The Federal Bailout

Post on: 19 Май, 2015 No Comment

Image courtesy of Allie_Caulfield (via flickr)

The US government actions, described earlier, to unfreeze credit markets are best thought of as ‘first aid’. While necessary for stabilizing the patient, they have not cured the disease caused by ingesting ‘toxic assets.’

On September 19, 2008 President Bush announced his financial bailout plan, the Emergency Economic Stabilization Act of 2008 to confront the financial crisis. This plan was initially rejected by the U.S House of Representatives on September 29. After a great deal of public lobbying, on October 1, the U.S. Senate passed an amended version of the bill, which was subsequently accepted by the House two days later. This legislation created the $700 billion Troubled Assets Relief Program (TARP).

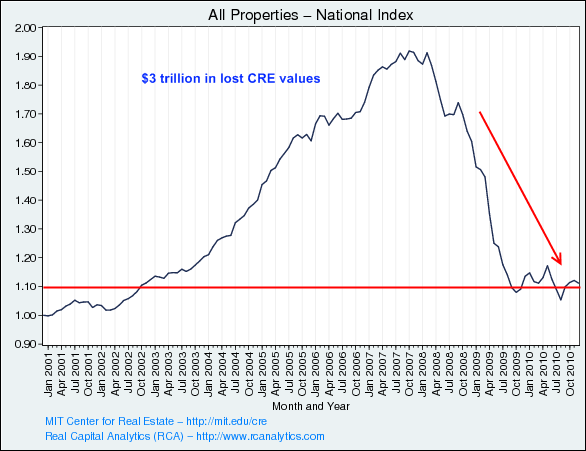

Financial businesses (both commercial and investment banks) had invested heavily in mortgage-backed securities (CMOs) and credit default swaps. Since the market had collapsed and no one was trading mortgage-backed securities, no one could say what they were worth, though it seemed clear they were worth less than face value. As a result, financial firms began hoarding cash instead of lending it out.

The original TARP plan was for the Treasury to use the TARP funds to purchase CMOs from commercial banks in order to stimulate bank lending. While much business lending, perhaps a majority, had been conducted by the so-called shadow banks, many of those had converted (or were in the process of converting) to commercial bank holding companies, making them eligible for TARP funds.

The Treasury intended to buy mortgage-backed securities at a discount from banks, which hopefully would induce banks to start lending again since lenders would know where they stood financially and borrowers would no longer have the taint of toxic assets. The price offered by the Treasury would be less than face value of the CMOs but more than the depressed current market value, assuming one could even find a buyer. The trick was to find the right price.

One potential consequence of the plan was that bank sales of CMOs at a loss could lower bank capital below the levels mandated by regulation, requiring the government to close those banks. The banks, therefore, proved reluctant to take the capital loss, hoping they could get a better price in the future, when CMOs became more widely traded again. In a thinly traded market, prices don’t necessarily convey accurate information. When no transactions are taking place, the first trades are likely to occur at depressed prices, prices which don’t fully value the securities. Over time as the market recovers, prices more accurately reflect the value of the securities. There was also concern that the first banks to sell to the Treasury would be perceived as desperate.

