The Basics Understand Assets Liabilities Equity

Post on: 20 Май, 2015 No Comment

The Basics — Understanding Assets, Liabilities, and Equity

Sign up

You can opt-out at any time.

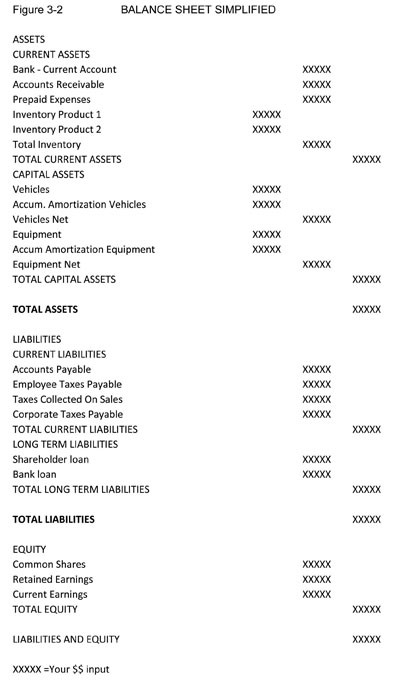

Before you set up your bookkeeping system, you have to understand the firm’s basic accounts — assets. liabilities and equity. Assets are those things the company owns such as its inventory and accounts receivables. Liabilities are those things the company owes such as what they owe to their suppliers (accounts payable), bank and business loans, mortgages, and any other debt on the books. Equity is the ownership the business owner and any investors have in the firm.

Balancing the Books

In order to balance your books, you have to keep careful track of these items and be sure the transactions that deal with assets, liabilities, and equity are recorded correctly and in the right place. There is a key formula you can use to make sure your books always balance. That formula is called the accounting equation :

Assets = Liabilities + Equity

The accounting equation means that everything the business owns (assets) is balanced against claims against the business (liabilities and equity). Liabilities are claims based on what you owe vendors and lenders. Owners of the business have claims against the remaining assets (equity).

Initial Bookkeeping Terms Related to the Accounting Equation

Photo Credit: Hopeoremegue