The Cash Flow Statement

Post on: 16 Март, 2015 No Comment

MARCH 2007 — In recent years, the statement of cash flows has received increasing attention from readers of financial statements. The cash flow statement gives vital information about a companys performance, as well as its major activities during the year; however, some of the rules for preparation make the cash flow statement less useful than it should be.

The weaknesses with the cash flow statement can be divided into five sections:

1) differences between commercial and industrial companies versus financial institutions; 2) problems with operating activities; 3) problems with investing activities; 4) problems with financing activities; and 5) the role of free cash flow. The authors offer potential solutions to these problems that could improve the cash flow statement.

Financial Institutions Versus Commercial and Industrial Companies

In the case of financial institutions, the identification of the core operating activities is important, because they differ markedly from nonfinancial companies in this respect. Consider commercial banking institutions, where the core operations can be divided between onbalance sheet activities and offbalance sheet activities. The offbalance sheet activities consist primarily of fee-based activities for services rendered that do not create an asset or a liability. These create no problem for the cash flow presentation because they appear on the income statement and flow directly through the operating section of the cash flow statement.

The major problems are created by activities that have significant impact on the balance sheet. They are: 1) managing the accounts of depositors, which appears on the balance sheet as liabilities; 2) lending money to customers, which appears on the balance sheet as assets; and 3) trading in securities, which appears on the balance sheet as assets.

If these are a banks core operations, one would expect them to be in the operating activities section of the cash flow statement. Instead, customer deposits are listed as financing activities, while loans to customers and securities activities appear in the investing activities section. As a result, the figure for cash provided by operations is meaningless. In other words, the breakdown of cash flows into operating, investing, and financing activitiesas presently constituted for financial institutionsis not useful to readers of the financial statements. A totally new form of presentation is needed to provide useful cash flow information.

It is somewhat ironic that FASB, in Statement of Financial Accounting Standards (SFAS) 102, Statement of Cash FlowsExemption of Certain Enterprises and Classification of Cash Flows from Certain Securitiesan amendment of FASB Statement No. 95decided to use the fact that financial institutions securities trading is an operating activity as the basis for requiring that commercial and industrial companies treat securities similarly. This is unfortunate for users of financial statements, because it makes it easy for a company to manipulate cash from operations by moving funds between trading securities and cash equivalents, which are treated as part of cash rather than as investments.

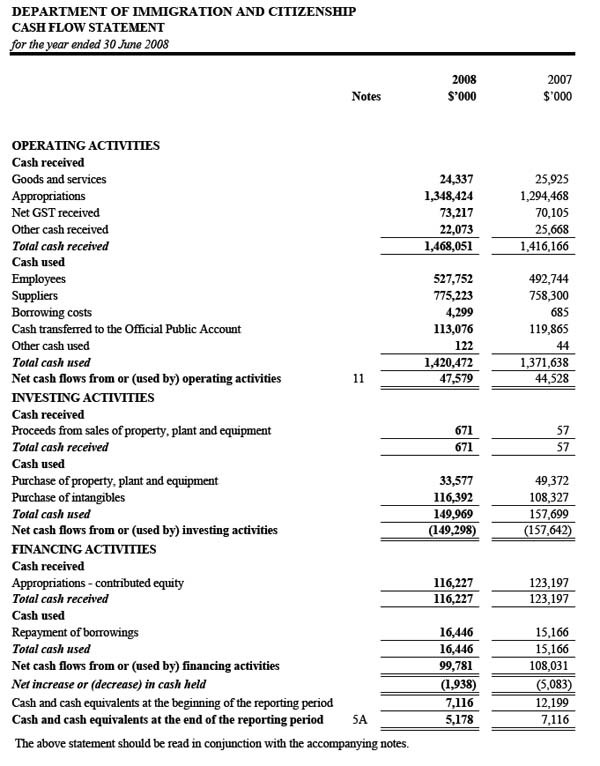

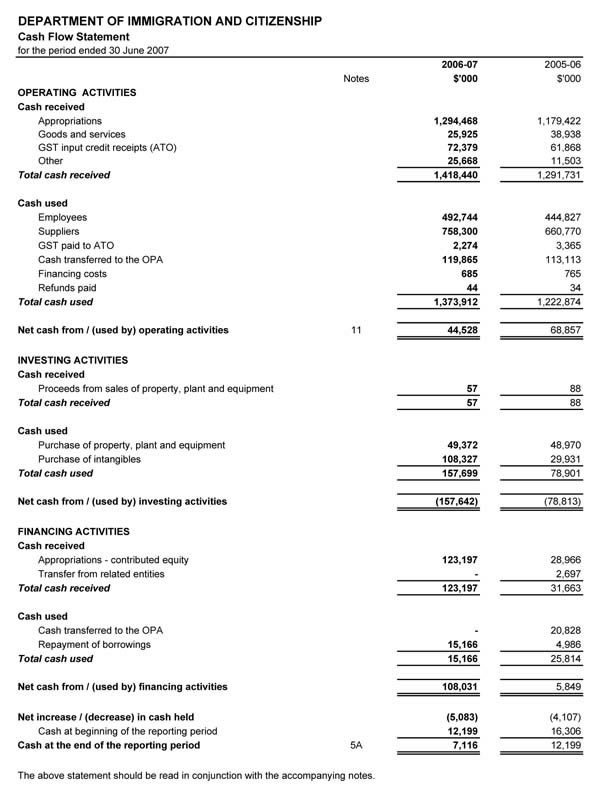

Exhibit 1 shows the current reporting practice of the cash flow statement for the banking industry, while Exhibit 2 proposes an alternative format.

