substantially.

PROFIT. limited to initial credit received.

LOSS. limited to the difference between the lower and middle strikes minus the initial spread credit.

RISK. limited.

REWARD. limited.

TIME DECAY. This position is a combined asset. As time passes, value of position increases/erodes toward expiration value. If volatility increases, increase/erosion slows; if volatility decreases, increase/erosion speeds up.

The Long Condor

Once again, the condor takes the body of the butterfly — two options at the middle strike — and splits it between two middle strikes rather than just one. In this sense, the condor is basically a butterfly stretched over four strike prices instead of three.

Long 70 call, Short 75 call

Short 80 call, Long 85 call

You can also view a condor as a combination of a bull and bear call spread.

Long 70 call, short 75 call (bull call spread)

Short 80 call, long 85 call (bear call spread)

The long condor can be a great strategy to use when your feeling on a stock is generally neutral because it’s been trading in a narrow range. Like the butterfly, the condor is a limited risk, limited reward strategy that profits in stagnant markets. Imagine that a stock trading at $75 has been relatively flat for some time. If you think the situation is unlikely to change, you can sell one 75 call and one 80 call. At the same time, you’d buy one 70 call and one 85 call as a hedge in case the market moved against you. This combination of options creates the long condor. The position is considered long because it requires a net cash outlay to initiate.

Long Condor

Sell 1 75 Call @ $6.00 — ($600) (condor body)

Sell 1 80 Call@ $4.00 — ($400) (condor body)

Buy 1 70 Call @ $9.00 — $900 (wing)

Buy 1 85 Call @ $2.00 — $200 (wing)

Cost of Trade. $100 ($1,100-$1,000)

* Note: the same position can be established using puts.

The profit/loss above does not factor in commissions, interest, or tax considerations.

In this case, the maximum profit is achieved at expiration with the stock between 75 and 80. At $75, the 75, 80, and 85 calls would expire worthless and the 70 calls would be worth $500. Thus, you would achieve your maximum profit of $400 ($500 — $100 initial debit). Between 75 and 80, the loss on the short 75 calls is more than offset by the 70 calls. Since the 80 and 85 calls would again expire worthless, the value at expiration is the same as the value of the 70/75 bull call spread ($5).

At any price above $85 or below $70, you would experience the maximum loss of $100.

The Short Condor

When your feeling on a stock is that it’s about to move one way or the other, but you’re not sure which way, the short condor can be an effective strategy. Like the long condor and long butterfly, the short condor is a limited risk, limited reward strategy. In this case, you would buy one 75 call and one 80 call. At the same time, you’d sell one 70 call and one 85 call as a hedge in case the market moved against you. This combination of options creates the short condor. The position is considered short because you will collect a credit for making the trade.

Note. the same position can be established using puts.

With this spread, the maximum profit is limited to the $100 credit received when this trade was initiated. At expiration, if the stock is above $85 or below $70, you’ll keep the $100. The $400 maximum loss for this position will occur between $75 and $80 where the profit on the 75 call is more than offset by the loss on the short 70 call. Meanwhile, the 80 and 85 calls would expire worthless.

Short Condor

Buy 1 75 Call @ $6.00 — $600 (condor body)

Buy 1 80 Call @ $4.00 — $400 (condor body)

Sell 1 70 Call @ $9.00 — ($900) (wing)

Sell 1 85 Call @ $2.00 — ($200) (wing)

Credit from Trade. ($100) ($1,100-$1,000)

* The profit/loss above does not factor in commissions, interest,dividend or tax considerations.