The Impact Of Taxation On Investment Decisions And CFC Transfer Pricing

Post on: 5 Сентябрь, 2015 No Comment

Corporations pay a variety of taxes, which are determined by numerous factors, based on the companies’ physical location and nature of the business. To avoid taxation in more than one location or country, businesses do careful tax planning that takes into consideration more than one country’s taxation system.

There are two main approaches to businesses paying taxes: the worldwide and the territorial. These are based on considerations of fairness and efficiency, and they have drawn some controversy because it appears that a territorial taxation system — under which a country imposes taxes on the worldwide income of its residents thus avoiding double taxation — is superior to a worldwide system that offers deferrals and/or exemptions. The U.S. is using the worldwide taxation system, which means that any American company’s income is subject to both taxation systems, the foreign country’s and that of the U.S.

To reduce double taxation, the U.S. government provides tax credits equal to the taxes paid in the foreign country and deferrals until the income is received in the U.S. in the form of cash or dividends. Income tax laws, rules and regulations impact corporate investment and transfer pricing decisions. The Controlled Foreign Corporation (CFC) tax guide states that a U.S. person can be a shareholder of a foreign corporation who is not required to pay U.S. income taxes on the income of the corporation, until that income is distributed to the U.S. owners as dividend or salary. U.S. shareholders of a CFC are subject to income tax on certain income of the corporation and, generally, foreign investment income and certain kinds of foreign source business income are subject to U.S. taxation.

Definition of a CFC

A CFC is a corporation in which U.S. shareholders own more than 50% by vote or value of the foreign corporation. A U.S. shareholder is one who owns 10% or more by vote of the foreign corporation. Shareholders that own directly or indirectly 10% or more of the foreign corporation stock are included in the more than 50% ownership test.

Corporate Tax Considerations

A foreign corporation, whether owned by U.S. shareholders or foreign shareholders, may be subject to U.S. income taxation. If the foreign corporation has business income based on a U.S. source (IRC Section 861) and is effectively connected with the conduct of a U.S. trade or business, or if the foreign corporation has a permanent establishment in the U.S. then it is subject to U.S. taxation. The foreign corporation, regardless of who the shareholders are, will need to file a Form 1120 and pay U.S. corporate income taxes on its U.S. source income from a trade or business in the U.S.

If the foreign corporation is subject to U.S. income taxation and it also has U.S. shareholders, then later distributions to those shareholders, if treated as dividend distributions. will be subject to an additional personal income tax (double tax, since the corporation receives no deductions for dividends paid). However, this is the same treatment as dividends received by U.S. shareholders of U.S. corporations. The U.S. has no taxing authority over a foreign corporation with no U.S. source income and no permanent establishment in the U.S. However, U.S. tax laws do have taxing authority over U.S. shareholders of foreign corporations. (For more information, also see Understanding The U.S. Tax Withholding System .)

CFCs operate within varying tax authorities, which generate revenue either from direct or indirect methodology. The distinguishing factor is how the tax is applied, either directly to reported income or indirectly through some other measurable component of the subsidiary.

The typical taxing methods are the corporate income tax, withholding tax and value added tax. The corporate income tax is applied to a corporation’s reported income. The withholding tax is applied on passive income owned by the corporation in another country. The country where the income was originated withholds taxes, since the receiving corporation is under no formal obligation to report income received outside its own taxing jurisdiction. A value-added tax is a national sales tax collected at each stage of production or consumption of a good. Often, based on the political climate, the taxing authority exempts certain necessary living items, such as food and medicine from the tax.

Impact of Corporate Taxation on Corporate Investment Decisions

Corporate income tax and the company’s attitude toward risk are two of the largest factors that contribute to corporate decision making because either one can negatively impact a corporate investment by reducing its potential return. Corporate taxation is a very important factor in the financial investment decision-making process because a lower tax burden allows the company to lower prices or generate higher revenue, which can then be paid out in wages/salaries and/or dividends. The income tax of a potential domicile for a subsidiary company would be a location (tax haven) with the lowest tax rate, which would increase the company’s net income as well as the amount of cash kept by the subsidiary and in turn by the parent company.

