The BuySide Of The M&A Process

Post on: 16 Август, 2015 No Comment

Mergers and acquisitions (M&A) activity cleared the $1 trillion hurdle in the first half of 2007. Private equity, hedge funds, investment banks and strategic companies have been busy doing both large cap and middle market transactions. While 2006 was a record-breaking year in terms of M&A (close to $1.6 trillion worth of transactions were conducted worldwide), all indicators point toward an even higher level of M&A activity for 2007.

The M&A process can be either lengthy or short. It is not uncommon for transactions involving two large companies with global operational footprints to take several years. Alternatively, both multi-billion dollar and smaller middle-market transactions can also take merely a few months, from initial exploratory dialogue all the way to the closing documents and transaction announcement to the markets. (To read background on M&As, see The Basics Of Mergers And Acquisitions . The Merger — What To Do When Companies Converge and The Wacky World Of M&As .)

With the mandate and objective of increasing the value of the company, management — often with the aid of investment banks — will attempt to find external organizations with operations, product lines and service offerings, and geographical footprints that are complementary to their own existing operation. The more fragmented an industry is, the more an intermediary can do in terms of analyzing the companies that may be suitable to approach. With relatively consolidated industries, such as large commodity-type chemicals or bridge manufacturers, a company’s corporate development staff is inclined to do more of the M&A work.

Starting Dialogue

Smaller companies often undergo leadership planning and family issues, and such concerns may present opportunities for an acquisition. merger. or some derivation thereof, such as a joint venture or similar partnership. Most potential acquirers employ the services of a third party such as an investment bank or intermediary to conduct initial, exploratory conversations with targeted companies.

Is your company for sale?

The M&A advisor contacts several companies that meet their client’s qualified acquisition criteria. For instance, a client company might wish to expand to certain geographical markets, or may be interested in acquiring companies of a certain financial threshold or product offering. Once the advisor is engaged in initial dialogue, it is prudent not to ask blunt questions such as is your company for sale? Operators often find such a direct inquiry to be offensive and often raise insurmountable barriers to further discussions. Even if the company is currently for sale, such a direct approach will likely trigger a flat rejection. Rather, effective M&A advisors will ask whether the potential target is open to exploring a strategic alternative or a complementary working relationship in order to drive value for its shareholders and/or strengthen the organization. (What value driven manager or shareholder will say no, I do not wish to increase the value of my company?) Such a query is gentler in its approach, and coaxes existing owners to contemplate on their own that partnerships with external organizations can create a stronger overall organization. (For more see, Mergers Put Money in Shareholders’ Pockets .)

Keeping Communication Open

If there is interest in moving forward with the discussions, other details can be covered. For instance, how much equity is the existing owner willing to keep in the business? Such a structure can be attractive for both parties since the current shareholder can take a second bite at the apple. That is, the existing owner can sell most of the current equity now (and receive cash), and sell the rest of the equity later, presumably at a much higher valuation, for additional cash at a later date.

Two Heads are Better than One

Many mid-market transactions have the exiting owner keep a minority stake in the business. This allows the acquiring entity to gain the cooperation as well as expertise of the existing owner, who is often also the day-to-day manager, as the equity retention (typically 10-30% for mid-market transactions) provides the existing owner incentives to continue to drive up the value of the company. Minority stakes should not be ignored. Many exiting owners who retain minority stakes in their businesses often find the value of those minority shares to be even higher with new owners and more professional managers than when they previously controlled 100% of the business. Existing owners may also want to stay and manage the business for a few more years. Thus, stock participation often makes sense as a value-driven incentive. In a competitive market, many incoming shareholders who succeed in finding a good acquisition opportunity do not want to risk blowing their deal by taking a rigid stance with sellers.

I’ll show you mine.

Many advisors will share their client company’s financial and operational summary with the existing owner. This approach helps to increase the level of trust between intermediary and a potential seller. Additionally, the sharing of information encourages the owner to reciprocate this sharing of company insights. If there is continued interest on the seller’s part, both companies will execute a confidentiality agreement (CA) to facilitate for the exchange of more sensitive information, including more details on financials and operations. Both parties may include a non-solicitation clause in their CA in order to prevent each party from attempting to hire each other’s key employees during sensitive discussions.

Once a more thorough set of information has been communicated and analyzed, both parties can begin to grasp a range of possible valuation for the target company given possible scenarios in the future. Anticipated future cash inflows from optimistic scenarios or assumptions are also discounted, if not significantly, in order to lower a contemplated range of purchase prices.

Into the Mixing Bowl: LOIs to Due Diligence

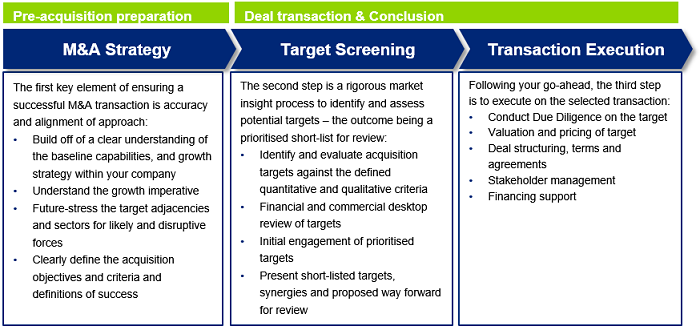

The executed LOI becomes the basis for the transaction structure, and this document will help to eliminate any remaining disconnects between both parties. At this stage, there should be a sufficient meeting of the minds regarding the two parties before due diligence takes place, especially since the next step in the process can quickly become an expensive undertaking on the part of the acquirer.

The accountants and financial consultants focus on financial analysis as well as discerning the accuracy of financial statements. Also, an assessment of internal controls is conducted. This aspect of due diligence may reveal certain opportunities to lessen tax liabilities not previously used by existing management. Familiarity with the accounting department will also allow incoming management to plan for consolidation of this function post-transaction, thereby reducing the duplication of efforts and overhead expenses. A buyer should understand all of the legal and operational risks associated with a proposed acquisition.