Tax Law For Mortgages Mortgage Rates News from The Mortgage Reports

Post on: 30 Июль, 2015 No Comment

Last reviewed March 13, 2015

Dan Green is a mortgage market expert, providing over 10 years of direct-to-consumer advice. You can also connect with Dan on Twitter and on Google+

As Seen On

This article is current for the 2014 tax year and should not be considered tax advice. For tax-related questions or mortgage strategy related to your individual tax liability, speak with a licensed accountant.

Tax season may feel like a burden for some Americans, but homeowners have plenty of advantages when it comes to claiming deductions.

The U.S. tax code is designed to offer incentives to homeowners, and by taking advantage of these breaks, 1040-filing citizens can maximize their financial investment in homeownership.

Whether a home is financed via a mortgage, or paid-in-full with cash, there are a multitude of tax-savings opportunities associated with owning a home. Of course, every homeowner’s financial situation is different, so please consult with a tax professional regarding your individual tax liability.

Tax Deduction. Mortgage Interest Paid

Mortgage interest paid to a lender is tax-deductible and, for some homeowners, interest paid ca provide a large tax break — especially in the early years of a home loan. This is because the standard mortgage amortization schedule is front-loaded with mortgage interest .

At today’s mortgage rates, annual interest payments on a 30-year loan term exceed annual principal payments until loan’s 10th year.

Mortgage interest tax deductions are extended to second mortgages, too.

Interest paid on refinances, home equity loans (HELOAN) and home equity lines of credit (HELOC) are tax-deductible as well. However, restrictions apply on homeowners who raise their mortgage debt beyond their property’s fair market value.

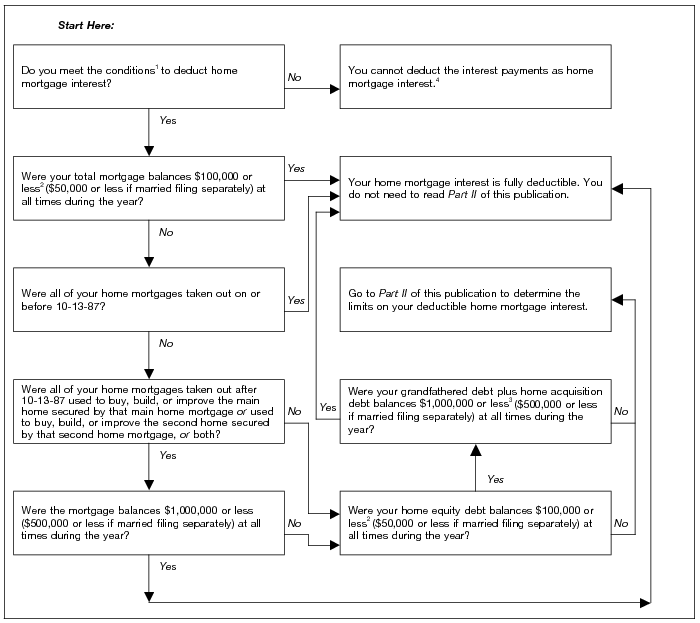

The Internal Revenue Service (IRS) imposes a $1 million loan size cap. Loans for more than one million dollars are exempt from this tax deduction.

Tax Deduction. Discount Points

Mortgage tax deductions can extend beyond your monthly payment. Discount points paid in connection with a home purchase or a refinance are often tax-deductible, too .

A discount point is a one-time, at-closing fee which gets a borrower access to mortgage rates below current market rates.

As an example, if the current market mortgage rate is 5 percent, paying one discount point may get you access to a mortgage rate of 4.75%. The IRS treats discount points as prepaid mortgage interest which, in turn, can render them tax-deductible.

When discount points are paid in conjunction with a purchase, the cost may be deducted in full in the year in which they were paid, dollar-for-dollar. With respect to a refinance, discount points are not fully tax-deductible in the year in which they are paid.

With a refinance, discount points are typically amortized over the life of the loan.

The cost of one discount point on a 30-year loan can be deducted at 1/30 of its value per tax-calendar year.

Other Deductions. Property Taxes, Renovations, Home Office

Real Estate Taxes

Homeowners typically pay real estate taxes to local and state entities. These property taxes can often be deducted in the year in which they are paid. If your mortgage lender currently escrows your taxes and insurance, it will send an annual statement to you which you can file with your complete federal tax returns. Your accountant can help determine the payment’s tax deductibility.

Home Improvements

For tax-paying homeowners, certain types of home improvement projects are tax-deductible. Home improvements made for medical reasons, for example, can be tax-deductible. If you are making home renovations to accommodate a chronically ill or disabled person, and the renovations do not add to the overall value of the home, the project costs are typically 100% tax deductible. Repairs and improvements made for aesthetic purposes are not tax-deductible.

Home Offices

Homeowners who work from their residence can typically deduct the expenses of maintaining a qualified home office. Allowable tax deductions for a home office include renovations to the room(s), telephone lines, and the cost of heat and electric. Before claiming a home office on your returns, though, be sure to speak with an accountant to understand the benefits and liabilities. There are caveats to claiming home office tax deductions on your tax returns, and the rules can be tricky.

Homeowners. Budget For Your Tax Breaks

Tax deductions will reduce your annual costs of homeownership and, for some homeowners, mortgage interest tax deductions will shift the answer to the Should I Rent or Should I Buy? question.

Tax law changes frequently, though. Consider building your housing budget with the help of a tax preparer. Get a feel for how much home you can afford before and after accounting for your various homeowner tax breaks. And, as you build your budget, use legitimate mortgage rates in your calculations.

Get them here, for free, and specifically tailored to your home.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.