The difference between unit trusts and ETFs

Post on: 30 Июнь, 2015 No Comment

With the rise of Exchange Traded Funds (ETFs), comparisons have been made with unit trusts as to which provides the optimal vehicle for retail investors. The reality, however, is that unit trusts and ETFs are two very different investment products and are not necessarily competitors in the retail investment industry.

There are many different types or categories of unit trusts and the funds themselves number 913 while there are 25 ETFs in South Africa offering a wide range of investments into shares, bonds, property, money market and offshore markets.

The key difference between these two products is that unit trusts offer a blend of investments or asset classes managed by investment professionals, while ETFs offer a single entry into each investment, which are index-based and computer programme driven. (The best known ETF currently is the Satrix 40, which tracks the JSE Top 40 shares – aggregated by market capitalisation.)

As a result, ETFs can be a good choice for the experienced investor – particularly those with a knowledge of shares – who has the expertise to make investment decisions on their own. For the normal saver, however, unit trusts tend to be more appropriate as the investments are managed by professionals who have the skill sets to make complex investment decisions. Some of these include:

- asset allocations between equities, bonds, property and cash

- cash weightings – general equity unit trusts can hold between 0% and 25% in cash

- defensive or aggressive strategies

- currency exposures

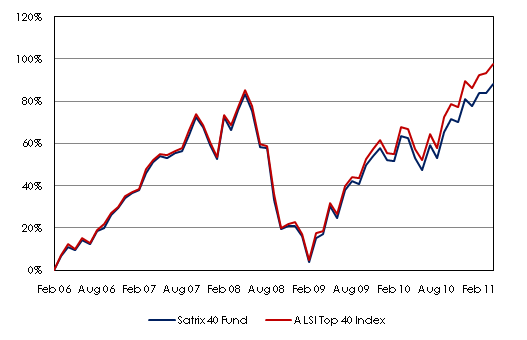

Another misleading comparison which is often made between ETFs and unit trusts is out-performance, where ETFs are often portrayed as providing superior returns to unit trusts. This will depend on which unit trusts are compared. Since the inception of ETFs in November 2000, premium branded unit trusts such as Allan Gray, Coronation, Investec, Nedgroup Investments Rainmaker (managed by a boutique) and Prudential, have produced an average annual return of 20.5% p.a. This is 4.1% p.a. higher than the Satrix 40 ETF that produced an average annual return of 16.4%.

Investing R10 000 in November 2000 into “premium branded” unit trusts would now be worth R58 141, verses R41 907 invested in the Satrix ETF, which is 38.7% more in value.

Premium Brand unit trust performance Nov 2000 to April 2010