Technical Indicators and Charting Patterns

Post on: 24 Сентябрь, 2015 No Comment

Over the years, technical analysts have developed hundreds of technical indicators and detected dozens of chart patterns that they contend help them forecast future price changes. While we cannot describe or even list all of them, we can categorize them based upon the nature of irrationality that we attribute to markets. Consolidating all of the irrationalities that have been attributed to financial markets, we have created five groupings:

- Market participants over react to new information: If this is true � prices rise too much on good news and fall too much on bad news � you would draw on contrarian indicators which would help you to gauge the direction in which the crowd is going and to go against it. Market participants are slow learners: In many ways, this is the polar opposite of the first grouping. If investors are slow learners, prices will under react to new information and you would expect price direction to persist and use momentum strategies, which would gauge market direction and move with it. Investors change their minds frequently and often irrationally, causing significant shifts in demand and supply, causing prices to move. If you believe that this is the way markets work, you would use technical indicators and charting patterns to detect these shifts. There are a group of investors who lead markets, and finding out when and what they are buying and selling can provide a useful leading indicator of future price movements. If this is what you believe about markets, you would track the trading of these leading investors and try to follow them. There are external forces that govern up and down movements in markets that override fundamentals and investor preferences. Technical indicators and charting patterns that allow up to see their larger cycles in stock prices can allow us to get ahead of other investors.

Within each, we can consider different technical indicators that we can broadly categorize into three groups � price indicators, which are based upon past price movements, volume indicators, that look at trading volume and sentiment indicators, that use qualitative measures of how bullish or bearish investors feel about stocks.

Markets overreaction — Contrarian Indicators

There are many practitioners and some economists, especially in the behavioral school, who believe that investors overreact to new information. This, in turn, can create patterns in stock prices that can be exploited by investors to earn excess returns. In this section, we consider some of the indicators, which we label contrarian, that have been developed by analysts who subscribe to this view.

The Basis for Overreaction and Implications

Why would markets over react to new information? Some researchers in experimental psychology suggest that people tend to overweight recent information and underweight prior data in revising their beliefs when confronted with new information. Others argue that a few investors tend to panic when confronted with new information, and that they take the rest of the market with them. As evidence, you could point to the strong evidence of price reversals over long periods that we presented earlier in this chapter.

If markets overreact, it follows that large price movements in one direction will be followed by large price movements in the opposite direction. In addition, the more extreme the initial price movement, the greater will be the subsequent adjustment. If markets overreact, the road to investment success seems clear. You buy assets when others are most bearish about it and selling, and sell assets when other investors are most optimistic and buying. If your assumption about market overreaction is correct, you will earn excess returns as markets correct themselves over time.

Technical Trading Rules based upon Contrarian Opinion

There are a number of indicators, some based upon price patterns, some based upon trading volume and some on market views that are designed to provide you with a sense of market direction. The objective is to not follow the market direction but to go against it and these are contrarian indicators. We will consider three widely used indicators in this section, each of which focused on a different subset of investors.

Trades that are in lots of less than a 100 are called odd-lots and are usually made by small investors. There are data services that track the number of odd-lot trades � both buys and sells — in individual stocks and in the market. As small investors become more enthusiastic about a stock, odd lot buys increase relative to sells. When they become pessimistic, the reverse occurs. To the extent that you view small investors as more likely to over react to information, you would sell as odd lot buying increases and buy as odd lot selling decrease.

But what if you believe that it is institutional investors who panic and not small investors? After all, large price movements are usually caused by institutional buying and selling. rather than by individual traders. There are indicators that track the stocks that institutions are selling and buying, with the objective of doing the opposite. There are also indicators that track the percent of mutual fund portfolios that is invested in cash and near cash investments, a good indicator of how bullish or bearish mutual fund investors are. When mutual funds are optimistic about the market, cash holdings tend to fall, whereas cash holdings increase as they become more pessimistic. If you believe that mutual fund managers over react, you would buy when they are bearish and sell when they are bullish.

