The case for dollarcost averaging

Post on: 4 Май, 2015 No Comment

Share this:

There may be better ways to invest your retirement savings. But dollar-cost averaging is more than just an investment strategy.

I was pleased to see a comment at the end of last weeks blog post Making saving simple about the importance of automatic payroll deductions. Brian Poncelet, a financial advisor, wrote: Dollar-cost averaging looks good on paper but does not work in the real world.

Poncelet raises a worthwhile discussion point. Vanguard, the U.S. mutual fund company, published a study in July 2012 that highlighted an important flaw in the dollar-cost averaging strategy.

The study sought to answer a simple question: If you inherited $1 million, would you be better off investing it all at once or would your portfolio perform better if you were to invest the funds gradually over time (in other words, if you implemented a dollar-cost averaging strategy)?

Vanguard studied stock and bond returns in the U.S. U.K. and Australia. The research covered multiple stretches of time that featured widely varying market conditions, and investment holding periods ranging from one to 30 years. About two-thirds of the time, investors were better off with a lump-sum approach than they were a dollar-cost averaging strategy.

Does this mean dollar-cost averaging is a mistake?

It probably does, if you come into a large sum of money all at once, and you have a long enough time horizon before you need your money. This argument against dollar-cost averaging isnt complicated. It merely (and correctly) identifies the likelihood that over time, your money will perform better if it is invested in the markets than it will if it is held in cash (either in a savings account or a low-interest earning cash instrument like a Guaranteed Investment Certificate). If someone hands you $1 million, its probably not in your best interest to invest $100,000 into a balanced portfolio and stuff the rest under your mattress to be invested piece by piece.

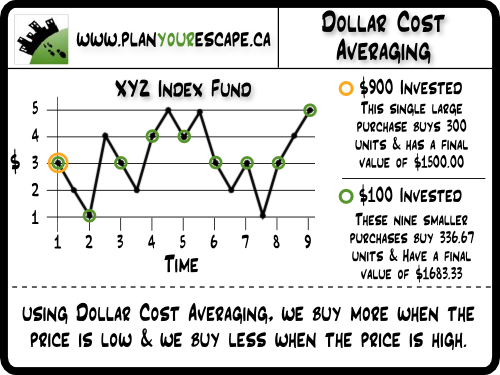

But for those of us not lucky enough to inherit a small fortune, dollar-cost averaging still makes sense. It helps make saving easier, and it prevents our trying to time the market. Save the same amount every month, and the price of your selected funds will dictate whether you buy a lot (when prices are low) or a little (when prices are high).

Dollar-cost averaging is as much a saving strategy as it is an investment strategy.

Read more about investing: