Tax Efficient Investing For Retirement

Post on: 23 Май, 2015 No Comment

by Todd Smith on 2012-02-06 12

Are you saving for retirement? Consider the tax ramifications.

It’s painfully obvious that we have officially entered into a period in which many people work far past the age of retirement whether it’s because they actually want to or because they have to. With people living to be much older nowadays, “retirement” tends to last much longer and with no guarantee of ever seeing a penny of Social Security. The employee has suddenly become responsible for making sure they have money to live on once they reach that golden age.

Therefore, having an effective savings plan and a strong investment portfolio is not just attractive it’s also just common sense. But is your retirement savings plan tax efficient? With so many retired folks spending twenty-five years or more in retirement, taxes can absolutely cripple your hard-earned savings!

So wed like to bring up the idea of handling our investments in such a way as to minimize our tax obligations. After all, we all want to keep more of our money to better support our retirement. You should invest your money with tax efficiency in mind. Taking advantage of tax-efficient investments will allow you to build a bigger nest egg and enjoy your retirement without the anxiety of wondering how youll make ends meet. So how do you make tax-efficient investments a reality?

Image from Rediff.com

How To Make Your Retirement Investment Portfolio Tax Efficient

There are three critical factors to retirement fund success: your philosophy on spending, diversification of tax accounts and asset allocation. These can affect whether or not you achieve tax efficiency in your investments. Lets go through each of these factors in more detail:

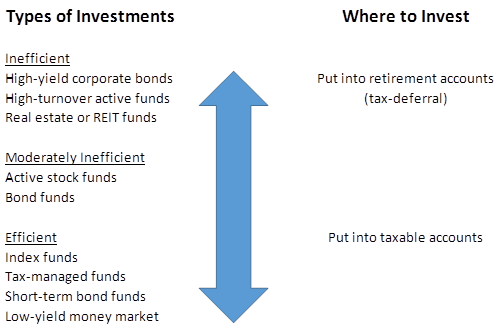

1. Asset Location

When we talk about asset location (no, thats not a typo), we are referring to the ability to maximize our overall portfolio’s expected, after-tax return by positioning assets between taxable and tax-advantaged accounts. This is sometimes also referred to as preferred domain. This approach can be most beneficial for people who have a mix of taxable and tax-advantaged accounts and who have a long enough time horizon. To accomplish the optimal mix, you need to place your least tax efficient investments (bonds, high turnover stock funds, etc.) into tax-deferred accounts, and your tax efficient investments (municipal bonds, index funds, etc.) into taxable accounts.

2. Your Personal Spending Philosophy

Most retirees favor “income” and are typically looking for assets that have the best yield. But this approach generally results in a portfolio that is geared towards income generation (via taxable bonds, high-yield bonds, cash/cash equivalents such as online savings accounts. bank cds or high yield checking accounts ), and that tends to focus on dividends rather than long-term gains, which can have favorable tax treatment. Also, many try to minimize taxes by investing in municipal bonds, even when their tax bracket does not warrant them, which produces a lower yield than taxable bonds.

So whats the alternative? You may want to consider a “total return” spending approach (heres a writeup from Vanguard about this ). Instead of opting for a pure income portfolio to accommodate your spending, you would opt for a diversified portfolio and spend from both income and principal. In this way, you would be reducing ordinary income (and, therefore, taxes) and favoring long-term gains in your overall portfolio; it would steer your portfolio allocation away from an “income tilt” thus allowing a better alignment with risk tolerance and other investment considerations.

Thus when we spend, we would not be drawing yield necessarily, but the amount we need from the appropriate accounts. In doing so, our spending order would be as follows:

- First, taxable assets;

- Second, non-qualified annuities;

- Third, qualified retirement plans and Traditional IRAs;

- and finally, Roth IRA’s, Roth 401(k)s/403(b)s and other employee sponsored retirement accounts.

3. The Mapping And Diversification Of Your Tax Managed Accounts

Its not uncommon for people to be in a higher tax bracket during retirement as compared to when they are working. Tax rates are dynamic and future rates are fundamentally unpredictable. You are doing yourself, and your portfolio, a disservice by assuming you will be in a lower tax bracket when you stop working. So, just as it is prudent to diversify between stocks and bonds, you shouldnt really put your entire nest egg into one tax bracket. That is don’t bet 100% on one tax bracket since you cant really predict what the future will bring, in terms of your tax situation. To accomplish this, it makes good sense to hold after-tax investment accounts and Roth IRAs to complement the pre-tax accounts you may have (i.e. Traditional IRAs, SEP IRAs, 401(k)s, 403(b)s, etc.).

Remember that there are limits to the amount you can contribute across certain retirement vehicles, but you can own multiple retirement accounts of various types. For instance, if you are eligible, you can take advantage of both a Roth IRA and a traditional IRA, but you must keep your total contributions to both under the IRA contribution limits for a given tax year. Check out this post on Roth IRA rules and tips for additional information as well.

The Bottom Line On Tax Efficient Investing

Most long term investment and savings goals boil down to achieving a comfortable retirement or reaching financial freedom. It’s not just “here’s the watch; have a nice life” anymore. The fact is that these days, we expect to have longer lifespans, and therefore, possibly more time spent in the retirement phase. For these reasons, it not only makes sense to have a very good savings and investment plan in place, but also to do it in the most tax efficient way possible, because taxes, like costs, can take a big bite out of our returns and ultimately our nest eggs. Take a peek at your portfolio gains and realize that not all of what you see there is yours to keep a portion of that is going to the tax man!

Therefore, think about creating a tax-efficient portfolio with a little planning. Accomplishing a tax-efficient portfolio and ultimately, a retirement nest egg, may take a little forethought. It may also require looking at things a bit differently from a spending perspective. But all this is worth it if you are paying less taxes over the duration of your retirement, which can make a big difference in maintaining your lifestyle and possibly passing assets onto your heirs.