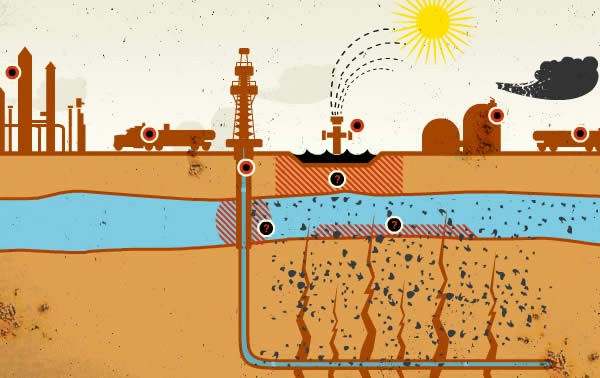

The fracking

Post on: 5 Октябрь, 2015 No Comment

Are home value declines near wells another multi-billion dollar subsidy for oil and gas industry?

The New York State Bar Association calls it the perfect storm begging for immediate attention. For homeowners who have been caught in the storm, it is an unmitigated economic disaster. But for the oil and gas industry at the center of it all, it is just the latest potential roadblock threatening to derail its plans to quickly drill up our nations natural gas reserves before changing laws and growing negative public sentiment permanently alter the prospect for doing so.

The perfect storm that is keeping the lawyers up at night is the realization that the current oil and gas boom, which has been aggressively marketed as an economic windfall for the U.S. by both the industry and politicians whose cash-strapped regions are desperate for new sources of revenue, may, in fact, be something far different.

New research indicates that many of the 15.3 million Americans living within a mile of a hydraulically fractured well thats been drilled since 2000 may have lost or be in the process of losing a good portion of their wealth as a result of this drilling activity.

So just how big of a loss are we talking about cumulatively? If the research is correct, its billions upon billions of dollars. As a matter of perspective, recent research indicates that drilling wells within just one mid-size community such as Longmont could, in a worst-case scenario, trigger a drop in home values of more than 15 percent. And a 15 percent drop in Longmont real estate values, a town with a population of only 88,000, would equal somewhere around a $1.2 billion loss.

The losses of those living near wells is due to the diminishing values of their homes and property as a result of the fact that an increasing number of buyers have become hesitant to purchase real estate near fracked wells and their accompanying industrial production platforms. It also doesnt help that fracking/oil and gas shale development is also threatening the primary and secondary mortgage markets. No buyer, no sale. No mortgage, no sale. Its that simple.

It seems that while most of the nation has been focused on the debate over whether or not fracking poses a risk to the environment and public health, a few curious minds have been researching frackings impacts on the real estate and mortgage markets. And while the science on frackings very real potential health dangers is still being collected, studied and debated, it appears that the verdict is in on the controversial extraction practices impact on what is, for most Americans, their largest single investment, namely, their homes.

The fracking/real estate conundrum will not be easily solved. It is not so simple as identifying the fact that most people wont buy a home if its sited near oil and gas activity that they believe could be harmful to their health or negatively impact future property values. That part of the equation is just common sense and is indirectly linked to the ongoing scientific health debate over fracking.

In the real world, housing prices rise and fall with public perception, not with the quality of Haliburtons latest scientific explanation for why its 500 toxic chemicals used in the fracking process wont find their way into your groundwater. Or put another way, industry white papers dont sell houses.

For the most part, the real estate market operates on just one principle; if a prospective buyer isnt sure that they will be able to sell a property later for at least what they paid for it today, they wont buy. Real estate buyers correctly understand that the scientific and political arguments that are increasingly being debated around the subject of fracking and increasingly reported in the media are causing apprehension in the real estate market. They know that because of that apprehension, regardless of whether or not it is justified, a growing number of people dont want to live or invest in a property near an existing well or even in an area that could one day end up with a well nearby because some third party owns the mineral rights.

Because perception is reality in the real estate market, informed buyers and qualified real estate agents are beginning to steer clear of houses and properties near oil and gas shale plays unless they are at a substantial discount to similar properties that are not threatened by such drilling activity. And if buyers and agents are aware of frackings impact on real estate values, you can bet that banks are also well aware of their potential exposure when lending money in those same areas.

If housing prices in an area fall because of the fear of fracking, then lenders stop lending in areas where fracking may occur, and when that happens, prices in those areas fall still further. Like many ups and downs within the investment community, it is a chain reaction triggered entirely by perception, but the results are all too real.

But if research is finding that oil shale development is driving down real estate values, then why does the industry continue to claim just the opposite to be true? The answer is likely twofold.

First, if people in communities and counties sitting atop oil and gas shale formations realize that they could potentially lose 5 percent to 20 percent of their property values should drilling occur anywhere near their homes, they would likely go the same route as Colorados Front Range citizens and begin to vote for moratoriums and outright bans on fracking. And that would create a disastrous delay for an industry whose economic vitality is literally dependent upon its ability to drill, produce and export our natural gas overseas as quickly as possible.

