Technology Sector Dividend Analysis

Post on: 1 Август, 2015 No Comment

This article will be the 3rd of a 6 part dividend analysis aimed at identifying the top dividend stock in each of the following sectors:

4. Consumer Staples

5. Big Tobacco

6. Dividend Cornerstones

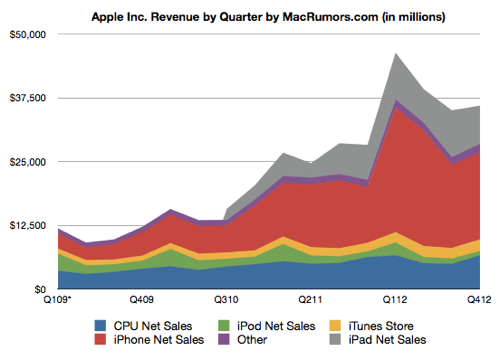

Source: Yahoo Finance

Beta

Beta is the measure of volatility (or systematic risk) of a stock in comparison to the market as a whole. A beta of 1 means the stock price will move in line with the market. With the exception of Cisco, all the betas in this analysis are under 1 which means they are less volatile than the market and offer less risk than one might expect for a tech stock. When evaluating investments for a dividend income portfolio, beta is an extremely important metric to consider to limit your risk.

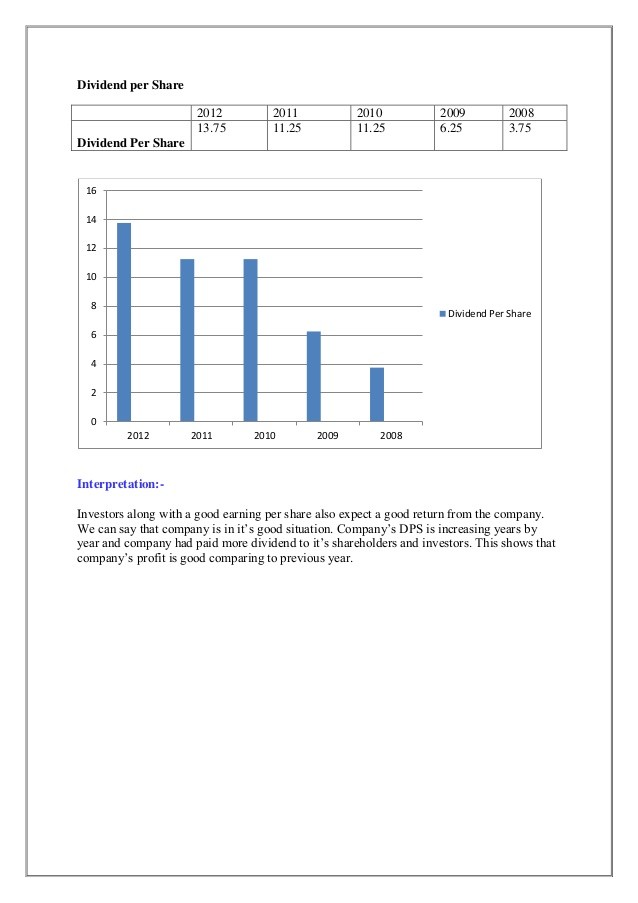

Dividend

*Apple pays a quarterly dividend of $3.05/share.

IBM, Microsoft and Qualcomm have raised dividends every year for the past 5 years and no company in the analysis has decreased its dividend during this time period. On March 4, 2014, Qualcomm again raised its dividend by 20% to $0.42/share. Qualcomm is the only company in this analysis with a yield below 2%, but I included it because it has a strong track record of increasing dividends and returning value to investors. Apple just reinstated its dividend in 2012 after getting rid of it in 1995. Apple has paid $3.05/share for the past 4 quarters. Cisco too just started paying dividends in 2011 and has done a good job of steadily increasing it over time.

Microsoft, IBM, Qualcomm and Intel all have a strong track record of paying and raising dividends. All stocks in this analysis can easily pay and sustain their dividend. It would take a huge turn of events for one of these giant companies to stop its dividend payment.

Dividend Yield

While technology stocks don’t have the strong dividend yields of oil and utility companies, they offer diversification in any dividend portfolio. Technology stocks have more exposure to capital appreciation than utility companies, so they can enjoy the run up that comes along in a bull market. The stocks included in this analysis aren’t volatile tech stocks, they are all well entrenched businesses that aren’t going anywhere soon. Tech doesn’t get the respect when it comes to dividend yields, but investors shouldn’t overlook any of these quality dividend paying companies. Intel and Microsoft stand out with high and consistent dividend yield. Intel in particular stands out with a dividend yield rarely falling below 3%.

Payout Ratio

Much of a technology company’s budget goes to R&D so the company can stay one step ahead of the competition. One great aspect of these stocks is they are so large and established, they can easily support a large R&D budget as well as safely sustain attractive dividends. The payout ratios for these stocks are really impressive. Not a single stock spends more than 50% of earnings on dividends.

IBM leads this category with a payout ratio that rarely fluctuates and is usually less than 25%. You can compare IBM’s historic dividend payout ratio to any dividend paying stock and it will be equally as impressive.

Conclusion

Many investors don’t take into account technology stocks when building a dividend income portfolio, but these stocks can be an excellent path to diversify a portfolio. Oftentimes conservative investors are worried about fluctuations and potential dividend cuts and dismiss the sector as a whole. However, the stocks in this analysis have proven track records, are well established and are flooded with piles of cash. Combined these 6 companies have over $200 billion in cash. That’s enough to buyout all 6 utility companies in my previous article and still have roughly $30 billion left.

All the stocks in this analysis would be a great addition to any portfolio. Intel would be my favorite for its high dividend yield and proven track record. Intel does have one of the higher betas in the group making it slightly more volatile, but also a greater chance for capital appreciation during bull markets.

I believe Qualcomm may be positioned the best going forward due to its dominance in mobile device processors. It has also been aggressively increasing its dividend and buying back shares.

For the conservative investor, Microsoft and IBM are great additions. Microsoft has the largest cash position of these stocks with $83 billion, a low beta and a history of steadily raising its dividend. IBM has been around for decades and isn’t going anywhere. It has the lowest P/E, beta and payout ratio in the group making it a conservative investor’s dream. For a hesitant dividend income investor just starting out in the technology sector, IBM and Microsoft offer reliability and safety.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.