Testing An Asset Class Rotational Model that Trades ETFs

Post on: 21 Май, 2015 No Comment

4,217 views

There are literally hundreds of research reports out there that demonstrate the ability of relative strength (momentum) strategies to beat the market. The latest one I read is here. and it is highly recommended. I plan to continue testing and development of relative strength rotational models as I feel confident that they are robust yet simple enough to be traded by just about anyone with a desire to do so.

Mebane Faber has generated a significant buzz with his rotational models, and so for this next round I will be testing an idea that he published almost four years ago A Simple Momentum System for Beating the Market. Rather than quoting extensively from his post, Ill rely on the reader to click over and read it for themselves. Ill cover the most important aspects of the system below.

The Asset Class Rotational Model:

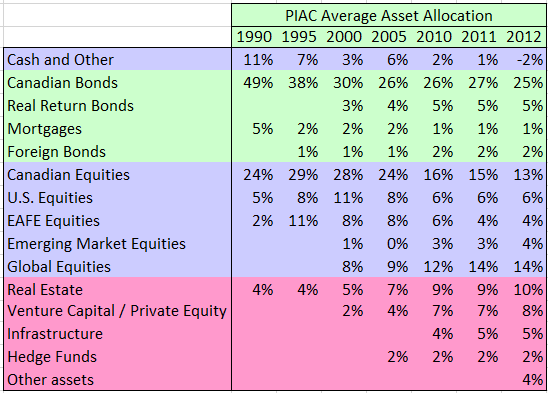

- uses 5 asset classes U.S. Stocks, Foreign Stocks, Bonds, REITs, and Commodities

- uses monthly bars to generate all calculations

- ranks the ETFs by calculating the 3 month, 6 month, and 12 month rate-of-change, and then averaging them

- trades the top 5 ranked ETFs with each position given an equal portfolio allocation

- re-ranks the ETFs at the end of the month and rotates out of ETFs that have fallen below the top 5 and replaces those ETFs with the ones that have replaced them in the top 5

- is long-only and in the market all the time UNLESS there are no asset classes with a rank above zero

- rotates at the close of the monthly bar

The ETFs used for this test are those suggested by Faber. No commissions or slippage were included.

All charts/graphs can be enlarged with a double-click.

Equity Curve:

Green areas show the periods when the system was not fully invested and had some or all of its capital in cash.

Historical Profits :

Caveats and Thoughts:

The most significant caveat is that many of these ETFs do not have data going back to 2003. Some of them did not start trading until 2008. Therefore the impact of the entire portfolio is not seen until after 2008. Using index data (which would allow testing even farther back than 2003) instead of ETFs would allow a more accurate sampling of how each asset class affects results prior to 2008, but since indices are not tradeable, the results may still not be reliably generalized.

The starting date and ending date for the test is also important to consider. I would have liked to include the 2001-2003 bear market but the ETF data is simply not available to do so.

2011 was the worst year of the test period. Since it is well known that many hedge funds underperformed in 2011, Im wondering if many of them were trading relative strength strategies.

Can the Strategy Be Improved?

The purpose of this post was to demonstrate the strategy outlined by Faber.

There are additional factors that can be added to increase the annualized results while decreasing the drawdown. The next post will describe and implement two new factors.