The great recession 200813

Post on: 18 Май, 2015 No Comment

The great recession refers to the period of economic downturn between 2008 and 2013. The recession began after the 2007/08 global credit crunch and has led to a prolonged period of low growth and rising unemployment. In particular, the great recession highlighted problems within the Eurozone and, unlike the US, Europe has experienced a double dip recession.

The main causes of the great recession involve:

- Credit crunch and fall in bank lending.

- Fall in confidence resulting from the financial instability.

- Fall in exports from global recession

- Collapse in housing markets leading to negative wealth effects.

- Fiscal austerity compounding the initial fall in GDP.

- In Europe, the single currency created additional problems because of over-valued exchange rates, and high bond yields.

The primary cause of the great recession was the credit bubble of 2001-2007 and the resulting global credit crunch (2007-08). This is a short background to why bad debts in the US housing market had such a big effect on economies in US and Europe.

Causes of credit crunch

- The period 2000-2007 was a time of strong economic growth, low inflation and falling unemployment. Central Banks appeared to be successful in targeting low inflation and ensuring economic stability. However, underneath the macro-economic stability, there were increasing problems, which only became fully apparent later.

- Housing bubble. Many countries experienced a rapid growth in house prices. House price rose faster than inflation and faster than incomes. This boom in housing was encouraged by a growth in bank lending and high confidence. Several countries, such as Ireland and Spain also experienced a boom in house building.

- Bad loans. In the period leading up to the credit crunch, banks became more aggressive and willing to take risks in lending. Especially in America, banks and mortgage companies loosened their criteria for giving mortgages. Many homeowners were given large mortgages, with limited checks on their ability to repay.

- Bad loans repacked and resold. These bad mortgage loans were sold onto other financial institutions around the world. For example, many UK and European banks bought these mortgage bundles from the US (CDOs) and so were exposed to any potential losses in the US housing market.

- Housing Bubble Burst. In 2006, the US housing market bubble burst. House prices started to fall, and there was a rise in mortgage defaults. Banks started to realise they had lost significant sums of money through the US mortgage defaults.

- The scale of bank losses started to increase and it became more difficult for banks to borrow money on money markets. This caused banks to reduce loans and mortgages. Because banks were losing money, it became very difficult to get credit and liquidity. Some banks lost so much, they were running out of money. In several countries, such as UK, Ireland and US, major banks had to be bailed out by the government. But, the realisation banks were short of liquidity harmed consumer and investor confidence. The fall in confidence led to lower spending and investment.

The role of the credit crunch and recession

- In 2008, all major economies experienced a very sharp drop in real GDP. The banking crisis severely curtailed normal bank lending. The result was a fall in investment and consumer spending leading to a sharp drop in real GDP.

- The fall in house prices was another factor leading to recession. In the boom years, rising house prices (and wealth) underpinned higher consumer spending. When house prices dropped, many homeowners faced negative equity. Therefore, they cut back on spending and could no longer rely on re-mortgaging to gain equity withdrawal.

- The global nature of the crisis meant that there was also a drop in world trade. Countries, saw a drop in exports as the global downturn led to lower demand.

- In 2008, there was also a peak in oil prices. This complicated matters because it caused cost-push inflation. This cost-push inflation made Central Banks more reluctant to cut interest rates. Also, higher oil prices reduced discretionary income and led to lower spending. Usually in a recession, oil prices fall. However, because of rising demand in China and India, we saw rising oil prices even as Europe and the US went into recession. High oil and commodity prices were another factor reducing demand.

Response to the great recession

- Firstly, governments felt obliged to intervene in the banking sector to avoid banks and financial institutions going bust. However, there was some reluctance to bailout those who were blamed for causing the crisis. In 2008, the US decided to allow Lehman Brothers to go bust. This caused a major loss of confidence. After the panic this created, governments realised they couldnt allow a repeat of this experience. In the UK, some argue the government were slow to bailout the banks. Though the intervention was sufficient to protect the fundamentals of the banking system.

- Cuts in interest rates. Towards the latter half of 2008 and early 2009, Central Banks cut interest rates to record low levels. The UK cut base rates from 5% to 0.5%. Usually, a major cut in interest rates would make borrowing cheaper and encourage consumption and investment. (e.g. in 1992, when the UK cut interest rates, the economy recovered fairly quickly.)

- Expansionary fiscal policy. The deep recession saw a sharp rise in budget deficits because government tax revenues evaporated. This was particularly damaging for countries who relied on stamp duty and tax from the finance sector. However, in the UK and US, there was a moderate degree of fiscal expansion. The UK introduced a temporary cut in VAT. In the US, there was also a moderate fiscal stimulus.

