The Hidden Risks of HighYield ETFs Yahoo Singapore Finance

Post on: 25 Апрель, 2015 No Comment

RELATED QUOTES

NEW YORK (TheStreet ) — Searching for income, investors have poured into high-yield ETFs. Among the favorite choices are iShares iBoxx $ High Yield Corporate Bond HYG and SPDR Barclays Capital High Yield Bond JNK. which both yield around 7%. Assets in the two funds total $25.3 billion, up from around $13 billion at the beginning of 2011, according to IndexUniverse.com.

But ETFs may not be the best way to hold high-yield bonds, which are rated below-investment grade. The problem is that junk bonds are not highly liquid. Many bonds rarely trade. During the downturn of 2008, markets froze, and it was difficult to trade bonds at all. As index trackers, ETFs must buy bonds — even if portfolio managers must pay a big premium to complete transactions. Instead of buying index funds, investors should consider actively managed portfolios, says Samuel Lee, an ETF analyst for Morningstar. Active managers have the discretion to avoid trading when prices are ridiculous, says Lee.

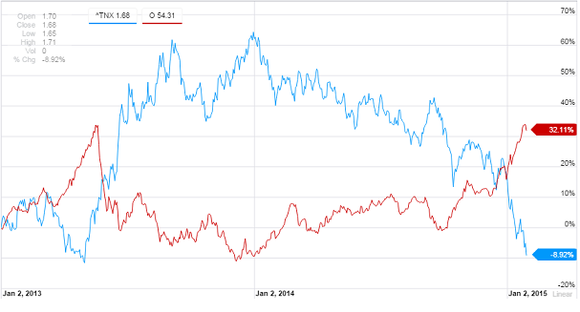

Partly because of their freedom to trade, many actively managed mutual funds have outdone ETFs in downturns. When investors worried about the outlook for the eurozone in May, high-yield bonds sank. For the month, the iShares iBoxx ETF dropped 3.2%, while the average actively managed high-yield mutual fund lost 1.5%, according to Morningstar. The active managers also excelled in September 2011 when they lost 3.3%, compared to a decline of 5.3% for the iShares fund. During the past three years, the average active fund returned 14.4% annually, while the iShares fund returned 14.1%.

Mutual funds can also have an advantage because the shares always sell for the value of the assets in the fund. In contrast, ETF share prices fluctuate. When many investors seek to buy, the ETF shares can sell for a premium to the value of the assets in the fund. During hard times, the shares can trade at a discount. Funds that hold highly liquid assets, such as the stocks of the S&P 500, rarely trade at big premiums or discounts. But the price of high-yield funds can vary. The SPDR high -yield ETF recently sold for a premium of 1.24%. So investors had to pay $101.24 to buy $100 worth of assets.

While investors are eager to pay up for high yields, the enthusiasm could melt suddenly. During the past year, the SPDR ETF has swung back and forth, rising to a top premium of 3.21% and falling to a discount of -3.65. An investor who bought at the top and sold at the bottom would have lost more than 6% because of the swings in pricing. When ETFs sell at premiums, investors should move cautiously, says Paul Amery, editor of IndexUniverse.eu. You should only buy at a premium if you think that the market is going to continue to rise, Amery says.

Will high-yield ETFs crash any time soon? Probably not. Corporate balance sheets are healthy, and annual junk bond default rates are running at less than 2%, compared to the historical average of 4%. But after the big rally, investors should not buy a high-yield ETF and expect to achieve sizable capital gains.

Vanguard Group recently issued a word of caution. In a press release, Vanguard CEO Bill McNabb noted that some shareholders were selling Treasury funds and shifting to high-yield funds. That could be a risky move, he warned. McNabb announced that he was barring new investors from Vanguard High-yield Corporate Fund VWEHX. an actively managed mutual fund. At a time when investors were flooding into the fund, the portfolio managers thought that it would be difficult to manage more cash. Investors who crave high yields should take note of the Vanguard move. If the experienced Vanguard team is wary about finding bargains, then other investors should approach high-yield bonds with caution.