Finally, you could look at investment advisors who claim to have divined the future. Investment advisory services often have their lists of most desirable and least desirable stocks. Value Line and Standard and Poor�s categorize stocks into classes based upon their perceived attractiveness as investments. In keeping with the notion that the market is usually wrong, you would sell those stocks that investments advisors are most bullish on and buy those stocks where they are most bearish.

Shifting Demand

Technical analysts often argue that the greatest profits are to be made at what can be called inflection points � a fancy term for shifts in price trends from positive to negative or vice versa. Since price is ultimately determined by demand and supply, analysts often look for leading indicators of shifts in demand, especially when they are caused my emotion rather than fundamentals. If they succeed, they will make money.

The Basis for Shifting Demand and Implications

The basis for the shifting demand argument is that demand shifts cause price changes and that these demand shifts often have no basis in economic fundamentals. The anecdotal evidence seems to bear out this view. Markets often move for no discernible reason and the volatility in stock prices seems to vastly exceed the volatility in underlying value. The empirical evidence also backs up the view that prices are more volatile than fundamental value. Shiller compared stock price movements over time to movements in the present value of dividends (which he viewed as a measure of fundamental value) and concluded that stock prices were significantly more volatile (See figure 7.14)

Figure 7.14: Are markets too volatile?

Note that the smoothed out line is the present value of dividends, whereas the volatile line represents the S&P 500.

It should be noted, though, that neither the anecdotal evidence nor Shiller�s study conclusively proves emotional volatility, In fact, some researchers have argued that if the value of a stock is based upon expectations, small news announcements can cause big shifts in expectations and stock prices.

Technical Trading Rules aimed at detecting Shifting Demand

There are numerous pricing patterns and indicators that chartists claim provide advance warning of shifting demand. We will consider four broad measures here. The first relate to the entire market, and measure the breadth of the market by looking at the number of stocks that advance relative to those that decline. The argument here is that a market that goes up with limited breadth (a few stocks are creating much of the upward momentum, while the rest are flat or declining) is a market where demand (and prices) are likely to decline soon. In fact, an extension of this measure is the advance/decline line. which is reported in many financial newspapers, where you graph the ratio of the number of stocks that have gone up to the number of stocks that have dropped. Here again, analysts argue that a divergence between index levels and the advance/decline line � a drop in the index accompanied by an improvement in the advance/decline line may indicate an upcoming shift towards buying.

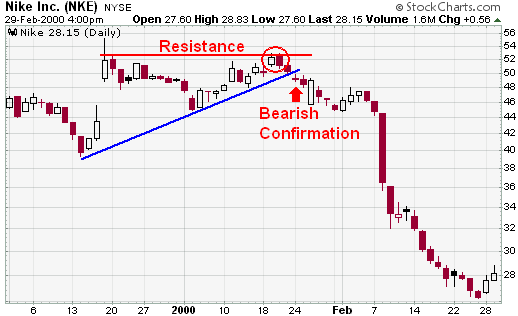

The second is the presence (at least perceived presence) of support and resistance lines in prices. A resistance line is an upper bound on the price whereas a support line represents a lower bound on the price. Both are extracted by looking at past prices. Thus, a stock that has tended to move between $ 20 and $ 40 over the last few periods has a support line at $ 20 and a resistance line at $ 40. It may be pure coincidence though we think not but support and resistance lines often are nice round numbers � you very seldom see a resistance line at $ 39.88 and a support line at $ 21.13. Figure 7.15 provides a chart with support and resistance lines.

