Tech ETFs In Focus The Holdings Are The Key

Post on: 27 Март, 2015 No Comment

This article was written by David Trainer, CEO of New Constructs.

Having too many choices can be intimidating for many investors and there are definitely lots of choices when it comes to ETFs. For example, in the equity market alone, there are 30+ technology sector ETFs, or 35 ‘large cap value’ and 20 financial ETFs. A very healthy selection abounds for every category of ETF.

(* # of Holdings excludes cash)

(Sources: New Constructs, LLC)

What is an investor to do? How do you pick the ETF that will deliver the best performance?

That question was posed to the major ETF issuers at Mornigstar’s ETF conference in Chicago a couple weeks ago. The issuers admitted that the landscape for ETFs is a bit cluttered and may be poised for attrition.

I was not impressed by the issuers’ plan for addressing the confusion caused by having too many ETFs. Their plan, not surprisingly, was to invest more in educating investors about their ETFs. In other words, they plan to invest more in sales and marketing with the goal of steering more business to their ETFs. Like most Wall Street types, the issuers are focused on how to profit from ETFs not how to help investors profit from ETFs [Compare any two ETFs with our Free ETF Comparison Tool ].

Accordingly, there is a dearth of quality research on funds. When I asked the issuers if they had any plans to narrow the gap in quality of research between funds and stocks, they basically said “no, there is plenty of quality research already out there.”

I disagree.

As highlighted by Barrons’ The Danger Within. for research on funds to rival the quality of research on stocks, fund research must be based on rigorous analysis of all the holdings within a fund. Given that there are lots of funds that hold lots of different stocks, any effort to provide broad-based coverage of funds would have to bring high-quality coverage of lots of stocks to the table.

Unfortunately, quality of research and number of stocks covered tend to be inversely correlated. There are a few exceptions, even fewer that are truly independent. Meanwhile, too many investors have been led to believe they can trust the ETF label, i.e. category, and believe that all ETFs within a certain category are the same when they are not.

For example, ProShares Ultra Semiconductors (USD ), our top pick among technology ETFs, holds 47 stocks while PowerShares Dynamic Software (PSJ ), our worst-rated technology ETF, holds only 30. The Vanguard Information Tech ETF (VGT ) holds over 400 stocks.

There is no substitute for rigorous analysis of every fund holding if one cares about investment performance. How else can one measure the potential risk and reward of making an investment in a fund? After all, a fund is the sum of its individual stock parts.

A challenge to quality fund research, as prefaced above, is being able to bring quality research to bear on all the many stocks that all the many funds hold. To give the reader a sense of how different funds can be, I share New Constructs analysis of tech sector ETFs [see all the stocks that are in your ETFs with the Stock Exposure Tool ].

Figure 1 above lists the top 25 technology ETFs and their holdings. The takeaway is simple: tech sector ETFs are not all made the same. Different ETFs have meaningfully different numbers of holdings and, therefore, different allocations to holdings. Given the differences in holdings and allocations, these ETFs will likely perform quite differently.

To identify the best ETFs within a given category, investors need a predictive rating for ETFs based on analysis of the underlying quality of earnings and valuation of the stocks in each ETF.

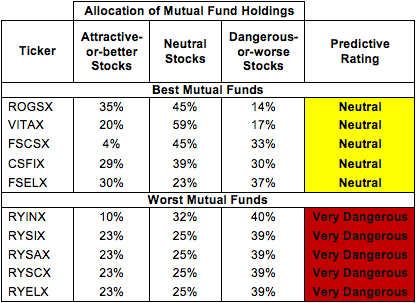

Meanwhile, Figure 2 below shows how the 25 tech sector ETFs stack up versus each other, the overall sector and the S&P 500 based on their risk/reward ratings and the allocation of their holdings by rating.

Figure 2: Investment Merit Based on Holdings and Allocations