Foreign markets are currently willing to pay as much as four times the going rate for gas here in the states, but that wont last forever. In fact, it is predicted that most foreign markets will be using their own domestically produced shale gas within the next five to 10 years.

So if the oil and gas industry is going to capitalize on this short window of opportunity to secure mass profits from shale gas, it needs to keep the public on its side for as long as possible while it moves forward with plans to get U.S. natural gas to Asia, Europe and elsewhere.

Oil and gas executives understand that nothing motivates the citizenry to grassroots action like hitting them in their pocketbooks. So for the industry, the story of job creation makes for better TV commercials than the story of real estate value declines.

The second reason the industry claims that oil and gas shale development is a positive for real estate values is because it has been so in some select areas. These exceptions to the lowerprice-near-drilling rule are often used as examples by the industry to try and quell a communitys fear that its real estate values could be harmed by nearby drilling activity. But it seems a somewhat disingenuous argument when all the facts are known.

Communities that have experienced a boost in real estate prices due to oil and gas shale development tend to be small, isolated towns located in close proximity to a major shale play during the drilling phase.

For example, Williston, N.D. has seen an extraordinary increase in property values due to the current oil shale drilling boom in the Bakken formation. Why this has occurred is not a mystery, nor is it applicable to other locations around the country such as the Front Range of Colorado.

In Williston, 15,000 mostly short-term (a few years at best) workers have descended, almost overnight, onto the tiny town with a population of 12,000 locals who already occupied nearly all of the 5,230 existing houses in the community.

As a result, wheat fields around the town have become home to thousands of travel trailers and motor homes of every size and shape. In these man camps, as theyre called by locals, its not unusual to find recently arrived workers paying thousands of dollars a month for the privilege of sleeping in a bunk in a crowded travel trailer. Many workers wind up living in their cars.

Its true that existing home prices in the area have increased three- to fivefold because, during the drilling boom, they are being sold as rental properties that can be used to house the glut of workers who are willing to pay thousands to share a room with four to six of their oil-patch pals. Fast money tends to inflate things.

Like the landlords, the local restaurants in Williston are enjoying the boom, but they are also shelling out $25 an hour just to get someone to wipe down tables or wash dishes. And more often than not, the restaurant owners also have to provide housing for employees in the form of a trailer in the eaterys parking lot.

When it booms, it booms. Strip clubs have shot up in Williston like gushers of oil from the plains. According to Hollywood Interrupted writer extraordinaire Mark Ebner, who has spent a fair amount of time of late rubbing against Willistons underbelly, dancers at these clubs who entertain the roughnecks while helping to separate them from their paychecks can make as much as $2,000 a night. And the folks cooking meth can do even better than that.

Williston is one of the real estate markets that the industry touts as being healthy and sustainable thanks to oil shale development?

But as with all booms, the bust will most assuredly come when the brunt of the drilling activity moves on to the next play. This is Willistons third boom since 1981. I was there for the first one and can assure you that the real estate prices went up and then fell back to reality as soon as the rig count plummeted and the oilies moved on.

The only thing that will be left when the current boom subsides will be a devastated little North Dakota town with a bad case of culture shock and a few new tattoos.

This is what has happened to some extent in small towns near shale plays all across the country, including Colorado towns like Rifle and Trinidad that have already experienced the boom and bust cycles attributable to shale gas.

The housing additions that were new and promising a few years ago are today bank-owned eyesores. The new restaurants, hotels and businesses that came have mostly gone. Today even the businesses that existed before the wells came are struggling to hold on now that the oil patch has shifted to the next unsuspecting, ill-prepared community.

It seems hardly an honest position for the oil and gas industry to point to such boomtowns as examples of oil and gas shale developments positive influence on real estate values. Industry folks know that, for the most part, the benefit to real estate values only occurs during a drilling boom phase of development due to severe housing shortages for workers in less populated corners of rural America.

In most areas where a larger population exists before the rigs move in areas such as Colorados Front Range or similarly populated parts of Pennsylvania, New York and Texas researchers have found that fracking has a substantial and negative influence over real estate prices.

In these more populated, more developed areas there is no upward pressure on housing prices when the drilling comes because there is ample housing and other businesses to handle any short-term influx of the drillingrelated workforce.

So the real, long-term impact on housing values for most Americans living near oil and gas shale development is to the downside due to the perception, right or wrong, that drilling and fracking may contaminate the air and water, create a visual/noise nuisance and threaten public health, at least that is what the research is finding.

