The Balance Sheet of the Federal Reserve System

Post on: 16 Март, 2015 No Comment

The Financial Status of The Federal Reserve System

Key to understanding the nature and role of the Federal Reserve System are two important financial statements the balance sheet and the income statement. We will begin by examining the Fed’s balance sheet.

The Balance Sheet of the Federal Reserve System

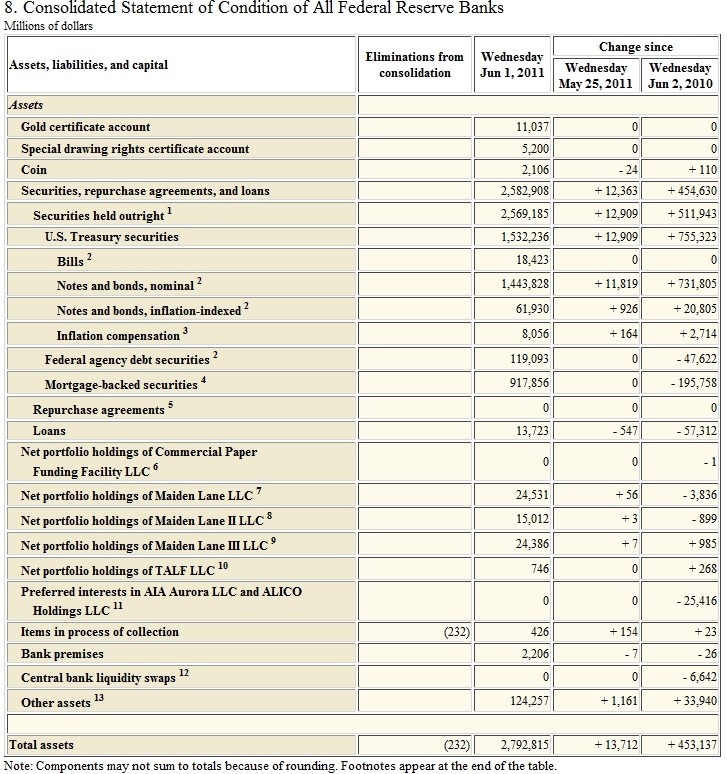

Table 12-1 presents the consolidated balance sheet of the 12 Federal Reserve banks a snapshot indicating the assets, liabilities, and capital accounts of the Fed at a given point in time. The Feds assets are those things it owns and claims it has on outside entities; its liabilities are debts it owes, or claims that outside entities have on the Federal Reserve. The Federal Reserves capital accounts are simply the difference between its total assets and total liabilities. We will begin with the Feds assets.

Federal Reserve Assets

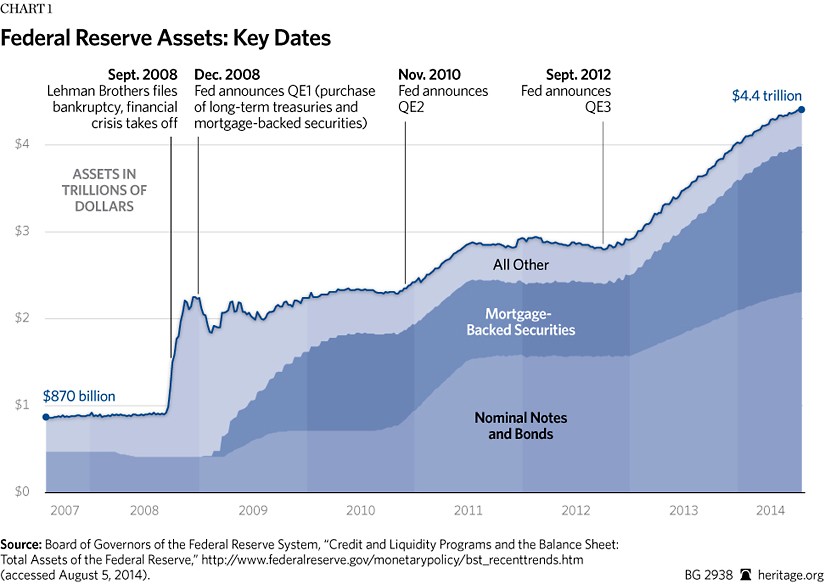

“U.S. government securities” refers to interest-bearing securities acquired by the Federal Reserve for the purpose of influencing the nation’s financial and monetary conditions. Federal Reserve holdings of U.S. government securities amount to more than 85 percent of the Fed’s total assets. As we shall emphasize later, the primary tool of Federal Reserve policy is open market operations the buying and selling of government securities for the purpose of influencing bank lending, the level of interest rates, and the nation’s money supply. The Fed’s massive government security portfolio has been gradually accumulated over the years as the result of measures taken by the Fed to expand the nation’s money supply to accommodate a growing economy.

Loans made by Federal Reserve banks to depository institutions are known as “discount loans,” or discounts and advances. These very short-term loans are initiated by depository institutions (banks) in response to temporary seserve deficiencies. Such reserve deficiencies result from unexpected net check clearings against banks’ reserve accounts at the Fed and from withdrawals of currency from banks by the public.

The relatively small item “coin” consists of coins issued by the Treasury that are currently held by the 12 Federal Reserve banks. The Fed holds coins to accommodate requests for coins by depository institutions, which respond to the public’s demand for coins.