Reporting of Operating Activities

Although the accounting profession talks about the importance of comparability of financial information, the fact that interest paid is treated as an operating activity while dividends paid is treated as a financing activity makes it difficult, if not impossible, to compare the performance of companies that make different financing choices. Analysts have resorted to their own measures to make such comparisons. One of the most common is earnings before interest, taxes, depreciation, and amortization (EBITDA); however, other means to compare exist, with no commonly agreed upon measure for all to use. Up to now, the accounting profession has simply ignored the issue. The only analytical measure that has been dealt with by the accounting profession is earnings per share, because this must be presented on the income statement.

A second problem affecting the operating activities involves the financing of receivables. Years ago, receivables were financed through borrowing, with receivables pledged as collateral. The monies received were treated as a financing activity, which was appropriate. In recent years, however, increasing concern on keeping debt off the balance sheet has led companies to replace the above treatment with sales of receivables, with and without recourse. Economically, these activities still represent a form of financing. The accounting rules, however, allow these transactions to be treated as operating activities instead of financing activities. This makes these transactions doubly attractive to companies: They keep the borrowing off the balance sheet and inflate cash provided by operations. Economically, the pledge of accounts receivable is the same as the sale of accounts receivable, but they are treated differently in the cash flow statement. This treatment is inconsistent.

Another problem that causes distortions in operating cash flows stems from the treatment of dividends received as an operating activity rather than as an investing activity. When a company has significant investments in affiliated companies, it has the ability to manipulate its own cash provided by operations by increasing the dividends it receives from such companies. This simple technique has been used by many companies to inflate operating cash flows. Furthermore, dividend income comes from investments. If the former is shown in the section of operating activities, and the latter placed in investing activities, the financial statement reader will not be able to visualize the whole picture of investment strategy.

Another inconsistency involves capital leases. It is true that, on day one, a lease is a noncash transaction. However, the payment for the lease principal and interest in later days is undoubtedly a cash flow event in a single transaction. And yet, the payment for the principal is treated as a financing activity in one section, while the payment for the interest is shown as an operating activity in another. One transaction is broken into two parts; it has lost its wholeness. It would be more informative if both were brought together as one transaction under financing activities.

Another potentially serious distortion to operating cash flows comes from the rule that requires taxes to be treated as an operating activity, even when the gain being taxed is included in investing activities. For example, consider a company that has low operating profit but has a large gain from the sale of investments. The bulk of the pretax income is from this gain, and therefore the bulk of the income tax expense is related to this gain. On the statement of cash flows, however, the gain is removed from operating activities and included under investing activities instead, as part of the proceeds from the sale of the investments. But the income tax expense on that gain remains in the operating activities sections, generating substantial negative cash from operations. This clearly is misleading, and violates the matching rules required on the income statement.

Another serious distortion involves deferred employee compensation. Many companies pay deferred compensation in the form of stock options that are off the balance sheet when issued. When the company later redeems the options by paying cash, the move is treated as a financing activityas though it were a capital allocation, when in reality this payment is not any different from wages. As such, it should be treated as an operating activity.

Finally, as mentioned earlier, SFAS 102 requires cash flows from trading securities to be treated as an operating activity, rather than an investing activity, allowing companies to easily shift cash flows between years by switching securities between trading securities and cash equivalents.

The Investing Activities Section

For many years, the distinction between cash equivalents (investments having no principal risk) and other marketable securities has caused serious confusion for the untrained reader of financial statements. Cash equivalents are treated as part of cash, while marketable securities are shown as investing activities. Where a companys portfolio manager does a lot of trading and switching between these two types of securities, very large numbers will appear in the investing activities section as purchases of marketable securities and sales of marketable securities. It is not uncommon to see financial statements in which these numbers represent the largest cash flows. Were one to ask the untrained reader what the most significant events for the company were during the year, the answer might be the purchasing and selling of marketable securities. Yet these numbers are irrelevant for understanding the companys performance. They merely clutter up the statement and cause confusion. Because SFAS 102 requires the buying and selling of securities to be treated as operating activities, the situation will be even worse.

Another major problem with the investing activities section is that it is based on the rule that only cash amounts may be shown in investing and financing activities. Thus, for example, if one company acquired another at a cost of $10 billion, but only $1 billion of it was in cash, with the rest paid in the form of debt and equity instruments, the cash flow statement would show only the $1 billion cash amount paid as the cost of the acquisition. The other $9 billion would be relegated to a footnote. The untrained reader would get a false picture of the true cost of the acquisition. This is another example showing the deficiency of the current rules in preparing the cash flow statement. The rules ignore the vision of a complete transaction.

