Tax Lien Loophole to Tax Foreclosure Property

Post on: 16 Июнь, 2015 No Comment

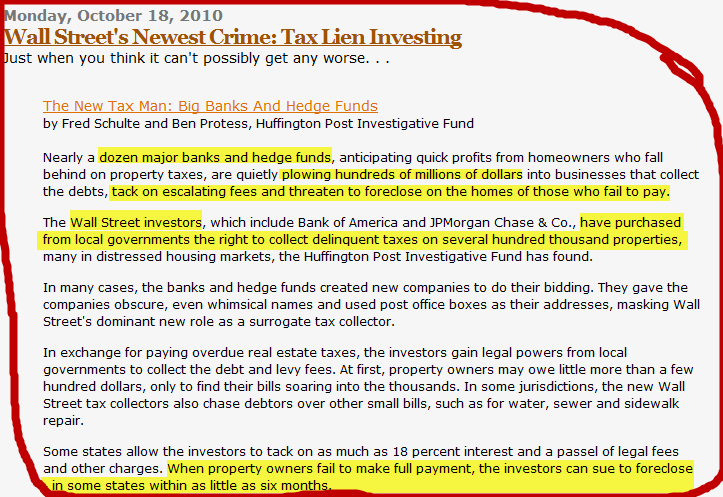

Tax liens can be an excellent investment. And, in the rare cases when an investor actually does get a bargain property directly from a tax sale, it’s usually the result of a successful tax lien purchase.

In the event one of your tax lien investment pays off (the homeowner pays the back taxes along with interest to redeem your tax lien), it’s likely that you’ve earned a handsome double-digit return on your money. However, it may surprise you that tax lien investments are COMPLETELY unsuitable for the casual investor or the investor with only a few thousand dollars to invest.

Here’s why: Contrary to popular belief, tax liens ARE NOT guaranteed by the government. They are guaranteed only by the underlying property with delinquent taxes. If your lien does not pay off, and you receive a property that is worth less than you paid for the lien and expenses, you lose money!

And in many areas, 50% or more of the liens offered at the sale are against completely worthless properties. So, this means that you must research all the properties offered at the sale to make sure they are going to be worth more than your ultimate investment in the lien.

If you try to cherry pick the properties on the sale to cut down on research, there is a good chance that you will only have the opportunity to buy a small fraction of those liens. Even if you invest $50,000 in liens, you would stand to make $5,000 in interest or so, and this barely reimburses you for the time you had to spend researching and the risk you took with your money.

Better than a hole in the head I guess, though! A few more things to be aware of: You will need to perform legal noticing to the owner, and pay a lawyer to do so, for your lien to remain valid. You will have to wait many months to several years to get title to the property if your tax lien is not paid off. Ironically, if you do a good job in your research and buy only liens with solid collateral behind them, you will likely obtain NO properties — 95%+ of quality liens that are purchased at a good price, pay off.

Let’s avoid all that investment, waiting, risk, research, legal work, and other terrible stuff. Here’s how you’ll profit in a tax lien state ANYTIME without doing any of that:

The Tax Lien Loophole

1. Do a public records request for a listing of all the liens that were ALREADY SOLD IN THE PAST, and NOT REDEEMED.

2. Find out how long the owner has, to pay off the lien (the redemption period), and see which owners are about to run out of time!

3. Then contact them. A lot of them don’t even realize the deadline is approaching! Or, like the tax deed sale property owner, they’ve given up on raising the taxes and they’ll take something instead of nothing.

4. Get out your list of cash buyers, hustle a few over to the property, and put a deal together. No fuss, no muss!

There is no need to get a lawyer to buy a tax lien certificate. The thing that you need to be most concerned with is researching the lien BEFORE you buy it. That is the most important thing, I mean, you dont want to buy a lien that no one will ever pay the taxes on like an easement.