The Highest Dividend Stocks

Post on: 13 Август, 2015 No Comment

The Highest Dividend Stocks

The Highest Dividend Stocks Are They the Best Bet?

When deciding where your investment dollars should be placed, the highest dividend stocks may not always be the best bet. Why? When doing your stock investment research, be on the lookout for factors that affect a company’s stability. The last thing you want to do is invest in stock that is artificially inflated on the charts and think you will get great dividends, and then the company and the stock crash.

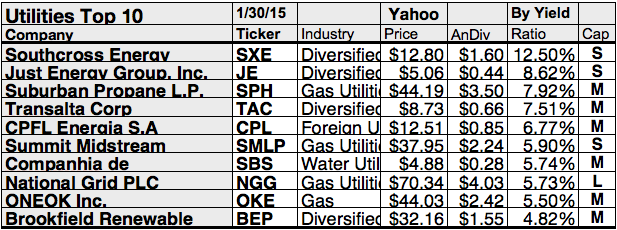

That being said, a savvy researcher can provide you with a highest dividend stocks list that has been thoroughly sifted through. This process eliminates the risky stock and only retains those companies which are built on solid business fundamentals, have a track record of stability and generous payouts from their high yield dividend stocks .

The Highest Dividend Stocks What Can You Expect?

If you are hoping for a dividend income, there are some things to get educated about. Where to buy the high paying dividend stocks. how to compare one stock to another so you can make the best informed purchasing decision, and how to buy the stock. You will want to know what these terms mean: declaration date, payable date, record date and ex-dividend date. What is dividend capture and why is this important to investors?

When you are studying stock charts at NYSE, Dow-Jones, TSX or some other Stock Exchange, you will notice that there are a lot of abbreviations on the charts. These entries give you a lot of different information about each stock. Sometimes more information is better when trying to make a decision, but sometimes it can feel like you are drowning in a sea of information overload. Some of these columns of data can be filtered out so that you are only looking at the data you need to make your investment decision.

Which Are the Best Dividend Stock Funds?

If in doubt about which are the best dividend stock funds. consult someone who knows how to read the charts, interpret the data, and give you some informed advice as to your best investment for your needs. A well-rounded stock portfolio is always a good idea, and investors are wise to supercharge their investments by picking the highest dividend stocks which are stable and pay out a decent monthly dividend to their stock holders.

Dividend capture is a strategy employed by big-time investors who have low trading fees. Normally, this strategy doesn’t pay off for small time investors. Basically, stocks are purchased right before the dividend pay-out date. The pay-out is made to the new purchaser, and then the stock is re-sold. The investor has collected the dividend and then immediately re-sold the stock. It may sound good in theory, but each buy/sell/trade transaction for stocks has brokerage fees. These fees can eat up the profits, unless a sizeable amount of stock can be bought at one time.

A dividend capture strategist must re-sell the dividend stock at the same or higher stock value than it was purchased. Normally, dividend stock value drops right after a dividend pay-out, so the purchaser would sit on the stock until it reached the original sale value before reselling.

A definite disadvantage of buying highest dividend stocks with the intention of reselling after the dividend is collected, is that the stock value may never reach the original purchase value, or it may take a long time in doing so.

Tips for Small Time Dividend Paying Stock Investors

Small time dividend paying stock investors should purchase with the intention of keeping their stock long-term and using the dividend as passive income. When long-term investing in highest dividend stocks, it cannot be over-stressed to do your homework on the company, it’s stability and it’s past dividend performance.

Firstly, we need to understand exactly what dividend paying stocks are. Simply put, a dividend is an allotment of the company’s earnings that are paid out to their investors, either in the form of cash or additional shares. The dividend yield is calculated by taking the annual dividend per share and then dividing by the stock price per share. The resulting yield is the profit that the investor makes on their investment. It’s really important that investors look at this figure, especially when they are new to the world of investing.

Some dividend paying stocks may have a high dividend yield, but it’s important not to get overwhelmed just looking at this number alone. Investors should take the time to research whether or not this high yield dividend has grown a minimum of at least 5% over the past five years. You will also want to check for other areas of growth such as whether the earnings per share is growing at an acceptable rate (at least 10% in consecutive years for the past 3 years), the revenues in the company have grown at least 10% over the past year and if the company has a return on equity of at least 15% and has achieved free cash flow within the past 2 consecutive years.

Also important is looking at the company’s debt load and how stable the profit increase has been. The longer time period you can track, the better your information will be. Does the company make most of its profit from services or the selling of commodities? Is there a significant seasonality to their earning trends? Are they in a sector that is considered evergreen, or will interest in it fade away, and therefore your dividends will fade away like the receding tide? Do you want your dividend paying stocks to provide you with stable monthly income?

Dividend Paying Stocks – Factors

For the investor who is also looking at regular yield dividend stocks, you’ll still want to consider the above factors in determining what works best for your portfolio. Companies should definitely have the market advantage in their sector, be able to produce growth in income year after year, low levels of debt, a payout ratio of under 80% and still be generating a good amount of free cash flow. The last factor you’ll want to assess is the excess amount of earnings the company has. All these can make for sound investments in the dividend paying stocks of your choice for years to come.