“Cash items in process of collection” refers to checks being processed by the Fed for which the Fed has not yet received payment. The Fed collects on such checks by debiting the reserve accounts of the depository institution on which they are written (right- hand side of the Fed’s balance sheet). These cash items are an asset to the Fed because they are claims against the depository institutions, which the Fed will exercise within a few days by debiting the institutions’ reserve accounts at the Fed.

The Fed’s gold certificate account is more of historical interest than of current significance. For each dollar’s worth of gold the U.S. Treasury acquires, it issues a one-dollar gold certificate and presents it to the Federal Reserve. The Fed compensates the Treasury by making a bookkeeping entry in which it credits the Treasury’s deposit account at the Federal Reserve (on the liability side of the Fed’s balance sheet). Years ago, a law required that the paper currency issued by the Fed (Federal Reserve notes) be backed by gold certificates. This requirement placed constraints on the amount of currency the Fed could issue. As the volume of Federal Reserve notes needed to accommodate a growing economy increased over the years, and as the U.S. gold stock gradually diminished in response to persistent balance-of-payments deficits, the gold certificate requirement was reduced and then eliminated in 1968. The final vestige of the gold standard was abandoned.

The Special Drawing Rights (SDR) certificate account is similar in nature to the gold certificate account. SDR certificates represent the Fed’s claims against Special Drawing Rights, which are issued by the International Monetary Fund and held by the U.S. Treasury (and by other governments). Special Drawing Rights are issued by the IMF to help finance international trade. When the Treasury acquires additional SDRs from the IMF. it issues SDR certificates to the Federal Reserve, which compensates the Treasury by crediting its deposit account at the Fed.

The item “denominated in foreign currencies” consists chiefly of foreign government bonds bonds denominated in such currencies as yen and deutsche marks. These foreign assets provide ammunition to the Federal Reserve for supporting the exchange value of the U.S. dollar at times when the Fed deems it essential. In times of excessive weakness of the dollar, the Fed can liquidate these interest-earning assets and use the foreign currencies they bring to purchase dollars in the foreign exchange market.

Other assets of the Federal Reserve include such items as the Feds physical facilities its buildings, furniture, equipment, computers, and fleet of automobiles.

Federal Reserve Liabilities

The dominant liability on the Fed’s balance sheet is Federal Reserve notes, the paper money issued by the Fed. This item constitutes approximately 90 percent of total Federal Reserve liabilities. The Fed issues this currency in response to the publics demand for it. as manifested by the withdraw al of currency from depository institutions. When depository institutions run low, they contact the Fed, which issues the notes and sends them to the depository institutions in armored trucks. The Federal Reserve charges for this currency by debiting the depository institutions’ deposit accounts at the Fed.

Deposits are maintained at the Federal Reserve by various organizations. Commercial banks and other depository institutions hold the major portion of their legal reserves in this form in order to meet the Fed’s reserve requirements and to facilitate the clearing of checks through the Federal Reserve. When a check is deposited at a particular bank, the Fed processes it and credits that bank’s reserve account at the Fed. A check written by a bank’s customer results in a debit to that bank’s account at the Fed.

The U.S. Treasury pays for the bulk of its expenditures through checks written on its account at the Federal Reserve, and regularly replenishes the account by transferring funds from its accounts in private banks, known as tax and loan accounts.4 Foreign central banks also maintain checking accounts at the Federal Reserve, as do other international organizations such as the World Bank and the International Monetary Fund. Such organizations use their Federal Reserve account to make payments in the United States. The Fed processes checks written by these organizations by debiting the account of the international organization at the Fed and crediting the accounts at the Fed of the U.S. banks in which the checks are deposited.

Deferred-availability cash items” corresponds to “cash items in process of collection” on the asset side of the Fed’s balance sheet. This item represents the aggregate value of checks being processed by the Fed which will soon be credited to the accounts of the depository institutions which received the checks. These banks have a claim on the Fed. and in a day or two the Fed will be making a bookkeeping entry crediting their reserve accounts. The difference between “cash items in process of collection” and “deferred-availability cash items” is known as Federal Reserve float. Float is normally positive because the Fed typically credits the account of the bank in which a check is deposited a day or so before it debits the account of the bank on which it is -• written. (Float is discussed in more detail in Chapter 14.)

Federal Reserve Capital Accounts

The capital accounts of the Federal Reserve System consist of the difference between its total assets and total liabilities. A major portion of the Fed’s capital accounts derives from capital paid in that is, the equity the owners of the Federal Reserve have invested in the Fed. The remainder comes from funds that the Fed has transferred from its net income to “surplus,” a component of the capital accounts.

Technically, the Federal Reserve is ‘owned by the member banks of the Federal Reserve System. Each member bank is required to purchase shares of stock in the Federal Reserve in the amount of 6 percent of the bank’s own capital accounts. In return, the Fed pays the bank a 6 percent dividend on its shares. The “ownership” of the Fed by private institutions (the member banks) is a manifestation of the distrust of government that influenced the writers of the Federal Reserve Act. It is, however, a highly unusual form of ow nership, because the member banks do not exert significant influence over the Fed’s operations or policies. Indeed, if they did, the Fed would be unable to carry out its chief functions in a satisfactory manner.