Tech sector told to prove itself to attract super fund backing

Post on: 1 Август, 2015 No Comment

Pauline Vamos says the VC industry needs to learn how to demonstrate its value to superannuation funds. AFR -

Yolanda Redrup and Paul Smith

The chief of Australia’s peak superannuation body has said the burgeoning technology start-up sector needs to prove itself worthy of investment, rather than seek rule changes in a bid to access the $1.9 trillion it holds under management.

Pauline Vamos, chief executive of the Association of Superannuation Funds of Australia, said the secretive nature of Australian tech-focused venture capital funds, and a lack of long term track record, meant calls for super funds to take a punt on start-ups were premature.

Australian tech entrepreneurs have long-lamented an inability to access cash from super funds, citing it as an impediment in creating a Silicon Valley-style eco-system in Australia. It has led for calls for changes to legislation to require super funds to allocate money to tech-focused VCs.

The founder and CEO of Australian tech export Nitro, Sam Chandler, said just a small allocation of Australian super fund money would make a significant difference towards overcoming structural issues which make local VC investment unattractive.

His company has largely relocated to the US and taken US venture funding in order to expand, and he said government intervention was needed.

It’s become incumbent on the government to drive this, Mr Chandler said. There needs to be an innovation allocation The original intent of super was for the long-term benefit of the state.

Imagine if super funds had to invest 0.5 per cent of the fund into innovation and have it committed to VC funds in Australia, or VCs outside of Australia which invest in Australian companies.

No preferential treatment

However, Ms Vamos said the industry would be very concerned about any legislation that provided preferential treatment to a certain sector.

Experience has shown people running VC organisations earn more than those who have invested in it, she said.

Funds are very careful. If funds cannot see if they’re a good long-term investment they will not invest.

Ms Vamos said the VC industry needed to learn how to demonstrate their value to the superannuation funds.

Opaqueness just doesn’t do it any more. This isn’t an issue where you can say super doesn’t want to invest in VC. But the deal must stand by itself.

However, Mr Chandler said it was a bit rich for the super industry to say it didn’t want a mandate, when it only existed because of government legislation.

He said super funds should be used to help build industries, which would be important for the country’s future prosperity.

How can a fund manager, when they could be looking at a 0.01 per cent allocation, say it’s a real encumbrance on the fund to put aside this amount to invest in companies that will become the bedrock of the technology economy in the next 10, 20, 30 years?

Seasoned entrepreneur and venture capitalist Michelle Deaker, who runs a growth fund, OneVentures, tipped to close at $100 million, has previously sought to bring attention to the importance of greater investment in the tech eco-system for the broader economy.

If we don’t start investing in the new economy, $3.5 trillion is going to transfer out of our top companies because of disruption and it will go overseas, Ms Deaker said late last year.

She said a super fund had recently confided in her that tech-related businesses were their best-performing asset class, but for them to get involved and invest the minimum size of their investment was about $150 million, excluding local tech players.

They can only be 10 to 20 per cent of any one fund, so their ability to invest in Australian VC has become quite limited because of the industry consolidation, Ms Deaker said.

Not all of Australia’s tech luminaries believe super funds should be mandated to back the sector. Atlassian co-founder and Blackbird venture partner Mike Cannon-Brookes said such a move would be unnecessary.

He said super funds were burned by tech VC funds in the early 2000s and the sector needed to prove itself to be trustworthy before expecting investment.

There’s a general industry sense that we have to fix the problem, but we have to fix it with results, rather than with any sort of intervention, he said.

Now they’re watching to see if we perform well, and if we do they’ll be interested.

Falling funding

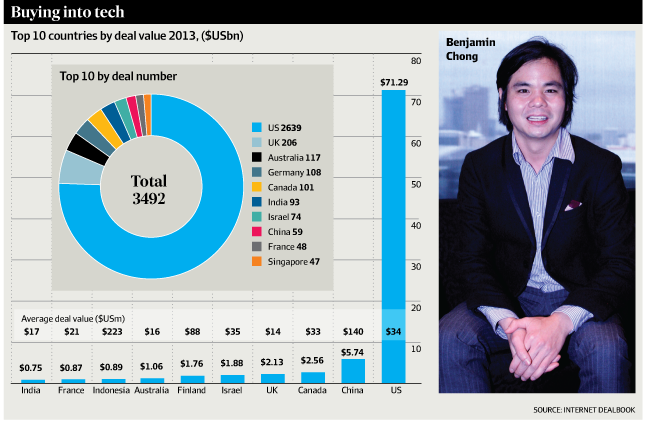

In the 2014 financial year venture capital fundraising fell by 21 per cent to $120 million in Australia, spread across four funds, according to the Australian Private Equity and Venture Capital Association’s annual yearbook.

For the first time since 2007, there were no new government commitments to VC. Sovereign wealth funds became the largest source of new commitments, overtaking superannuation, pension funds and funds-of-funds.

Figures published on February 19 by AVCAL and Cambridge Associates showed Australian private equity and venture capital investments had outperformed the S&P/ASX 300 index by 21 percentage points in the 12 months to December 30.

While some Australian super funds have been hesitant to invest in local VCs, they have been more inclined to invest in US tech funds. Labor MP Ed Husic recently returned from a US study trip, where he said he found plenty of evidence that local super funds could see the value in tech firms.

I lost track of how many times VCs and firms within the US tech ecosystem remarked upon the inability to channel a stream out ofour massive pool of national savingsinto early-stage innovation, Mr Husic said.

I’d explain how super funds were deeply conscious of their mandate to deliver returns for fund members but then they’d recall stories they’d heard of Aussie super funds only investing in US VCs that supported US innovation.

One thing all sides agreed on was that the venture capital community in Australia was failing to attract investment from super funds due to its small size.

AVCAL chief executive Yasser El Ansary said the opportunity and scale of VC funds offshore was far greater than in Australia.

For so many super funds there is a minimum threshold below which it’s uneconomic for them to allocate money, he said.

There’s recognition from an economic point of view that the scale has to align for there to be an attractive proposition.

Mr Ansary said rather than targeting the big super funds, the VC community should engage with self-managed super funds.

There are some very important attributes which go with SMSFs which are neatly aligned with venture investment, he said.

There is a predisposition to backing Australian business, as there is appetite to invest in Australia to help promote a prosperous economy for the future.

The Australian Financial Review