TargetDate Funds Are They Right For You

Post on: 4 Октябрь, 2015 No Comment

Target-Date Funds: Are They Right For You?

Oct 16, 2014 4:01:00 PM

Whether you’ve been introduced to what a target-date fund is or not, you should know that over the last 20 years they’ve become a pretty big deal in the retirement world. If you are saving for retirement either through your employer-sponsored plan or on your own, target-date funds can be a key investment vehicle and have become an important component shaping the retirement landscape.

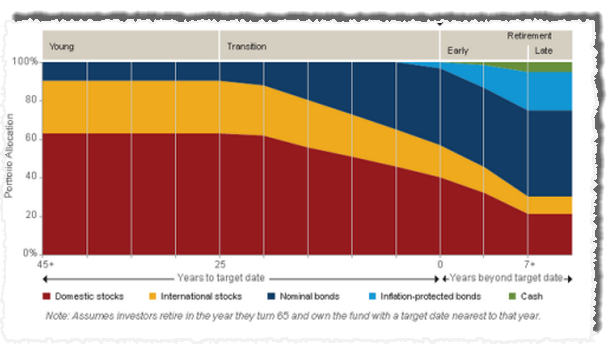

Simply put, target-date funds, or TDFs, are a “do-it-for-me” investment strategy consisting of several mutual funds whose asset allocation, or mix of stocks, bonds, and cash, automatically rebalances to match your time horizon. This means that the TDF, generally, becomes more conservative as the investor nears retirement. The industry term for this process is called the glidepath. What you’ll hear quite often if you read anything about TDFs is that they are the set it and forget method of retirement investing. You pick an option based on your current age (let’s say 35) and predicated retirement age, usually indicated by the names of these funds i.e. BlackRock LifePath 2050, with the number indicating the year that you are targeting for retirement. These “glidepaths” can work in many ways; for the most part, the fund will invest heavily in stocks at the outset (the further you are from your “target-date”) and gradually move towards a more conservative allocation the closer you get retirement (the “target-date”). “Target date funds have become the a popular investment vehicle for retirement plan investors and a core piece of an organization’s investment menu,” says our Lead Advisor, Alex Assaley. “As companies have shifted more responsibility towards their employees when it comes to investing and saving for retirement, we have seen a significant increase in TDFs by employees due to their ease of use; as well as employers selecting these strategies as their default option, or QDIA.”

Sounds easy right? Almost too good to be true? For as much good as TDF’s have contribute to the industry, there is always another side to the story.The popularity of these retirement plan products doesn’t seem to be slowing any time soon so it’s important to be educated in the details of how these strategies work. Let’s explore a few positives and negatives that come with investing your retirement savings into target-date funds.

TDFs can be great for those of you who don’t have the time, interest, or ability to actively review, select, and pick your own retirement funds. Let’s compare investing in a TDF to a real life example. Have you ever gone on an all-inclusive vacation? Flight, hotel, food, drinks, etc. are all included in the price so once you get to the airport, the amount of planning you need to do is minimal. A similar concept applies to a TDF. It can be a more low-maintenance option for those with minimal investing prowess.

The investment mix chosen by the managers of these funds is not chosen with the goal in mind to outperform the markets. TDFs are developed with a long-term retirement strategy, not for short-term returns. Choosing the investment option with the highest returns won’t necessarily be the best strategy for someone picking investments to get them in a position of financial stability 30 years down the road.

Even if you do a perfect job of selecting your own funds when you first enroll into the plan, it’s highly unlikely that you’ll be able to keep up the rebalancing act every quarter. Target-date funds take the guess work out of this for you and ensure your investment mix stays on track.

TDFs are usually built for the average investor”. The goal is for the masses to get the most benefit from these strategies, but how many people really think of themselves as average? Every person is different. Everyone has different financial goals. If your retirement plan offers a TDF as an option, it may not be the best fit for your unique risk tolerance and there isn’t really anything you can to do about it due to their limited flexibility.

TDFs are more complicated than they seem. Each of the hundreds of target-date funds currently in existence come with their own unique fee structure, risk profile and investment mix. Because of this, evaluating the performance of these unique funds is more difficult than say, comparing returns on two different large-cap funds.

TDFs are usually proprietary. That means the Fidelity TDF has all Fidelity funds. Even if they don’t have the best say, small-cap value fund, Fidelity uses their manager for this asset class. We aren’t saying this isn’t “right,” but when you build your own investment mix you may select investments from a number of different best-in-breed fund companies. That usually isn’t the case for TDFs.

Target-date funds have become so popular for a reason: they can be a great investment option for those who don’t want to actively manage their investment mix, don’t want to navigate the volatility (ups-and-downs) of the market, don’t want to get emotional about when to “get in” or “get out,” and instead, would like a hands-off approach to selecting investments. While TDFs aren’t perfect for every investor, they can help a lot of investors and retirement plan participants get on track with a suitable investment mix. Read the fact sheets about these funds or check sites like Morningstar to understand past performance and other factors. Also, carefully consider investment objectives, risks, charges and expenses which can be found in each fund’s prospectus. While no investment option can guarantee that your retirement needs will be met, the right glidepath strategy and investment mix, target-date funds could be a viable option for your saving needs. Of course, you always need to make sure you are saving enough too – but that’s a blog for another day.

Investments in target date or target retirement funds are subject to the risks of their underlying holdings. The performance of an investment in a target date or target retirement fund is not guaranteed at any time, including on or after the target date, and investors may incur a loss. Target date and target retirement funds are based on an estimated retirement age of approximately 65. Investors who choose to retire earlier or later than the target date may wish to consider a fund with an asset allocation more appropriate to their time horizon and risk tolerance.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the mutual fund, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.