Tailor Your Own Portfolio Strategy

Post on: 26 Июль, 2015 No Comment

With some basic investing knowledge and an outline of how the financial markets operate, you are uniquely situated to tailor an investment strategy that’s right for you and manage it as your needs change.

- Risk and return go hand-in-hand. The higher the potential return, the higher the risk.

- One way to manage this risk/return relationship is through appropriate asset allocation, which is the single most important factor in determining investment returns.

- You manage your asset allocation by periodically rebalancing your portfolio and then change your allocation as your financial goals and risk tolerance evolve.

When you invest your money, you need to make a decision: Do you hire a pro to manage your portfolio or do you manage it yourself? You may be more capable of taking the DIY approach than you think. Here are a few basics you’ll want to keep in mind.

Focusing on your goals

Investing is a little like planning a trip. You need to know where you’re going or you might end up wandering around aimlessly, or worse, getting lost. Your financial goals are your investment destinations. Pin those down so you know what you need from your investment accounts.

Short-term goals could include buying a new car or replacing the refrigerator. In the medium-term, you may be saving for a larger house or for your kids’ college education. Your long-term goal should be focused on how much income you’ll need to provide a comfortable lifestyle throughout a long retirement. Our Retirement Income Calculator can help with the last one.

You’ll likely have several accounts earmarked for these various goals, from bank products like savings accounts and CDs, to taxable brokerage accounts for buying stocks and mutual funds, 529 college savings plans and IRAs and 403(b) plans to supplement your retirement pension. To remain focused on the big picture, manage the investments in each individual account as specialized parts of a single investment portfolio.

Aligning risk and reward

One basic tenet of investing is the correlation between risk and return. Generally, the higher the potential return, the higher the risk. In this case, risk means the chance of losing money if the value of an investment falls below what you paid for it. Historically, stocks offer higher return and risk, while money market or cash investments offer lower return and risk. Bonds fall somewhere in between.

The amount of risk you take on in your portfolio is determined by two factors: your time horizon (the length of time your money will stay invested before you need it) and your emotional tolerance for volatility (whether you can sleep at night as your investments go up and down in value over time). This is sometimes called your “risk personality.” The longer your time horizon, the more risk you can take on because you’ve got time to wait for your investments to recover from temporary drops in value. But this will always be balanced against your risk tolerance.

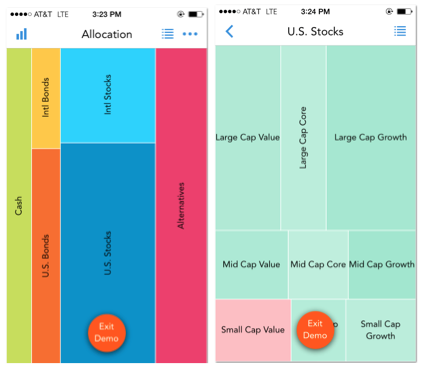

Allocating your assets

To help manage risk, create an asset allocation that includes different investment types, or asset classes, such as stocks, bonds and cash investments. The percentage of your assets that you allocate to each type of investment will influence your return potential and level of risk. Studies have shown that your asset allocation is the single most important factor in determining investment returns. So it’s important to have an asset allocation appropriate for each goal’s time horizon.

For most people, that means a larger percentage of stocks for a long-term goal like retirement, with a lower percentage of stocks for shorter-term goals. Again, the percentage of stocks in your asset allocation will correlate with your level of risk, so the percentages may change depending on whether your investment risk personality tends to be aggressive, moderate or conservative.

Rebalancing to stay on course

Asset classes perform differently from one another. At any given time, stocks could be doing well while bonds are lagging behind. Before you know it, the reverse could be true. This is why diversifying across different asset classes and different investments within each asset class helps to spread risk. And it’s also why your asset allocation can get skewed over time. For example, if stocks outperform bonds for two years running, the stock percentage of your allocation will grow and the bond percentage will shrink. This will change your risk/return ratio.

When this happens you need to rebalance your portfolio to get back to your preferred allocation percentages. You can do this by directing new money into the asset classes lagging behind, or, you can sell some of the better performing investments and reinvest those profits into the lower performers. Either way, you want to maintain the allocation percentages you previously determined provide the best combination of risk and return. Many people rebalance once a year.

Adjusting your strategy

When you experience life events such as marriage or having children, your financial goals can change. Also, many people tend to get more conservative as they get older and may not want to take the same risks as when they were younger.

So periodically review your goals and risk tolerance and check it against your investment strategy and asset allocation. At some point, you will start to adjust your percentages. You also need to review your investment performance to make sure you are on track to reach your goals. If your investments are not providing a high enough return, you’ll either need to get a bit more aggressive in your allocations or save more.

Review your account statements quarterly, or at least annually, to see if changes are warranted.

Being patient and disciplined

A study by DALBAR, a leading financial services market research firm, revealed that from 1990 to 2010, the unmanaged S&P 500 Index earned an average of 7.81% annually. Over that same period, the average individual stock investor earned just 3.49% annually. Why the big difference? Because individuals got too emotional about their investments when they weren’t performing well and tended to sell their stocks after they had dropped in value and buy them back after they had already gone back up in value. Quite the opposite of the age-old advice to “buy low, sell high.”

The lesson here is to be patient and disciplined. It takes time to make money with your investments. And there will be rough patches where your portfolio may lose value. But if you’re disciplined and generally stay the course, you’ll have a better chance of getting decent returns over longer time periods.

You can learn a lot about managing your investments by reading the many articles and using the resources right here in the Retirement Planning Center. The more you know about investing and the markets, the more confident you will be in managing your portfolio and making changes when necessary. With knowledge and patience, you can increase your chances of reaching your financial goals.