The Definition of Internal Rate of Return (IRR)

Post on: 10 Июнь, 2015 No Comment

How Does it Work?

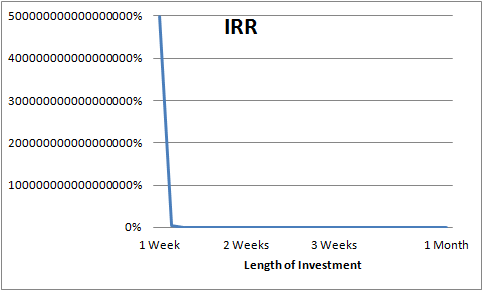

When an investor, which might be an individual or a company, analyzes the viability of a prospective investment, such as a stock or a client project, the investor is interested in that investment’s net present value (NPV). The NPV is an arithmetic function that expresses something’s estimated future value at the present time. The internal rate of return is the rate that would, in theory, make an investment’s NPV equal to zero. This means that the IRR might be positive or negative. A negative IRR value indicates that an investment is likely to lose money and should be ruled out. A positive IRR value indicates viable future returns and should be maximized.

Net Present Value

Calculation

An investment’s internal rate of return is derived by solving the net present value equation for the rate of return, substituting zero for the NPV value itself. Similar to solving the NPV, solving for the rate of return may yield either a positive or negative IRR value. Calculated in conjunction with an investment’s specific NPV, this IRR calculation provides an estimate of the annual cash returns accounting for revenues and expenses for a specific number of years into the future.

Implications for Companies

References

More Like This

You May Also Like

For future investments, if its a negative number, youve lost the money; if its a positive number. Internal rate of return.

The other numbers are positive because the hope is that there will be a positive, increasing return on the investment. 4.

Internal rate of return is the estimated amount of growth you can expect from a particular investment. IRR is an important concept.

. (you don't need to use negative numbers). (Internal Rate of Return). Your results will have little meaning as comparison.

The internal rate of return on a project is a measure of the profitability of an investment. The Definition of Internal.

People often use the word income interchangeably with salary or wages. However, a business uses the word income to represent the company's.

When businesses or individuals consider different choices for investment opportunities, they need a way in which to ascertain which would benefit them.

The internal rate of return method allows you to. value and one negative value in order to calculate the IRR.

Internal Rate of Return. Thinkanddone.com: IRR Definition: Formula: Example: Calculation: Interpolation; Investopedia: An Inside Look at Internal Rate of Return;

Internal rate of return is the estimated amount of growth you can expect from a particular investment. What Does a Negative.

Definition of Marginal Rate of Return. How to Calculate the Internal Rate of a Return; ehow.com. About eHow; eHow Blog; How.

Internal Rate of Return (IRR). and if the number is negative, money is made. A zero IRR means your investment broke.

How to Explain the Internal Rate of Return. The internal rate of return. The Definition of Internal Rate of Return.

Internal Rate of Return (IRR) is a type of return on investment formula used to measure profitability of investments. Implications of.