Figure 7.15: Support and Resistance Lines

The fact that the stock stays below the resistance line and above the support line is not news, but a stock that breaks through either gets attention. When a stock breaks through the resistance line, technical analysts view it as a sign of a shift in demand upwards and the beginning of a sustained upward movement in prices. Conversely, when a stock falls below the support line, analysts view it as a breakdown in demand and the precursor of a further decline in prices. While the notion of arbitrary support and resistance lines strikes us as fanciful, if enough investors buy into their existence, there can be a self-fulfilling prophecy. To see why, assume that a stock with a resistance line of $ 40 sees its stock price go up to $40.50. Investors who believe that this is a beginning of a surge in prices will all try to buy the stock on the event, causing the stock price to go up. Whether such a price increase can be sustained for more than a few days is an open question. In the graph, you can also see another widely followed chart pattern, called �head and shoulders�. In fact, there are hundreds of patterns that chartists have uncovered over time that have been offered as leading indicators of price changes. [1]

Central to much of technical analysis is a reverence for moving averages. i.e. averages of stock prices over the last few months or weeks. Often, you will see price charts with a moving average line superimposed on actual prices. Again, analysts view any deviation of stock prices from a moving average line as an indication of an underlying shift in demand that can be exploited for profits.

Analysts have also long used a charting technique called point and figure to detect trends in prices. The essential feature of a point and figure chart is that it is composed of a series of Xs and Os. Each X represents a price movement of a given size called a box size. As long as prices continue to rise, Xs are added to the column. If there is a price decline of more than a given magnitude (called the reversal size), a new column of Os is opened. Figure 7.16 presents a point and figure chart.

Figure 7.16: Point and Figure Chart

In recent years, information on trading volume for individual stocks has become increasingly accessible. Technical analysts now routinely look at trading volume for clues of future price movements, either in conjunction with price changes or by itself. For instance, an increase in the stock price that is accompanied by heavy trading volume is considered a more positive prognosticator of future price increases than one generated with light volume.

Empirical Evidence on Technical Indicators

There is not much empirical evidence for or against many of the individual charting patterns. Part of the reason for this is that many of these patterns are so subjectively defined � different analysts use different and often shifting definitions of what comprises a support or a resistance line, for instance — that they cannot be tested empirically, which serves both sides of the argument very well. Supporters of charting can then use their own tests which are often biased to offer proof that their patterns works. Opponents of technical analysis can rest secure in their absolute conviction that charting is for the na�ve and the misguided and not worry about evidence to the contrary.

It is quite ironic that some of the best defenses of technical analysis have been offered by academics who would not categorize themselves as chartists or technical analysts. Lo, Wang and Mamaysky (1998) present a fairly convincing defense of technical analysis from the perspective of financial economists. They use daily returns of stocks on the New York Stock Exchange and NASDAQ from 1962 and 1996 and use the most sophisticated computational techniques (rather than human visualization) to look for pricing patterns. They find that the most common patterns in stocks are double tops and bottoms, followed by the widely used head and shoulders pattern. In other words, they find evidence that some of the most common patterns used by technical analysts exist in prices. Lest this be cause for too much celebration among chartists, they also point out that these patterns offer only marginal incremental returns (an academic code word for really small) and offer the caveat that these returns may not survive transactions cots.

Are currency markets different?

While there is little empirical evidence to back the use of charts in the stock market, a number of studies claim to find that technical indicators may work in currency markets. To name a few:

� Filter rules, where you buy a currency if it goes up by x% and sell if it goes down by the same amount earned substantial profits in the Deutsche mark, yen and sterling markets between 1973 and 1981. [2]

� Moving average rules would have generated excess returns in foreign currency markets. [3]

� Head and Shoulder patterns would have generated excess returns in the pound sterling, Canadian dollar, French franc and Swiss franc markets between 1973 and1994. [4]

Though there are dissenting voices, there clearly seem to be more opportunities for technical analysis in currency markets. Some attribute it to central bank intervention. When banks target exchange rates, they can generate speculative profits for investors. Another possibility is that the foreign currency market is less efficient that the stock market.

Slow Learning Markets: Momentum Indicators

If investors are slow to assess the effects of new information on stock prices, you can see sustained up or down movements in stock prices after news comes out about the stock � up movements after good news and down movements after bad news. There are analysts who contend that this is indeed the case and create trading rules that take advantage of this slow learning process. Since these rules are based upon the assumption that trends in prices tend to continue for long periods, they can be categorized as momentum rules.

