The fallacy of dollarcost averaging

Post on: 4 Май, 2015 No Comment

KirkSpano

Kirk’s Latest Posts

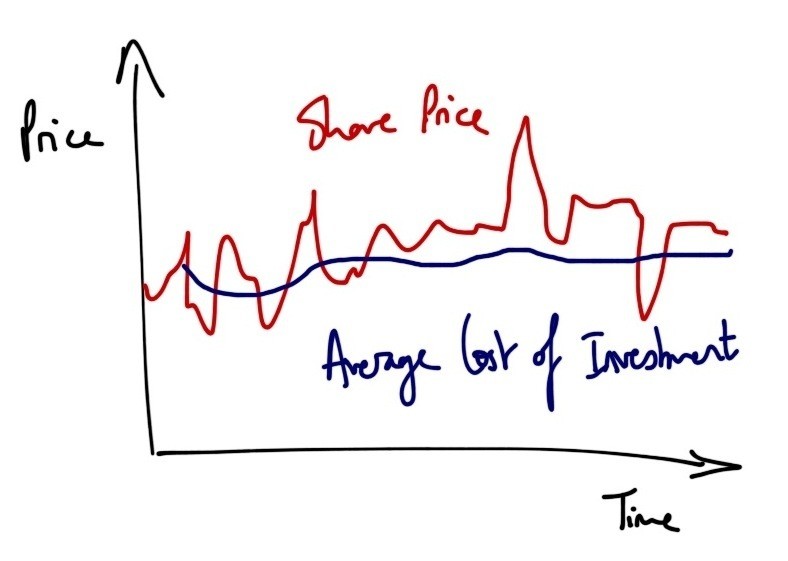

Throughout my career, I have heard financial people talk about dollar-cost averaging as if it were a way to cut risk. It isn’t. But, because the idea of dollar-cost averaging being somehow good is repeated over and over, people think it must be true. In fact, most financial consultants even believe this nonsensical idea, because frankly, they don’t understand finance or math anywhere near the level that they should.

Don’t believe the hype. Dollar-cost averaging is nothing more than a well-constructed sales pitch. It is a method for getting people to do what a sales person wants them to do, generally open an account, move an account or buy a product.

Any cursory comparison of dollar-cost averaging versus investing a lump sum shows that after just a few years, the investment results are negligible. Sometimes dollar-cost averaging wins by a point or two, sometimes the lump sum investment wins by a point or two. If you want to check for yourself, do an online search of dollar-cost averaging calculators and find one with historical comparisons.

What you will find in running different scenarios is that there is no financial benefit to dollar-cost averaging. The salesperson would now argue there is a psychological benefit. Folks, the only psychological benefit that matters should come from making a little more money with a little less risk. Dollar-cost averaging offers neither a better investment outcome, nor reduced risk.

In fact, dollar-cost averaging virtually assures an investor of about 100% of the market risk. Why on earth would anybody want that unless they were trying to make more than the market they were investing in? Most investors don’t have the stomach to take 100% of market risk, yet that is what they get, despite the fact that they would generally be happy just beating inflation by a few points.

Dollar-cost averaging is a myth that is similar to the myth of Modern Portfolio Theory. Jeff Joseph of Venture Populist has discussed the weaknesses of Modern Portfolio Theory with regularity. What I will say is that MPT is the easily categorized canned theory that most financial planners and consultants use to conjure their version of asset allocation. That is, no real asset allocation at all.

What is an investor to do then who is sitting on the sidelines like so many are today? It is very simple, buy low when low happens. It is that easy and that hard. But it is not impossible with an informed and patient approach.

The first thing I recommend is finding a long-term strategic asset allocation to use as a base. For most people who can leave their holdings, beyond their cash equivalent holdings and business interests (if they have any), invested for a decade if need be, a core asset allocation often looks like this:

- 20% hard asset linked and alternatives, i.e. SPDR Gold Shares ETF GLD, +0.14% the ELEMENTS Rogers International Commodity Agriculture ETN RJA, -1.32% CBRE Clarion Global Real Estate Income IGR, +0.00%

- 30% fixed income with various currency exposure, i.e. Templeton Global Bond TPINX, -0.40% at net asset value.

- 50% global equities, i.e. as I have discussed. Peabody BTU, -6.01% Veolia VE, -0.34% General Electric GE, -1.42% or Kodiak Oil and Gas KOG, +1.31% .

Those strategic asset allocation percentages aren’t hard and fast. We allow the market to tell us when to invest in each category, tactically. From time to time, we might want global equities to be 80% or more of our holdings, as in the second quarter of 2009. From time to time, we might want to reduce our global equities, as in 2007.

Right now, an appropriate asset allocation is about 30/10/60 as fixed income is terrible all over the planet. With the strong dollar at the moment, I would expect that hard assets and alternatives will soon increase as a portion of asset allocation and equities would shrink.

Let’s go back and ask now, could you make those asset allocation changes if you were married to a dollar-cost averaging program that likely had little management for changes to the financial markets? The answer is obviously no.

About the only benefit of dollar-cost averaging is the forced savings component. In those cases, your money should be getting invested into a money-market fund within an investment account to await proper asset allocation when prices tell us to make a move.

Kirk and clients of Bluemound own shares of Peabody Energy, Veolia Environment, General Electric and Kodiak Oil and Gas, as well as, have various option positions. Neither Kirk nor Bluemound clients plan any transactions in the next three trading days. Opinions subject to change at any time without notice