The best funds for cautious Isa savers with the help of the Sharpe ratio Yahoo Finance UK

Post on: 14 Май, 2015 No Comment

RELATED QUOTES

A simple but underused fund measure — the Sharpe ratio — can give investors vital insight into how much risk a fund takes to produce its returns. Here we name the funds that pass and fail the test

To some, investing in the stock market is a gamble in which ever more outlandish punts must be taken to increase returns. Without risk, there is no reward, they say.

But what if you could identify investments that load the dice in your favour? After all, many fund managers claim their central aim is to generate the largest return for the least risk.

Calculating this risk-reward balance is exactly what the so called Sharpe ratio tries to do. Named after its inventor, Nobel Prize-winning academic and American economist William Sharpe, it is a brilliantly useful — and underused — tool for investors. It looks like a complex algebraic equation but is actually very simple.

First (Other OTC: FSTC — news ) it looks at how the fund has grown over a set period, typically 10 years. Then it looks at how much risk was taken to generate that return. Risk, for these purposes, is simply seen as a scale of the fund’s swings in value, or volatility.

For instance, if the fund had very pronounced peaks and troughs, it would be classed as highly volatile and therefore risky. If it hardly deviated from its growth path it would be classed as low risk.

A high score on the Sharpe ratio indicates that a fund manager took very little risk to generate strong returns, and vice versa.

The millions of investors preparing to put money into Isas when the allowance is increased to £15,000 on Tuesday would be well advised to bear in mind Mr Sharpe’s formula — particularly because the strong rise in the FTSE 100 index over the past five years means any future upward path is unlikely to be straight.

Here we explain how you can use the Sharpe ratio — and name the funds with the best scores over the past decade.

How do you calculate the Sharpe ratio?

To get the Sharpe ratio, you simple divide the fund’s rise a over a 10-year period by its volatility over that time. These figures are often displayed in the fund literature and on websites such as FE Trustnet and Morningstar (NasdaqGS: MORN — news ).

What does a high score mean?

The higher the ratio the more an investor has been compensated for any additional risk taken by the fund manager. The funds with the highest scores tend to be managed in a more conservative fashion, focusing on capital preservation and steady growth.

A low ratio means the fund manager is not generating enough return to justify the risks taken. This makes the fund more likely to perform poorly over the long term, because when markets fall the fund is likely to slip heavily.

Michael Holland, managing director of FE Trustnet, said funds with a high Sharpe ratio should reassure investors that their money was being used wisely.

While performance data is of course useful when looking at a fund’s track record, being able to put it in the context of risk and volatility is of great benefit to investors.

Over a set period, a manager may well have doubled investors’ money, but one who has returned slightly more with a fraction of the volatility is in many ways more impressive.

