The biggest risk investing in an IPO i

Post on: 18 Июнь, 2015 No Comment

This article appeared in the December 2013 ASX Investor Update email newsletter. To subscribe to this newsletter please register with the MyASX section or visit the About MyASX page for past editions and more details.

Knowing how to read a prospectus is critical when reviewing investment opportunities in float.

By Michael Kemp, Barefoot Blueprint

When a company is preparing for a listing on the stock exchange it produces a prospectus. This is supposed to realistically present the future business prospects for the company. Hence the name prospectus.

The company could be a new (start up) business or one that’s been operating privately for years. Either way the company is now inviting prospective investors to stump up their hard-earned cash in exchange for shares in the soon to be listed business. To prise open investor’s wallets the prospectus usually delivers an enticing investment story. But remember, as the following story shows, the company’s business prospects aren’t always as attractive as potential investors might believe.

Picture early 18th century London. Devoid of a formal stock exchange much of the share trading spilled into the alleyways bounded by Cornhill and Lombard Streets. It was 1720 and England was approaching the crescendo of a raging bull market referred to as The South Sea Bubble. Like every bull market since it was characterised by a wave of new offerings in startup companies. Some were legitimate businesses. Many weren’t. The crazy offerings were unaffectionately referred to as Bubble Companies. But of all the bubble offerings one stands out above the rest. Its promoter saw an opportunity to make a quick buck and, devoid of ideas as to what line of business his new company might undertake, hurriedly cobbled together a prospectus describing it as:

A company for carrying on an undertaking of great advantage but nobody to know what it is.

Now we’ve all heard of the problems associated with a lack of corporate transparency but this prospectus took things to a whole new level. The promoter’s only saving grace was he actually admitted to it!

The promoter of the bogus company collected 2,000 in deposits in just one day and then did a runner — never to be seen again. And while you might see this as an amusing, if not a little archaic, story it carries a powerful message. Particularly for those who believe that today’s sophisticated investing public would never be so gullible as to fall for such a bogus claim. But the reality is the same thing happened again and only recently.

In 1999, near the peak of the crazed Dot.com bubble a prospectus was issued by a US company called NetJ.com. It stated that: The company is not currently engaged in any substantial activity and has no plans to engage in such activities in the foreseeable future.

Sound familiar?

The $110 million capital raising was oversubscribed as profit crazed investors dived in. NetJ’s share price climbed 18 fold within months. But those who still held their NetJ shares in the wake of the Dot.com bust lost their shirts. NetJ, not surprisingly, went belly up.

So let me make state very strongly, that is if you haven’t already twigged to it yourself:

The biggest risk investing in an IPO is ….

You.

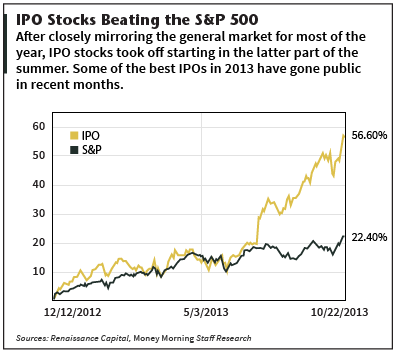

That’s because many investors convince themselves they are going to take up shares in an IPO BEFORE they’ve actually read the prospectus! This is partly because IPO’s are increasingly offered during bull markets, at the very time a growing band of unsophisticated investors are entering the market. A time when share prices are broadly rising and even experienced investors have dropped their guard. A bull market and a profit hungry public is a dangerous mix.

But for the rational ones, those who think reading a prospectus before investing is a good idea, let’s identify some potential traps lurking within its pages.

The role of the regulators

The regulators are acutely aware that prospectuses are largely pitched at retail investors. So the Australian Securities & Investments Commission (ASIC) have identified the need for prospectuses to deliver information in a clear, concise and transparent way.

Statutory checklists (which defined what had to be in a prospectus) were abandoned in 1991. This resulted in prospectuses becoming large, unwieldy and virtually unreadable. Prospectus drafters argued that it was better to have more than less so as to minimize the risk of leaving anything out.

In 2011 ASIC identified the key shortcomings of prospectuses and presented its solutions. It was concerned that prospectuses:

- Had become too heavy on the salesmanship (glossy photos and celebrity endorsements), but light on with respect to relevant and digestible information.

- Underplayed the risks and overplayed the benefits of the investment.

- Weren’t clear and used excessive industry jargon particularly where it was in the interests of the promoter to muddy the message.

- Were too long.

After consultation with the industry, ASIC issued Regulatory Guide 228 — Prospectuses: Effective disclosure for retail investors . Despite the improvements these guidelines delivered investors still need to be on their guard when reading a prospectus today.

Where to start

Start your reading by turning to the investment overview or summary found at the front of the document. Make sure it clearly explains three things:

- What the company does or is proposing to do

- Why it’s making the offer

- How it’s going to spend your money.

Question profit predictions

Despite the regulator’s best efforts in cleaning things up, there’s something you must never forget. The earnings figures in prospectuses (if included) are forward looking and are therefore estimates. Estimates are based on assumptions. Assumptions aren’t facts.

So there are some questions you need to ask yourself when interpreting the earnings forecasts:

- Are the projected earnings in line with the operating results most recently delivered by the company?

- Are they significantly higher? If so is this due to a jump in revenue or to anticipated cost savings? If so can they be realistically justified?

- Has the company been listed on the stock exchange before? If so then how did it perform then?

- How does the company’s claimed performance compare with the performance of other companies operating in the same sector?

It is a requirement that prospectuses clearly outline the risks associated with the investment. The key risks are listed in the overview section. They are described in greater detail in the Risks section.

It’s not enough to simply be aware that a risk exists. It’s important to have a feel for how likely the risk could be realized and the financial impact this would deliver to the bottom line. A high probability risk with a low financial impact is more tolerable than a low probability risk which could wipe out the company.

It’s important to understand whether payment for the shares is a one off or whether future installments will be required. In the case of partly paid or contributing shares only a portion of the face value of the shares is paid up front. The prospectus will list the date(s) when further payment(s) fall due. Alternatively it could be at the company’s discretion when the call for the additional capital will be made.

Be very clear on this issue because it has the potential to catch investors out. The 2008 IPO for the ill-fated BrisConnections asked for three $1 payments spread over an 18 month period. The share price plunged on listing leaving disgruntled shareholders with the task of unloading shares carrying an obligation for two additional $1 payments.

Interpreting any prospectus essentially relies on a sound appreciation of the business sector the company operates in and how that company dovetails into the sector. Hard work? Yes. But without it you’re running on blind trust.

If in doubt then best to gain advice from a licensed financial advisor or stock broker.

About the author

Michael Kemp is chief analyst at The Barefoot Blueprint. a leading wealth-management tool.

ASX Upcoming floats provides information on companies that applied for admission to the office list of ASX.