The Bull Put Spread Option Ideas

Post on: 4 Июнь, 2015 No Comment

Share | Subscribe

The Bull Put Spread is a strategy to use when you expect a flat to slightly Bullish movement of a stock’s price. But, the strategy can also show a small gain even if the underlying instrument goes against you and declines a bit. When you believe that a stock has a short tem potential for its price to rise, the Bull Put Spread is an inexpensive way to capture profits with very little risk.

The Bull Put Spread involves buying and selling a Put option. The sold option brings in cash at the time the trade is placed. The bought Put option uses up some of the income from the sold option but, in return, you have an offset to the potential assignment risk of the sold option. This is a CREDIT spread, so you will receive income at the time that you place the trade.

How To Construct A Bull Put Spread

Generally, you will buy a Put that is Out-Of-The-Money and sell a Put that has a higher strike price that is either At-The-Money or In-The-Money. Both options will have the same expiration date. The premium that you receive from selling the higher priced Put will bring in more money than the premium that you pay for the lower priced Put. This is why you will end up with an initial credit from the trade.

If the stock’s price stays flat or increases at the time of expiration, you will retain most if not all of the premium that you received. If the price of the stock goes against you and is lower than when you initiated the trade, you may suffer a loss.

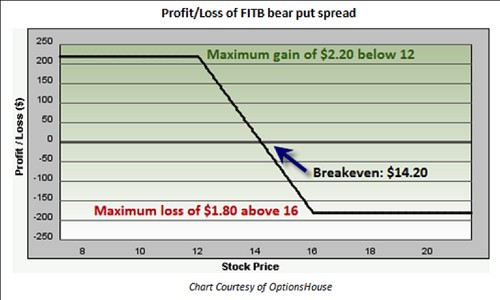

The maximum gain from a Bull Put Spread is the full amount of the net premium that was received when the trade was placed. This would occur if, at the time of expiration, the stock price is above the strike price of the higher priced option. This is the Put that was sold.

With a Bull Put Spread, the maximum loss is the difference between the two strike prices minus the net amount of the premium that you received. This would occur if, at the time of expiration, the stock price is below the strike price of the lower priced option. This is the Put option that was bought.

However, keep in mind that there is no reason to suffer the entire maximum loss. If the trade begins to go against you, the choice that you always have is to close out the transaction at any time before maximum loss occurs. This is accomplished by buying back the short Put and selling the long Put.

Breakeven Point

With the Bull Put Spread, the maximum gain on a trade is the initial premium that you receive. This gain will decrease if the stock price, at expiration, is below the strike price of the Put with the higher strike price (this is the short Put).

If the stock price, at expiration, has dropped to an amount that is equal to the strike price of this higher Put minus the amount of the initial premium received, then the trade will be at a breakeven — you have no gain or loss.

If the stock price, at expiration, drops below this level (the higher option strike price minus the net premium received) then you begin losing money on the trade. But remember, no matter how far the stock’s price goes against you, you cannot lose more money than the difference between the two option strike prices minus the amount of the premium that you received.

Examples: For each of the following examples SPY was at $134.47

Choosing Strike Prices

As shown above, you can determine the potential gain and potential loss of the trade by where you decide to place the strike prices of the options. If you lower the long Put strike price or increase the short Put strike price (or do both), you can increase the net premium income that you initially receive. However the tradeoff is an increase in the amount at risk if the movement of the stock price goes against you.

When Would You Use A Bull Put Spread?

Use this strategy to earn income with limited risk if your expectation is for the stock’s price to stay relatively flat or increase a small amount.

The Bull Put Spread is also used to make a profit when you expect a stock to have a moderate increase in price. It gives you the additional protection of having a defined maximum loss for the trade if the stock price drops instead of staying flat or rising.

You can learn more about different option strategies by downloading our free options booklet: 3 Smart Ways to Make Money with Options (Two of Which You Probably Never Heard About). Just click here.

And be sure to check out our Zacks Options Trader .

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.