Ten sure signs of overtrading in small businesses and their possible solution

Post on: 14 Апрель, 2015 No Comment

Ten sure signs of overtrading in small businesses and their possible solution

Small businesses by nature are more volatile. Their owners tend to try out so many ways of doing things within a short period of time. This in most cases land them in the trap of overtrading. Overtrading in common parlance simply means trying to achieve too many with too little. Small business owners usually allow their ambition and emotion to supercede the reality. The failures of small businesses are largely linked to the negative and ugly effect of overtrading.

Small business owners can shield themselves and their businesses from overtrading by being on the lookout for signs of overtrading and corrective actions taken. In this article are TEN signs of overtrading and also possible ways to eliminate their effects.

TEN SIGNS OF OVERTRADING

- Rapid growth in fixed assets. In this age of constant technological breakthrough, small business owners acquire sophisticated assets (especially IT related) on a daily basis. This is often without a corresponding growth in investment opportunity that the asset can be employed to generate adequate returns.

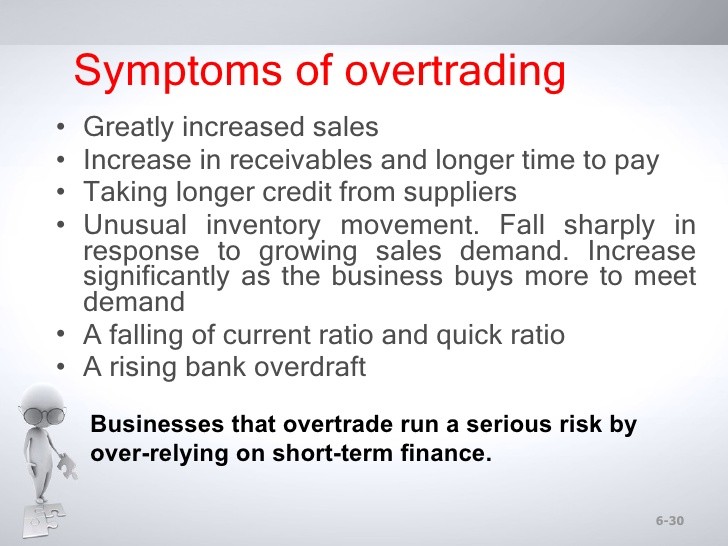

- Drastic increase in sales. Growth in sales is a normal thing. In fact, that is the essence of business but, when it becomes so drastic; its benefit will be lost. Growth in sales is like a two-edged sword- too low bad; too high bad. Many small business owners equate business success with rapid growth in sales (this is arguable anyway). And they achieve this by employing more sales staff than needed.

- Rapid increase in receivables. Small businesses usually employ so many incentives to increase sales and one of such incentives is to allow unnecessary long credit days. This usually place undue pressure on the need for additional working capital without additional benefit to the business.

- Over reliance on short term debt (usually in the form of overdraft facility ). Because of the principle of equity gap (a situation where a business has little owner fund and is not in a position to raise capital from the stock exchange such as The Nigerian Stock Exchange), many small business owners tend to resort to bank loan. There is nothing bad with this approach if well managed and monitored. Problems only come when too much reliance is placed on it.

- Sudden jump in inventory. Sudden growth in piled stock is a warning sign that overtrading is around the comer. May be in the bid to meet the surge in demand due to aggressive advertising, a company may pile up stock just to avoid the effects of stock-out which is another area to avoid in business

- Rapid decrease in cash balances and its equivalent. Companies quickly go bankrupt once it cannot meet its short-term obligations over a protracted period of time. A profitable business can still go bankrupt if it does not have a healthy cash flow.

- Stagnancy in owner(s ) equity. Owner’s equity is that portion of capital of a business that is permanent is the business for use. Significant disproportionate growth with debt finance is a danger sign that overtrading is creeping in.

- Little or no growth in reserve. Reserves by nature are supposed to be growing. It is a warning sign that there is danger as soon as it stops growing.

- Unusual increase in trade payables. In as much as I personally encourage small businesses to tap into the potentials of trade credit, problems come knocking when its use goes out of proportion. The business will loose its reputation and eventually go bankrupt if it is known to heavily rely on trade credit that gives rise to trade payables.

- Irrational emphasis on advertising. Small businesses start inviting overtrading as soon as they start competing with multinationals on the amount they spend on advertising and sales promotion.

POSSIBLE SOLUTIONS

The mere identification of these signs is a vital step in eliminating overtrading and its effect. More specific countermeasures are listed below

- Improved receivables and inventories control. Small business managers should keep an eagle eye on these variables so that they don’t go out of proportion. Good working capital management is a must in this regard.

- Increase owner’s equity. Small businesses should increase equity investment. As tough as this may be, small business owners should not see it as impossible. After all, that is part of the entrepreneurial spirit. You can consider using Business Angels or Venture Capitalists to raise equity.

- Investment appraisal . Proper investment appraisal should be carried out before investing in fixed assets.

- Employment of good cash management technique. Cash budgeting and other cash management techniques like Baumol Model should be used to make a calculated guess on the company’s cash need and necessary arrangements made.

I hope you enjoyed the time you invested in reading this article.

This entry was posted on Sunday, November 15th, 2009 at 11:30 pm and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. Responses are currently closed, but you can trackback from your own site.