The Basics Of Covered Calls

Post on: 9 Июль, 2015 No Comment

Widely viewed as a conservative strategy, professional investors write covered calls to increase their investment income. But individual investors can also benefit from this simple, effective option strategy by taking the time to learn it. By doing so, investors will add to their investment arsenal and give themselves more investment opportunities. Let’s take a look at the covered call and examine ways that you can use it in your portfolio.

What is a Covered Call?

As a stock owner, you are entitled to several rights. One of these is the right to sell your stock at any time for the market price. Covered call writing is simply the selling of this right to someone else in exchange for cash paid today. This means that you give the buyer of the option the right to buy your shares before the option expires, and at a predetermined price, called the strike price. (For more, see Cut Down Option Risk With Covered Calls .)

A call option is a contract that gives the buyer of the option the legal right (but not the obligation) to buy 100 shares of the underlying stock at the strike price any time before the expiration date. If the seller of the call option owns the underlying shares the option is considered covered because of the ability to deliver the shares without purchasing them in the open market at unknown — and possibly higher — future prices.

For the right to buy shares at a predetermined price in the future, the buyer pays the seller of the call option a premium. The premium is a cash fee paid to the seller by the buyer on the day the option is sold. It is the seller’s money to keep, regardless of whether the option is exercised.

When to Sell a Covered Call

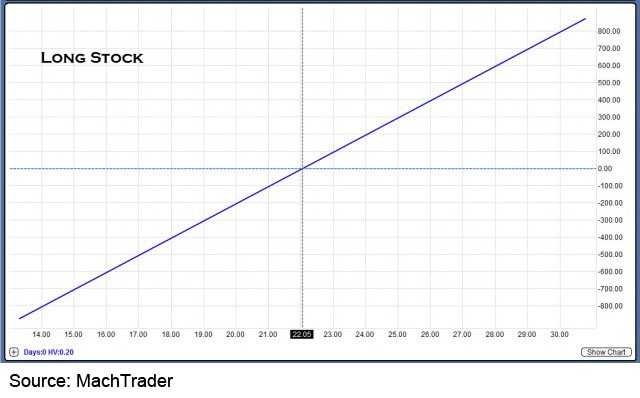

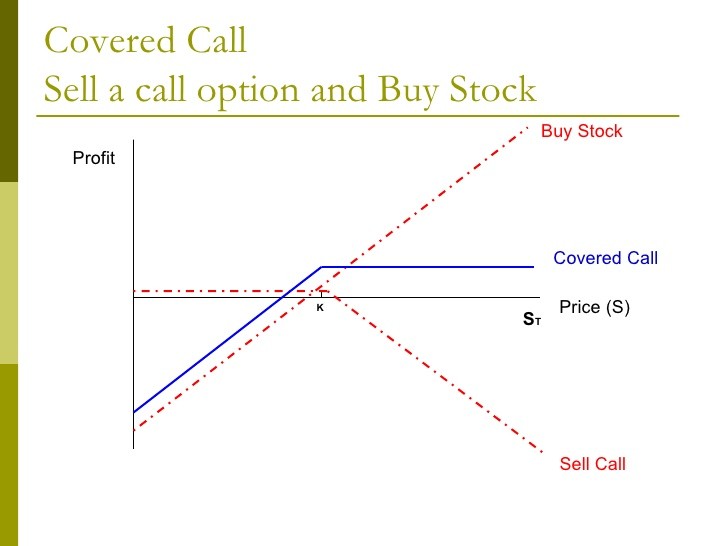

If you sell a covered call, you get money today in exchange for some of your stock’s future upside.

For example, let’s assume you pay $50 per share for your stock and think that it will rise to $60 within one year. Also, you’d be willing to sell at $55 within six months, knowing you were giving up further upside, but making a nice short-term profit. In this scenario, selling a covered call on your stock position might be an attractive option for you.

On the other hand, if the stock falls to $40, for instance, you’ll have a $10 loss on your original position. However, because you get to keep the $4 option premium from the sale of the call option, the total loss is $6 per share and not $10.