Additional factors to consider are the political and economic stability of the foreign country, the level of potential risk and uncertainty, the depreciation rate and the costs of concessions, pre-production development, etc. Reviewing the weighted cost of capital, a lower tax rate tends to lower the effective cost of debt for the corporation. The value-added tax (VAT) is, in effect, a sales tax with payment documentation from one stage of the production process to another that increases the importance of tax credits because the seller collects the tax for goods or products sold, and then receives credits for VAT already paid earlier in the production process. The withholding tax is an indirect tax levied on passive income such as dividends, royalties and interest that corporations pay out to non-residents (people or business entities) in another tax jurisdiction.

By establishing bilateral tax treaties to categorize the various passive income withholding rates, corporations manage to avoid double taxation on both themselves and their subsidiaries in the countries where such treaties exist. This further reduces the significance of withholding taxes and their impact on dividend decisions.

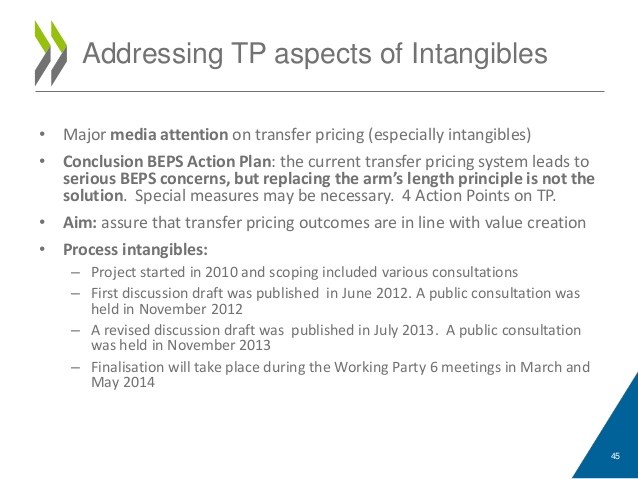

Transfer Pricing

Transfer pricing (TP), which accounts for about 60% of work trade, is a cash management method that allows the bookkeeping cost of goods to be transferred from the parent company to a branch or from one branch to another. The sale that creates the transfer is internal, and the cost tends to be flexible; it is within this flexibility that there is the potential to move funds from high tax and weak currency environments in ways that are beneficial to a corporation. Basically, TP is a method that allows corporations to circumvent host currency transfer controls and tariffs that are carefully reviewed by host governments. Domestic corporations have multiple ways to obtain a transfer price from one subsidiary to another; however, multinational companies with foreign subsidiaries face increasing pressures since the value of goods, services and the technology involved increase their cash outflows to pay taxes. TP opens the door for potential tax manipulation by charging higher-than-market transfer prices where countries have lower tax rates and allows for financing by charging lower than market transfer prices.

There are three common methods for determining transfer pricing:

1. The comparable uncontrolled prices method

2. The resale prices method

3. The cost-plus calculation method

A comparable uncontrolled price is the price a multinational corporation can obtain by selling goods to an independent company. This is the simplest way of determining resale prices for tangible goods among related parties and it tends to be the most reliable of the three methods provided the available information allows pricing. However, this method requires that similarity in functions and transactions among unrelated parties be used for comparison — meaning that the goods need to be standardized enough to be sold on an open market.

The resale pricing method compares the gross profit realized from the resale of tangible goods to a related party to the profits realized by comparable entities in uncontrolled transactions.

The cost-plus calculation method is mostly used in cases of assembling or manufacturing of goods or in any other phase of the production process of tangible goods that are sold to related parties. This method determines the resale price of tangible goods by measuring the comparable uncontrolled cost of manufacturing the good and by adding an appropriate profit margin.

Conclusion

Prior to deciding on a location for a CFC, corporate management considers the local tax laws and reviews the tax rates of possible locations in conjunction with the form the company operations will take. As well, the company must look at the conditions for favorable transfer pricing and location-specific withholding agreements.