Financing Activities

The major problems in the financing activities section are related to items discussed above. First is the failure of many companies to treat receivables financing as a financing activity. Second is the omission of major noncash financing instruments from the cash flow statement. Both may conceal the full extent of new financings engaged in by the company.

Exhibit 3 compares an industrial companys cash flow statement prepared according to current rules with a statement incorporating the changes suggested earlier in Exhibit 2. Exhibit 3 explains how each of the authors proposed changes to the cash flow statement would make the reporting clearer and more consistent.

The Role of Free Cash Flow

Another important deficiency in the current cash flow statement is the absence of the concept of free cash flow. What is free cash flow? Why is it needed? Traditional net income is a measurement of wealth from the proprietors point of view, but it does not serve managerial purposes. Earnings are appropriated for dividend payout, plant expansion, contingencies, and other needs. Earnings after these appropriations would be more useful for management planning. The cash flow statement is designed to identify the sources and applications of cash in line with net income. This does not serve managerial purposes either. Cash must be reserved for dividend payments and capital expenditures. The cash balance after these reserves would be more informative for the management of cash operations.

The concept of free cash flow was born for this reason. It is defined as cash without any restrictions on its use. It is available for any purpose at any time. It is similar to the concept of unappropriated retained earnings. Free cash flow has become increasingly important in financial statement analysis, yet the accounting profession has ignored it. One current problem with free cash flow is that it has a number of definitions. As a result, different users may be using different definitions and drawing different conclusions about a companys performance.

Following is a partial list of the definitions of free cash flow currently in use:

- Cash provided by operations less capital expenditures

- Cash provided by operations less capital expenditures and dividends paid

- Net income plus depreciation less capital expenditures

- EBITDA less captial expenditures

- Earnings before interest and taxes (EBIT) multiplied by 1 minus the tax rate, plus depreciation and amortization less changes in operating working capital and less capital spending.

The differences in definitions are based on key issues concerning what should be considered in determining free cash flow:

- Should it be unleveraged (before interest), or leveraged (after interest)? The advantage of unleveraged free cash flow is that it provides comparability between companies that finance with debt and companies that finance with equity.

- Should it be before income taxes? The advantage of using pretax numbers for cash flow is that it provides comparability between companies having noticeably different effective tax rates.

- Should it be after dividends paid? The advantage of subtracting dividends paid when arriving at free cash flow is that dividends represent payments that should be provided by operating cash flows, as opposed to other sources, such as borrowing, issuance of stock, or sale of assets.

- Should it be before or after the adjustments for changes in operating assets and liabilities? Using a free cash flow figure based on funds-flow before adjustments for changes in operating assets and liabilities takes a long-run view. In the long run, the changes will vanish. Furthermore, these funds-flow numbers are not distorted by company practices such as delaying payment of trade creditors to inflate cash provided by operations.

The advantage of using a free cash flow figure after adjustments for changes in operating assets and liabilities is that it represents a true cash number, whereas the funds flow number is essentially an adjusted accrual-based number. Furthermore, any company practices that inflate sales and net income (such as channel stuffing) will equally distort the funds flow number. However, the cash provided by operations number is not distorted, because it is reduced by the adjustment for the increase in receivables, which normally accompanies such practices.

(For a more complete list of free cash flow definitions, see John Mills, Lynn Bible, and Richard Mason, Defining Free Cash Flow, The CPA Journal. January 2002.)

Exhibit 4 illustrates how free cash flow could range from a low of $21,000 to a high of $85,000, based upon the definition chosen. If the actual capital expenditures are replaced by a mandatory level to maintain the existing level of plant and equipment, an additional eight values for free cash flow would be generated.

The accounting profession can play an important role in narrowing the choice of free cash flow computations under accounting standards. If the traditional cash flow statement can be extended to include a consistent concept of free cash flow, it would become far more informative and useful.

Improving the Statement of Cash Flows

In response to the issues above, the authors propose a number of changes that would make the statement of cash flows for commercial and industrial companies more useful to the readers of financial statements. For financial institutions, a dramatic reorganization of the cash flow statement is needed to make it a useful document, because the current presentation provides totals that are not useful for evaluating any of the activities of these institutions.

Concerning the concept of free cash flows, two points should be emphasized: First, increasing reliance is being placed on free cash flow numbers by a variety of users, including investor analysts, credit analysts, and finance and economics theoreticians. Second, as a result of the many users of free cash flow, a variety of definitions have been introduced for the determination of free cash flow.

Up to this point, the accounting profession has ignored the concept of free cash flow. The authors suggest that the profession take a serious look at free cash flow, with a view to narrowing and standardizing the conceptual definitions. The authors propose that some sort of free cash flow be disclosed in the financial statements, much as earnings per share must be included in the income statement.

Neil S. Weiss, PhD, CPA, MBA. is an assistant professor of accounting, and James G.S. Yang, MPh. CPA, CMA, is a professor of accounting, both at Montclair State University, Montclair, N.J.