The Five Biggest IPOs of 2014 Money Morning We Make Investing Profitable

Post on: 2 Апрель, 2015 No Comment

display>

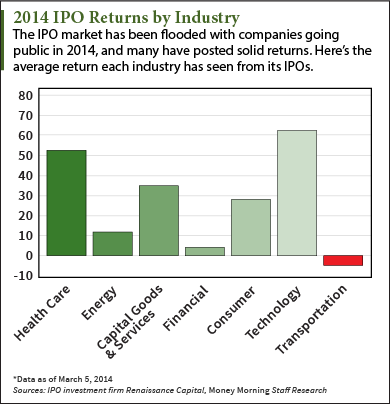

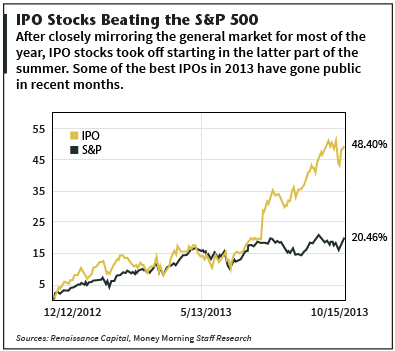

This year has been the busiest for initial public offerings since the dot-com era of 1999 2001. And the biggest IPOs of 2014 have raised some serious cash.

The 2014 IPO calendar has been crowded, with 135 offerings to date. That’s a 65% gain from 2013. Those 135 IPOs have raised a total of $29 billion, which is also an increase of 55% from 2013.

And 2014’s IPOs have far outpaced the amounts previous years’ offerings have raised, with price tags as high as $2.4 billion.

That $29 billion hasn’t exactly been spread out evenly. In fact, 28% of this year’s total IPO money has been raised by the top five companies.

Here’s a look at the biggest IPOs of 2014 and how they’ve fared since they’ve hit the market.

IPO Market 2014: Biggest IPOs to Date

Biggest IPOs of 2014, No. 5: Parsley Energy Inc. (NYSE: PE ) raised $925 million when it went public on May 22.

Parsley Energy is an exploration and production company that works in the Permian Basin. According to Westwood Holdings Group ‘s (NYSE: WHG ) Portfolio Manager Bill Costello, shale energy companies that operate in focused regions have been a popular play for investors in 2014.

It’s the flavor of the day, Costello told The Wall Street Journal . It’s easy to understand you’re in one basin, in one play, it’s repeatable.

Parsley priced its shares at $18.50, which was above the company’s estimated range of $15 to $18. The company had initially planned on selling 43.9 million shares in its IPO, but ended up offering 50 million.

On its first day of trading, PE stock climbed 20%. Today, PE stock trades at $22.78, which is 23% higher than its offer price. Credit Suisse Group (NYSE ADR: CS ). Goldman Sachs Group Inc. (NYSE: GS ). JPMorgan Chase & Co. (NYSE: JPM ). and Wells Fargo & Co. (NYSE: WFC ) served as lead underwriters on the deal.

Biggest IPOs of 2014, No. 4. IMS Health Holdings Inc. (NYSE: IMS ) is a global IT company that provides clients operating in the healthcare industry with industry data and consulting services. IMS hit the New York Stock Exchange on April 3.

Through the IPO, IMS raised $1.3 billion by selling 65 million shares for $20 each. Initially, the company had set a price range of $18 to $21 for its shares. JPMorgan, Goldman Sachs, and Morgan Stanley were the lead underwriters on the deal.

They have a very stable, large, profitable legacy business, and they’re looking to cross-sell additional products and value-added services into their existing client base, Allianz Global Investors’ Portfolio Manager John Schroer told The Journal before the IPO.

IMS stock jumped 15% in its first day of trading. Today, the stock is up 17% from its initial offer price.

But there were a few IPOs so far in 2014 that trumped PE and IMS. Check out the year’s top three