The Basis for Slow Learning and Implications

What is the evidence that markets learn slowly? The best support for slow learning markets comes from studies that look at information events such as earnings announcements or acquisitions. As we will see later in this book, there is evidence that markets continue to adjust to the information well after it has come out. For instance, a firm that reports much better than expected earnings will generally see its stock price jump on the announcement and continue to drift upwards for the next few days. The same seems to occur to a target firm in an acquisition. While there are alternative explanations for price drifts, one potential explanation is that markets learn slowly and that it takes them a while to assimilate the information.

If markets learn slowly, you should expect to see prices move in the same direction after a precipitating action. If the initial news was good � a good earnings report or an earnings upgrade from an analyst � you should expect to see upward price momentum. If the news was bad, you should expect to see the opposite. In fact, recent empirical studies (referenced in the earlier part of this chapter) have found evidence of price momentum in equity markets in the United States at least in the short term.

Technical Indicators to take advantage of slow learning markets

Momentum investors firmly believe that the trend is your friend and that it is critical that you look past the day-to-day movements in stock prices at the underlying long-term trends. The simplest measure of trend is a trend line. Figure 7.17 contains two trend lines � the graph on the left is for a silver futures contracts over the few months of its existence and the graph on the right is for cocoa futures over a much longer time period.

Figure 7.17: Trend Lines

In this silver futures contract to the left, you see an uptrend line, drawn by connecting a series of lows in prices, each one higher than the other. On the right, cocoa prices had been declining over the period in question and a down trend line is drawn by connecting a series of lower highs. As momentum investors, you would buy stocks that are going up and staying above the uptrend line. If the price falls below the uptrend line, it is viewed as a negative sign. Conversely, if the price rises above a down trend line, it is considered a bullish sign.

A closely followed momentum measure is called relative strength. which is the ratio of the current price to an average over a longer period (say six months or a year). Stocks that score high on relative strength are therefore stocks that have gone up the most over the period, whereas those that score low are stocks that have gone down. The relative strength can be used either in absolute terms, where only stocks that have gone up over the period would be considered good investments. Alternatively, the relative strength can be compared across stocks, and you invest in stocks that show the highest relative strength � i.e, have gone up the most, relative to other stocks.

Following the Informed Investors: Leading Indicators

This approach is the flip side of the contrarian approach. Instead of assuming that investors, on average, are likely to be wrong, you assume that they are right To make this assumption more palatable, you do not look at all investors but only at the investors who presumably know more than the rest of the market.

The Basis for Following Smart Investors and Implications

Are some investors smarter and better informed than others? Undoubtedly. Do they make higher returns as a consequence? Not necessarily. As Keynes was fond of pointing out, a stock market is a beauty contest, where the prize goes to the person who best gauges who the other judges in the contest will pick as the winner. In investment terminology, the high returns often go to the investor who can best pick the stocks that other investors will buy.

There are two keys to making a strategy of following other investors work. The first is identifying the smart investors, who may not always be the largest or best known. It stands to reason that investors who have access to the best information are most likely to beat the market and would be the ones that you should follow. The second is to find out when and what these smart investors are trading in a timely fashion, so that you can imitate them. This is often difficult to do. Even though insiders and institutions have to file with the Securities and Exchange Commission (SEC), providing details about their trades, the filings are made several weeks after the trades occur.

Technical Indicators for Followers

There are several technical indicators that attempt to pinpoint what better informed investors are buying and selling. Here, we consider two. The first looks at short sales made by market specialists. Since these specialists are close to the action and have access to information that the rest of us cannot see (such as the order book and trading on the floor), it can be argued that they should have an inside track on over priced and under priced stocks. Thus, a surge in specialist short sales in a stock would be a precursor for bad news on the stock and a big price drop. Some analysts look at all short sales made on a stock, arguing that only larger, more sophisticated investors can short stock in the first place. A study by Senchack and Starks in 1993 provides some support for this indicator by noting that stock returns tend to me more negative for stocks where the short interest (short sales as a percent of the outstanding stock) is higher.