Safest funds over ten years

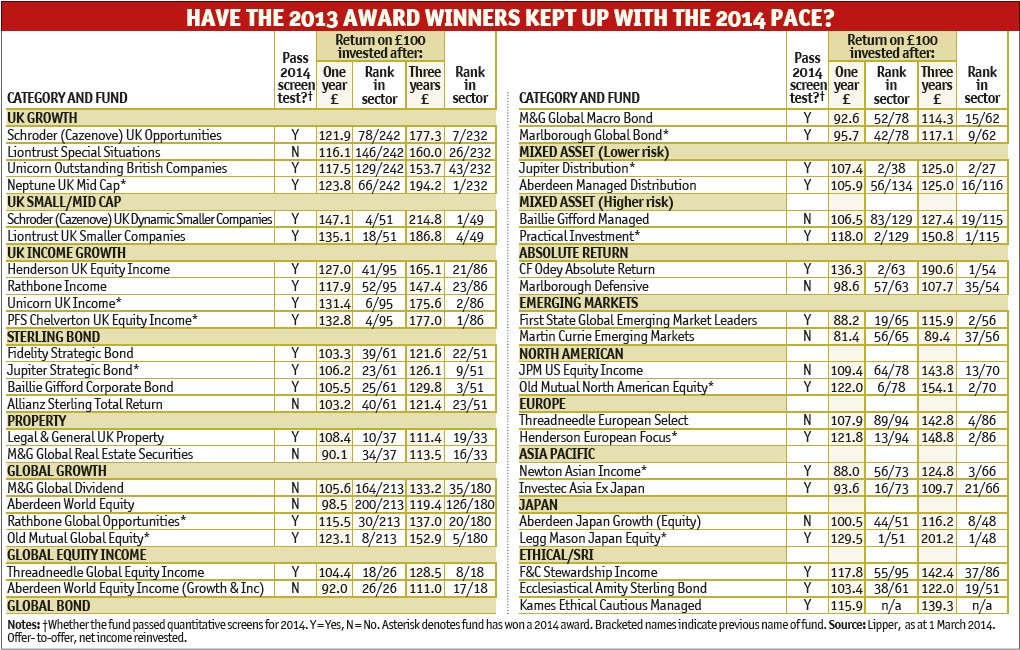

We checked the Sharpe ratio of the thousands of investment funds available to identify the five best-scoring funds over the past decade. These five all delivered the optimum mix of low risk and consistently strong returns.

For context, the average Sharpe ratio score was 0.68 over the period.

M&G Strategic Corporate Bond

It was unsurprising that a bond fund, which buys IOUs issued by governments or companies, topped the list. Bonds tend to be less volatile than shares. A good manager, such as Richard Woolnough of this fund, can show great worth. Mr Woolnough mainly buys bonds issued by companies such as HSBC and Imperial Tobacco and performs well in rising and falling markets. Risk-reward score (Sharpe ratio over 10 years): 1.57 Return (fund growth over 10 years): 85pc

Ruffer European

One of the best preservers of capital when markets fall. Typically has more than half its money in shares, but it is not afraid to move into cash when shares look poor value. During the 2008 financial crisis, this was one of the few funds to keep its head above water.

Risk-reward score 1.52 Return 278pc

Fidelity Extra Income

This fund invests in bonds to produce steady income for investors. The fund has 40p of every £1 invested in high-yield bonds, the riskiest type of bond you can buy. Given its high Sharpe score, the fund manager clearly compensates for this added risk. Risk-reward score 1.43 Return 80pc

Artemis High Income

Managed by respected duo Adrian Frost and Adrian Gosden, this fund’s money is split between shares and bonds for high income (current yield 4.2pc). The fund is often tipped by brokers and is seen as a safe option for those near or in retirement.

Risk-reward score 1.36 Return 106pc

Invesco Perpetual Corporate Bond

A bond fund that has produced solid performance over the long run without exposing investors to undue risk. It tends to invest in bonds with a high credit rating, which means they are less likely to default.

Risk-reward score 1.28 Return 77pc

‘Risky’ funds that failed to reward

The bottom end of the table was littered with funds that invested in Japan.

The past decade has been difficult for these funds — the average return is 35pc. Legg Mason Japan Equity, Invesco Perpetual Japan Smaller Companies and Threadneedle Japan Growth propped up the table with a score of 0.

Manek Growth, a UK fund managed by former pharmacist Jayesh Manek, also notched this score.

= The cheapest investment shops =

It’s not just about what you buy, but how you buy it. A price war has broken out between investment shops. These are the plaforms where investors buy, sell and hold funds and shares. As a general rule of thumb, the cheapest options for Isa investors with small portfolios are those that charge a percentage, such as Hargreaves Lansdown (0.45pc), Bestinvest (0.40pc) or Axa Self Investor (0.35pc). For larger portfolios — above £100,000 — consider flat-fee brokers such as Share Centre or Interactive Investor.

The Telegraph offers a service that is very competitive for buy and hold investors, charging a capped 0.2pc coupled with low-cost dealing fees: Telegraph Investor Centre (0.2pc plus dealing fees).

- See our full round-up of the cheapest fund shops

• Get Twitter alerts for all our investing stories: follow @telegraphinvest

• Investment tips every week by email sign up here