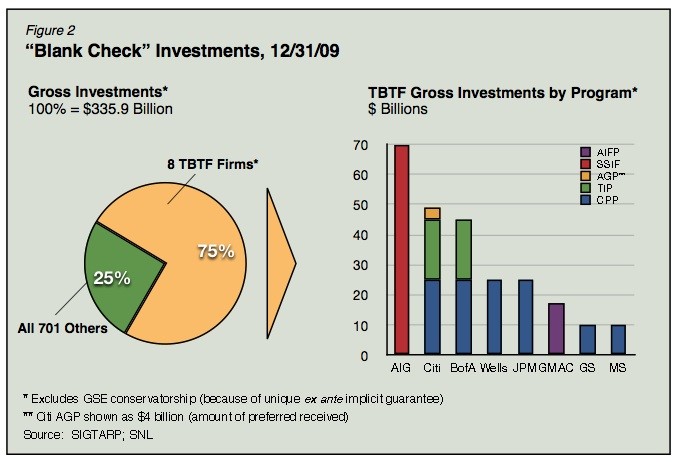

In any case, the Treasury began to back away from its original plan. On October 14. the US Treasury introduced its $250 billion Capital Purchases Program (TARP II) in which banks could voluntarily sell equity to the Treasury to boost their capital, while still retaining their CMOs. A month later on November 12, Secretary Paulson formally cancelled the original TARP plan in favor of the CPP, arguing that “the most timely, effective step to improve credit market conditions was to strengthen bank balance sheets quickly through direct purchases of equity in banks.”

Banks participating in TARP II were the biggest institutions in the US banking system. They included (in order of their Treasury equity) Citigroup, Bank of America, JP Morgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, PNC Financial, US Bancorp, GMAC, Capital One, Regions Financial, American Express, Bank of New York Mellon, State Street Bank, and Discover Financial. 1

Image courtesy of Downing Street (via flickr)

The new Obama administration returned the focus of the Federal bailout to its original intent by proposing a Public-Private Investment Program to purchase mortgage-backed securities from banks who were holding them. This proposal (TARP III) differed from the original plan in that it was designed to leverage tax revenues by bringing in private investment as well as other government agencies (the Federal Reserve & FDIC). The program was expected to remove as much as $1 trillion worth of troubled assets from banks, while the US Treasury would only have to invest $75 to $100 billion.

A key difficulty with the original TARP program was how to choose a price which accurately valued the CMOs. Government has no particular expertise at this. TARP III was designed to get around this problem by letting private investors determine the price, something they are experienced at, but then allowing the Treasury to share in any profit. The government would finance up to 85% of the investment. The remainder would be covered by half private equity and half US Treasury equity. [ Footnote: The government finance would be in the form of non-recourse loans, meaning in the event of default the government would take ownership of the underlying properties. ] Any profits would be shared 50-50 with the private investors, but any losses would have to eliminate all private equity before the government loans would be at risk. The private investors would be able to leverage their investment, but they also would have a strong incentive to get as lean a price for CMOs as possible.

As of early June 2009, TARP III has made little progress as various aspects have proven more difficult to implement than expected. Despite this, financial conditions have continued to improve.

In February 2009, US Treasury Secretary Geithner called for a Supervisory Capital Assessment Program (stress tests) of major US banks to determine the adequacy of their capital reserves in the face of a potentially larger economic downturn. Notice that the stress tests would assess of banks’ exposure to toxic assets, as well as other aspects of their balance sheets.

On May 7, regulators announced the results of the stress tests on the 19 largest US banks making up 2/3 of US bank assets. Nine of the banks, including JP Morgan Chase, Goldman Sachs, and American Express were determined to have adequate capital reserves, while the remaining ten banks, including Bank of America, Citigroup and Wells Fargo, were told to raise $75 billion in new capital. This qualified bill-of-health should help rebuild trust in the banking system, and indeed the TED spread shows some evidence of this.

In June 2009, the ten banks which “passed” the stress tests prepared to begin repaying their TARP money. Since TARP III, US banks have raised nearly $100 billion in new capital, leading FDIC Chairman Sheila Bair to comment. “Banks have been able to raise capital without having to sell bad assets through [TARP III], which reflects renewed investor confidence in our banking system.”

As time goes on, assuming no additional problems are revealed, financial markets should return to normal conditions. Some CMO transactions have occurred in private markets and their prices have been rising. Barclays Capital reports that prices on prime-jumbo CMOs have risen from 63 cents on the dollar (March 19) to 83 cents (May 14). Over the same period, Alt-A CMOs have risen from 35 cents to 45 cents. There is still no reported trading in subprime CMOs.

Footnotes:

- Three non-bank businesses also received substantial TARP funds. These were AIG (the insurance giant), and General Motors and Chrysler. ↩