In the last few years, as the SEC has speeded up the process of recording transactions by insiders and has made this data more easily accessible to the public. You can therefore look up stocks where insider buying or selling has increased the most. In fact, the ratio of insider buying to selling is often tracked for stocks with the idea that insiders who are buying must have positive information about a stock whereas insiders who are selling are likely to have negative information.

Long Term Cycles: Mystical Indicators

The final set of technical indicators are based upon long term cycles in prices that exercise an inexorable hold on how prices move. Since these long-term cycles operate independently of fundamentals, it is very difficult to explain them without resorting to mysticism.

Basis for long term cycles and Implications

There are two ways in which you can defend the use of long-term cycles. One is to abandon any basis in rationality and argue that there are a number of phenomena in nature that cannot be explained with models. [5] You can think of such investors as subscribers to the karmic theory of investing. In other words, everything that happens has already been pre-destined and there is nothing that we can do to stop it. This requires an almost religious belief that cycles will replicate themselves. The other defense is based on market behavior. You can argue that investors, even though they might be separated over time, behaved in very much the same way in the South Sea Bubble as they did in the dot-come bubble. Consequently, long term cycles reflect the pricing mistakes that investors make and remake over time. As a cautionary note, you should realize that if you look for patterns too intently in charts, you will find them, especially if you use visual techniques (rather than statistical ones).

Technical Indicators based upon Cycles

While there are numerous cycles that analysts see in stock prices, we will consider two in this section. In the first, the Dow Theory. the market is considered as having three movements, all going at the same time. The first is the narrow movement (daily fluctuations) from day to day. The second is the short swing (secondary movements) running from two weeks to a few months and the third is the main movement (primary trends) covering at several years in its duration. Proponents of the theory claim that you can tell where you are in the primary cycle by charting the industrial and transportation components of the Dow Index and looking for confirmation (i.e, both indices moving in the same direction). In figure 7.18, the Dow Theory is presented:

Figure 7.18: The Dow Theory

In 1922, William Hamilton wrote a book titled �The Stock Market Barometer�about the Dow Theory, where he presented evidence on its efficacy at predicting market movements. A recent study [6] appraised Hamilton�s predictions in the Wall Street Journal between 1901 and 1929 and concluded that he had far too many correct calls than chance would lead you to expect and that you would have earned excess returns following his advice.

While the Dow Theory has been around for decades, the Elliott Wave acquired a wide following in the 1980s. Elliot’s theory was that the market moves in waves of various sizes, from those encompassing only individual trades to those lasting centuries, perhaps longer. In the classic Elliot wave, a cycle lasts 200 years and has 8 waves � five up and three down � with smaller cycles within each of these waves. By classifying these waves and counting the various classifications, he argued that it was possible to determine the relative positions of the market at all times.

In the aftermath of the 1987 crash, there were several newsletters that based upon the Elliott Wave. [7] Most of them faded in the years after, as the predictive power of the model was found to be wanting.

Other cycles include: the Kitchen cycle (inventories, 3-5 years); the Juglar Cycl e (fixed investment patterns, 7-11 years); and Kuznets Cycle (building patterns, 15-25 years). Other more controversial theories include: the Kondratyev Cycle (also called the long economic cycle, about 54 years) in three stages of upswing, crisis, and depression. The Babson chart of business barometers uses statistics and charts to model a 20-year cycle in four stages: overexpansion, decline, depression, and improvement.

[1] For a comprehensive listing of indicators, see � The Encyclopedia of Technical Market Indicators � by Thomas R r obert Colby and Thomas Myers, Irwin.

[2] See �Analysis of Short-Run Exchange Rate Behavior: March 1973 to November 1981� by Dooley, M.P. and J.R. Shafer in Exchange Rate and Trade Instability, Causes, Consequences and Remedies, 1983, Ballinger.

[3] See �Time Varying Risk Premia, Volatility and Technical Trading Rules� by B.C. Kho, Journal of Financial Economics, v41, 246-290.

[4] See �Head and Shoulders: Not a flaky pattern�, by Osler,C.L. and P.H.K. Chang, Staff Paper, 1995, Federal Reserve Bank of New York.

[5] Scientists would undoubtedly disagree.