The Importance Of Diversification

Post on: 6 Сентябрь, 2015 No Comment

Over the last 4 months, there has been some disruptions in the markets which can cause fluctuations in a portfolio. If you are not confident in your investments and strategy, you may be susceptible to making harsh investing decisions. It’s important to have a strategy you believe in and to diversify your portfolio.

My portfolio diversification has allowed me to not really have any major impact on my portfolio during the October pullback and the recent oil pullback. While I have some oil investments that have pulled back, it has not made any major dent in the overall value of my portfolio. I continue to hold and use patience.

Performance of a Diversified Portfolio

Just to show how diversification can play, here is how my portfolio has fluctuated. The thick lines are US and CDN indexes and the other four are my separate accounts. RRSP is mostly US investments which shows a good correlation to the S&P500 but my other accounts don’t trend like the index except for my taxable account which is mostly banks, telecom and energy. The big dip in the indexes was in October but it doesn’t show in my portfolio.

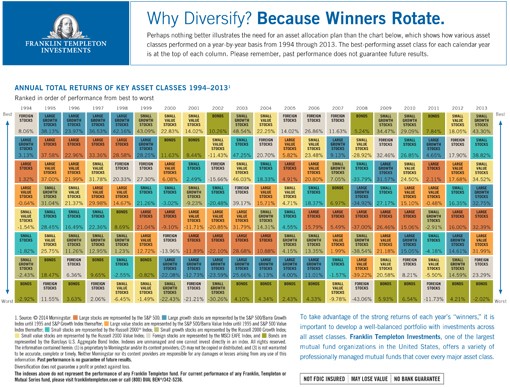

Diversification Approaches

Sector Diversification

Probably the most important diversification approach is to spread your investments across many sectors. When you start, this is a tough approach as you don’t have many investments and you may just start with indexes but over time, you will want to manage the diversification.

The growth in my portfolio has led me to the following diversification. It was not always like that, I was quite overweight in banks, telecoms and utilities for a while.

There are some sectors that cannot easily be invested in without investing outside Canada.

For those that have company plans where you purchase ESPP or receive stocks, it’s important to include that in your portfolio. You don’t want to be too over-exposed to one company.

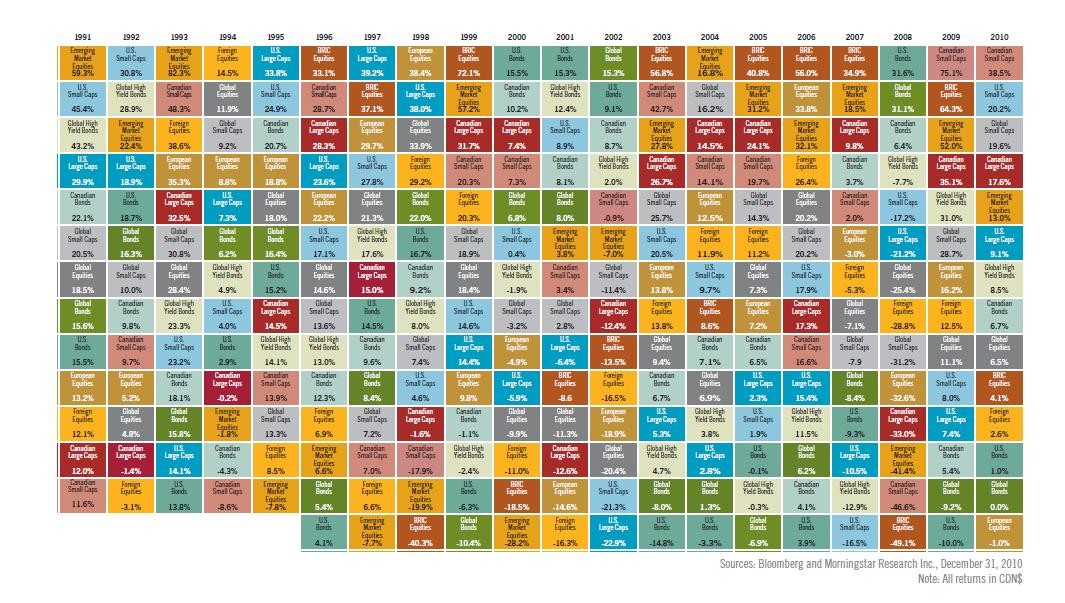

Country Diversification

While we may live in a world economy with inter-linked economies, not all countries have the same economies. It’s important to understand the other economies and to be careful with the home country bias. Canada is a relatively small market compared with other developed nations.

My strategy is to invest in US international conglomerates which gives me the exposure to many other countries including the US. That way, I can avoid investing directly outside North American companies.

Currency Diversification

One major diversification strategy I have put in place for my portfolio has been to diversify with the US dollar. It’s not that I have been trading currencies but rather that I have been investing holding many investments in US currencies including Canadian corporations that trade on the NYSE. A major part of this diversification is my international diversification but another part was to leverage the strength of the US currency. When the CDN dollar was on par or above the US dollar, I bought many US conglomerates.

It’s very easy to exchange currency between CDN and US dollars. I used 2 approaches:

- I buy a Canadian company on the TSX which also trades on the NYSE and then journal the shares over to the US exchange through my discount broker. I use this approach when I intend to hold the actual company but earn US dividends.

- I exchange my currency using the Norbert Gambit strategy with DLR and DLR.U.

Investment Diversification

This is probably one of the most challenging diversification as you want to decide how much you invest in income or growth products or choose between having cash on hand or bonds. Your decision can play a crucial role in the growth of your portfolio if you choose to play it safe too early. It is the one type of diversification that should change based on your age as you near retirement.

At this point in my life, I am mostly focused on growth investing while having my RESP account in income investing. So far, my diversification has provided my portfolio with stability during down markets.

Readers: How do you diversify?