Tax Statement Guide Form 1099R

Post on: 11 Июнь, 2015 No Comment

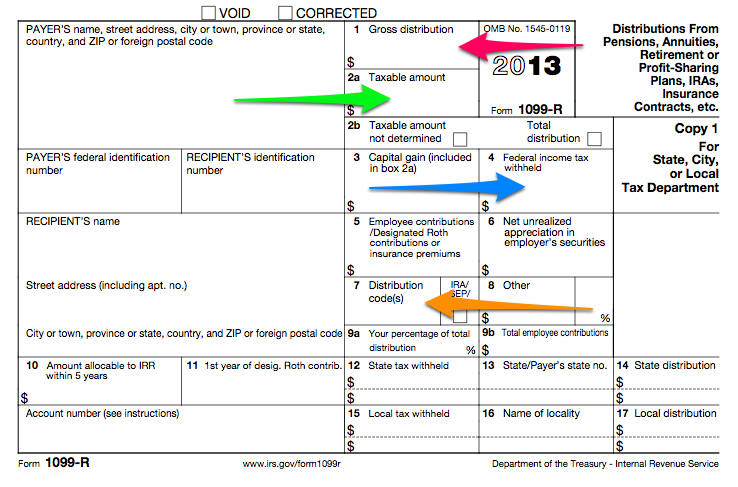

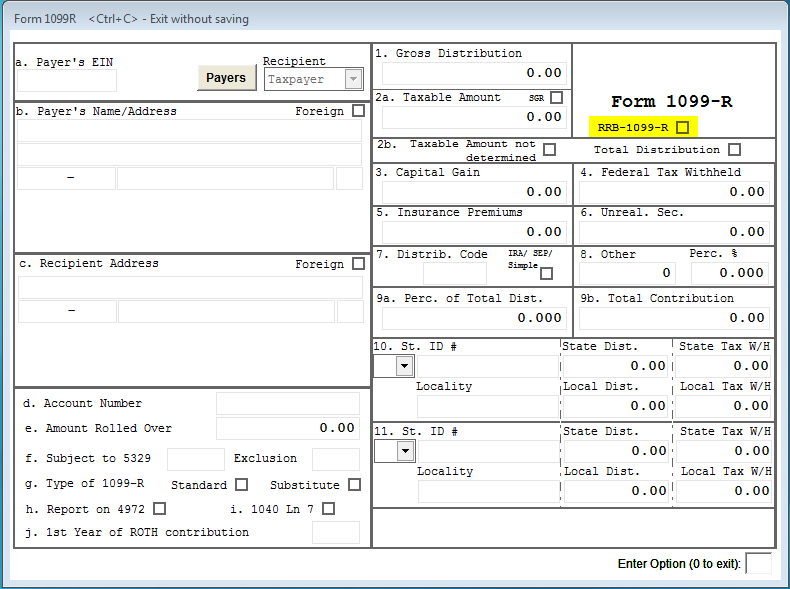

Form 1099-R

Illustrated explanation of Form 1099-R distribution information

Investing Your Distribution

If you are interested in investing your distributions, Fidelity offers a wide range of solutions that can help meet your needs.

Consider a certificate of deposit (CD) from Fidelity.

You know Fidelity as an expert in mutual funds and IRAs, but we also offer a wide range of CDs and money market funds that may be appropriate if you are looking for more conservative investing options. When it comes to ways to put your cash to use, Fidelity offers many important advantages over banks.

If your goal is to lock in a guaranteed rate, consider a CD 1 from Fidelity. You get:

- FDIC insurance.

- A wide, online selection of inventory from 500 banks nationwide. 2

- Competitive interest rates on CDs that you can browse and buy online, all in one place.

- A variety of choices to suit your investing time frame (3 months to 20 years).

- The flexibility to cash out before maturity with no penalty. 3

- Locked-in rates.

Consider a money market fund from Fidelity

If your goal is a competitive yield plus liquidity, consider a Fidelity money market fund. As the largest money market fund manager in the country, we offer:

- Competitive yields.

- Liquidity—you can withdraw funds any time with no penalties.

- The convenience of checkwriting.

- A wide selection of funds to help meet different goals—taxable fund choices include Treasury, government, and general purpose.

An investment in a money market fund is not insured or guaranteed by the FDIC or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. Unlike most FDIC-insured CDs or bank products, a money market fund’s yield and return will vary.

Get an estimate of your minimum required distributions (MRD)

Fidelity’s Retirement Distribution Center helps you estimate the amount of your minimum required distribution. It also makes it easier for you to keep track of whether you’ve withdrawn the required amount for the current year from your Fidelity IRA and Fidelity retirement plan account(s).

To view your information, log in. go to Accounts & Trade, and select Retirement Distributions from the dropdown menu. Or, from a retirement account, select the Action dropdown box and choose Retirement Distributions. Once you do that, the Retirement Distribution Center will appear. Note: The Retirement Distribution Center is visible only to customers who are age 59½ or older or to those who have inherited a retirement account.

Contact a Fidelity retirement representative at 800-544-4774 to develop a strategy for your distributions, and let us help you do more with your cash. As the #1 retirement provider, 4 we can offer the guidance and investment choice you need today.

1. Fidelity offers a type of certificate of deposit (CD) called a brokerage CD. Brokerage CDs are issued by banks for brokerage firms’ customers, with the deposits received being obligations of the issuing bank. The CDs are usually issued in large denominations and the brokerage firm divides them into smaller denominations for resale to its customers. If your CD has a step rate, the interest rate of your CD may be higher or lower than prevailing market rates. Step rate CDs are also subject to secondary market risk and often will include a call provision by the issuer that would subject you to reinvestment risk. The initial rate is not the yield to maturity. If your CD has a call provision, please be aware that the decision to call the CD is at the issuer’s sole discretion. Also, if the issuer calls the CD, you may be confronted with a less favorable interest rate at which to reinvest your funds. Fidelity makes no judgment as to the creditworthiness of the issuing institution and does not endorse or recommend the CDs in any way. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

2. Fidelity makes no judgment as to the creditworthiness of the issuing institution and does not endorse or recommend the CDs in any way.

3. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Your ability to sell a CD on the secondary market is subject to market conditions. If your CD has a step rate, the interest rate of your CD may be higher or lower than prevailing market rates. The initial rate on a step rate CD is not the yield to maturity. If your CD has a call provision, which many step rate CDs do, please be aware the decision to call the CD is at the issuer’s sole discretion. Also, if the issuer calls the CD, you may be confronted with a less favorable interest rate at which to reinvest your funds. Fidelity makes no judgment as to the credit worthiness of the issuing institution.