A recent study titled A Review of Hydro-Fracking and its Potential Impacts on Real Estate which was conducted by the University of Denvers Ron Throupe, a professor in the Daniels College of Business, along with his DU colleague Xue Mao and Robert A. Simons of Cleveland State University, found that the term fracking is having an influence on public opinion, and that when it comes to real estate, that influence is likely causing people to not buy or at best pay less for homes near such oil and gas activity.

The study surveyed homeowners in Texas, Alabama and Florida. The homeowners were asked if they would buy a home under certain conditions, which included that an energy company had bought the rights to inject a pressurized mixture of water, sand and chemicals into a lower groundwater aquifer to recover natural gas under the property they were considering buying.

In Texas, where residents have had a long relationship with the oil and gas industry, only about a quarter of those surveyed said they would be willing to purchase the house. Of those who said they would still purchase the home, the best offers were around 6 percent below what should have been the homes market value.

While just over a third of those surveyed in Alabama and Florida said they would be willing to buy such a home under the set conditions, those still willing to purchase the property discounted the property more heavily than the Texans, claiming that they would only buy if they could pay 15 percent below what should have been market value.

In a recent interview, Throupe told BW that in a county such as Boulder, where the apprehension over fracking is quite high, it is likely that homes near drilling operations could easily lose as much as 20 percent of their value. And he also pointed out that it isnt just the homes adjacent to drilling that are being impacted. For instance, if a well is being drilled and fracked on the edge of a housing addition or within a town, the homes located in close proximity to the well and/or production platform will decrease in value, but so will all the homes within the addition or within a certain distance to the well. This loss in real estate value to homes that cant even be seen from a well site is due to the comparable sales process used during the appraisal process.

The DU research also found that other factors near drilling operations, such as whether or not a home was on well water or city supplied water, also influenced potential purchasers willingness to buy and pricing.

Throupe and his colleagues are currently working on another research project examining the oil and gas industrys impact on Colorado real estate specifically by actually mapping oil and gas wells and then analyzing the real estate nearby. That study will be completed in a few months.

In 2004, another study titled, The impact of oil and natural gas facilities on rural residential property values: a spatial hedonic analysis was conducted by Peter C. Boxall and Melville L. McMillan of the University of Alberta and Wing H. Chan of Ontarios Wilfrid Laurier University. For simplicity this research will be referred to as the Boxall study.

The peer-reviewed Boxall study is believed to be the first actual study of the impact of oil and gas industry activity on real estate values. Because it examined a region on the edge of a significant population center, its findings may well be applicable to Colorados Front Range.

The Boxell study looked at the impact of gas wells and other associated industry development such as pipelines and production facilities on the values of real estate located just on the edge of Calgary, a million-plus-population city in Alberta, Canada. So the study looked at a populated area more similar to Colorados Front Range or the Barnett Shales proximity to Fort Worth, Texas, as opposed to a small isolated town like Williston, N.D.

The Canadian researchers examined how the fear of health risks from gas wells and the perceived lost amenity attributes caused by wells affected real estate values.

Its also important to note that this study revealed that the oil and gas industry had paid for three prior consulting papers examining the industrys impact on real estate values, and that those papers had all claimed that no negative impact existed.

However, the peer-reviewed Boxell study researchers found that all three industry-funded papers had serious shortcomings in the processes used to arrive at their conclusions and that the findings were, in fact, in error.

The Boxell study concluded, The results of this analysis strongly suggest that the presence of oil and gas facilities can have significant negative impacts on the values of neighboring rural residential properties.

The report found that properties located within four kilometers (2.48 miles) of gas wells lost between 4 percent and 8 percent of their value.

Perhaps most importantly, the Boxell study researchers also recommended that the findings of this study and others that would be done subsequently should be used in the U.S. and Canada as a way to help determine proper compensation to homeowners whose property values have been negatively impacted by oil and gas activity.

In many ways that suggestion could be a short-term answer for those communities and counties that are trying to prevent invasive oil and gas shale development while more research on frackings impact on public health and the environment is conducted.

If oil and gas companies were legally made to pay proper compensation for surface damages, which logically should include real estate value damages to homeowners, it is likely that much of the proposed drilling near populated areas such as Colorado Front Range communities like Longmont, Lafayette, Fort Collins and Broomfield would be deemed uneconomical, as damages could easily reach into the tens of millions of dollars or more for any well located in close proximity to concentrated housing.

At this point, the only reason that oil and gas companies can drill close to or even within communities is because outdated state laws regarding surface damages which exclude real estate value losses to nearby homeowners are, in fact, acting as a multi-billion dollar subsidy for the worlds most profitable industry.

And this is only the impact that the oil and gas industry is having on real estate values. Next week BW will be examining how oil and gas development is threatening to implode the primary and secondary mortgage markets of the United States. Its a problem that has thus far stumped some of the best legal minds in the country. But a solution must be found quickly before the next chain reaction starts unwinding more financial markets.

Respond: letters@boulderweekly.com