The Baltic Dry Index Lows Shipping Markets And Steel Consumption In China

Post on: 7 Август, 2015 No Comment

Summary

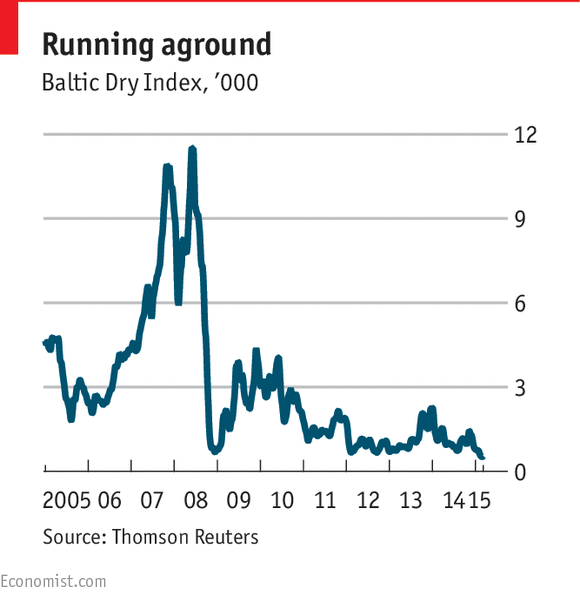

- Baltic Dry Index’s role as a leading indicator no longer reliable after 2008.

- Analysts believe the shipping market is still 20% oversuppplied compared to demand.

- The Baltic Dry Index has fallen over 60% in the past three months.

- With the oversupply in the shipping market, there is no clear end to the low spot rates for bulk carriers.

Baltic Dry Index Explained

Before exploring the lows the Baltic Dry Index has reached, and the possible repercussions, it is important to know what exactly the Baltic Dry Index tracks.

The Baltic Dry Index (BDI) is a shipping and trade index tracking dry-bulk rates for four types of vessels on 23 different shipping routes. The BDI breaks down into four different vessel sizes: Capesize, Panamax, Supramax, and Handysize, and the various routes that serve as a benchmark for overall trade volume. The rates are determined by t he Baltic Exchange directly contacting ship brokers to assess price levels for a given route, products transported, and time to delivery. Additionally, the Baltic Exchange also operates as a market maker in freight derivatives, in a type of forward contract known as forward freight agreements, ((FFAs)) that are traded OTC.

Economic Indicator

The BDI is important as it is seen as an economic indicator of global trade. However, economic forecasting is a difficult process. Howard Simons, president of Rosewood Trading. believes the indicator stopped serving as useful indicator after 2008. Yet, Peter Sand, chief shipping analyst at BIMCO (the world’s largest international shipping association) says, global trade is vital for gaining insight, as 90% of goods traded internationally are by ship. Thus, while BDI might not serve as an exact indicator of the global economy, it is still a useful measure to monitor.

The BDI’s role as a leading indicator no longer working after 2008 could be due to the large orderbook of vessels being delivered around and after 2008. The large number of orders before the financial crisis caused an oversupply in the shipping market, while meanwhile the financial markets were crashing. Global growth fell precipitously, and demand for commodities such as oil, coal, iron, and copper plummeted.

The world economy has recovered from the lows of the financial crisis, but not enough to match the oversupply of vessels available for shipping. Analysts believe the shipping market is still 20% oversuppplied compared to demand.

Baltic Dry Index Lows

According to Barron’s, the BDI has fallen over 60% in the past three months, hitting a 30-year low on Feb. 19th.

Yet, the BDI continued to slide, reaching a low of 509 on Feb. 18, according to Bloomberg. The index has since recovered to 540 as of Feb. 27.

Currently, bulk carrier (ships carrying grain, coal, ore, etc) spot rates remain low, and earnings only cover 33%-50% of operating costs. Accordingly, bulk carrier owners are losing cash every day. Since these owners are losing cash on a daily basis, they need enough working capital to weather the storm. Yet with the oversupply in the shipping market mentioned above, there is no clear end to the low spot rates and bulk carriers such as Star Bulk Carriers (NASDAQ:SBLK ), Paragon Shipping (NASDAQ:PRGN ), and DryShips (NASDAQ:DRYS ) continue to suffer.

As for the oil tanker market, the supply/demand (S/D) balance is closer than the bulk carrier market. However, improved earnings have caused more orders and could pose a shift to a more uneven S/D balance. Investors looking to play a recovery in the oil tanker market could look at companies such as Nordic American Tankers Limited (NYSE:NAT ), Frontline Ltd. (NYSE:FRO ) and Teekay Corporation (NYSE:TK ).

Steel Consumption in China

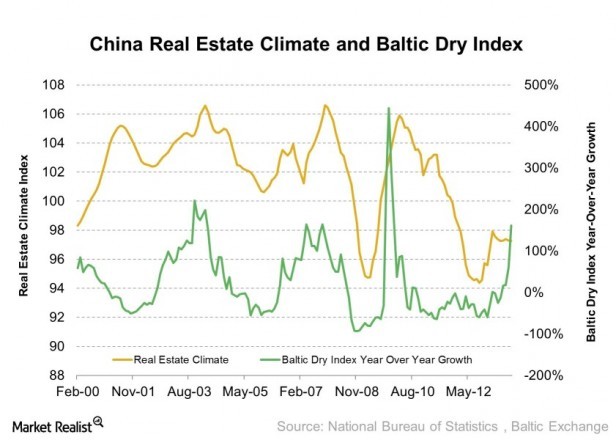

Routes from Australia and South America to China comprise a large part of the dry bulk carrier market, shipping iron ore and coal. China’s went from consuming 12% of the world’s metals in 2000, to 50% today. These raw materials are then combined to form steel, and fuel China’s massive growth in infrastructure.

Consequently, Clarksons Capital Markets believes Chinese demand for coal and iron ore should lift demand for dry-bulk vessels by 4.5% this year and 5.4% in 2015. Clarksons also predicts a recovery in the Baltic Dry Index to more than double its current levels as every vessel size sees a recovery in charter rates.

However, Chinese domestic steel consumption fell in 2014, the first time in 30 years. This statistic proves worrisome as a slowdown in China would hurt the shipping sector, as the sector has long depended on China as the major source of global shipping demand.

Play the Recovery in the Baltic Dry Index

Investors can profit from the projected moves in the Baltic Dry Index by speculating in forward-freight agreements, which are similar to commodity futures contracts. Alternatively, there’s Guggenheim Shipping ‘s exchange-traded fund (NYSEARCA:SEA ), which tracks a basket of shipping stocks. Investors should be aware, however, that because the Guggenheim ETF is more diversified than just companies in the dry-bulk sector, it doesn’t always exactly track the Baltic Dry Index.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.