- It is worth noting that in comparison to the great depression of the 1930s, two things were avoided in the great recession.

- Large number of banks going bankrupt was avoided (In US, over 500 commercial banks went bankrupt)

- There was no major trade war. In the 1930s, a tariff war developed as countries tried to protect domestic industries.

Why did normal policy fail to achieve economic recovery?

- Firstly, the recession was very deep. Because firms, banks and consumers were highly indebted, they decided they needed to pay down debt. Therefore, this led to a significant fall in spending as they concentrated on paying off debt. In the UK, the saving rate rose from 0% to 7% in a short space of time. This can be referred to as a balance sheet recession .

- Lower base rates didnt increase bank lending. Although Central banks cut interest rates, this didnt translate into higher lending and investment. (an example of a liquidity trap )

- Commercial banks didnt pass these interest rate cuts onto their consumers. Especially in the Eurozone periphery bank rates didnt fall. In the UK, bank rates fell, but less than the cut in base rates. (bank and base rates )

- Credit remained tight. Although credit was in theory cheap, it was difficult to get any loan. Banks were short of cash so discouraged lending. It became very difficult to get a mortgage, so demand for housing remained low.

- Eurozone crisis. In Europe, the crisis highlighted the fact that Greek public sector debt was much higher than previously thought. Before 2007, bond yields in the Eurozone had been very low. But, after the credit crisis and realising the true levels of Greek debt, bond yields in Europe rose rapidly. People became nervous about holding Eurozone bonds. The rise in EU bond yields created a new panic. European governments felt the necessity of cutting budget deficits (austerity). This involved cutting government spending and higher taxes. However, in a recession, this fiscal austerity lead to lower aggregate demand and worsened the recession.

- See more at Euro debt crisis

Problems specific to the Eurozone

- In the lead up to the recession, Europe experienced a trade imbalance. Germany and some northern countries ran a large current account surplus. (The UK and US also had large current account deficit, suggesting an imbalanced economy)

- Countries in the south, such as Portugal, Spain and Greece ran a very large current account deficit. This meant the south was uncompetitive, leading to lower exports.

- After the crisis, these countries needed to restore competitiveness through internal devaluation essentially lower wages. This caused lower demand and lower growth.

- No Central Bank. In the UK and US, bond yields fell during the crisis. With their own currency, they have a central Bank willing to intervene and buy bonds if necessary, this avoids any liquidity shortages. But, in the Eurozone, this didnt occur (at least not until late 2012). Therefore, bond yields rose, and countries felt a need to cut budget deficits quickly. The UK and US only pursued very moderate austerity in 2011/12. But, some countries in Europe, cut government spending very significantly.

- Combined with falling private sector spending, aggregate demand fell sharply.

- Southern Europe is in real depression.

The overall stats for the Eurozone is of a mild recession. But, in southern European, countries like Spain, Greece and Portugal have experienced depression level unemployment and falls in GDP. In Spain, Greece and Portugal, unemployment is close or above 20%. Youth unemployment is even higher.

The UK in the great recession

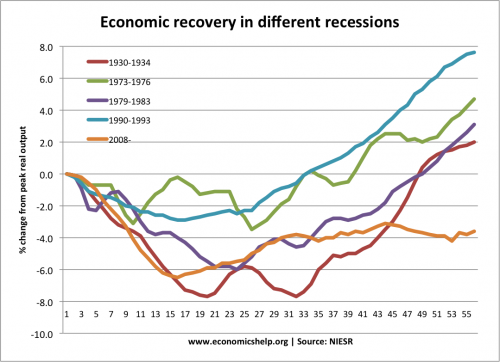

The initial recession hit the UK hard because of our relative reliance on the finance sector. The drop in GDP was longer lasting than in the 1930s.

Despite, cuts in interest rates and large sums of quantitative easing, the UK economy stalled in 2011 and went into a double dip recession (GDP stats may be revised, but it is clear the economy was stagnating at the least). Some felt that the governments austerity drive of 2010-12 was a significant factor in causing this double dip recession. Although spending cuts wre relatively mild. there was also an adverse impact on confidence. However, Unemployment rose less than might have been expected (UK unemployment mystery ) Most economists feel, the UK experience would have been worse, had we been a member of the Euro.

- Bond yields would have been higher

- There may have been pressure for much deeper austerity

- We couldnt have benefited from 20% devaluation in Pound

- Interest rates would have fallen more slowly

- Less scope for quantitative easing and funding for lending scheme.

However, the UK economy is still reliant on exports to Europe and a continued EU recession is a factor in slowing UK growth.