Tactical Asset Allocation for the Value Investor

Post on: 25 Июль, 2015 No Comment

by KenFaulkenberry

Asset Allocation for the Value Investor

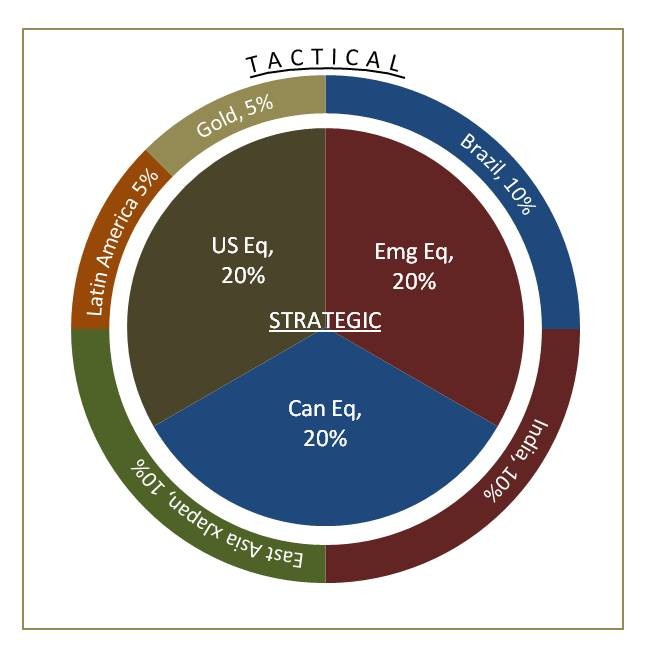

A tactical asset allocation is an active or dynamic investment strategy in which investors should rebalance their target asset allocation based on valuation probabilities. Determining the most effective mix of investment opportunities is the foundation for successful investing.

Asset Allocation involves dividing an investment portfolio on a percentage basis among different categories of securities (i.e. domestic stocks, international stocks, bonds, precious metals, cash, etc.). The main purpose of asset allocation is to diversify among asset groups that act differently and thereby reduce volatility of the portfolio as a whole.

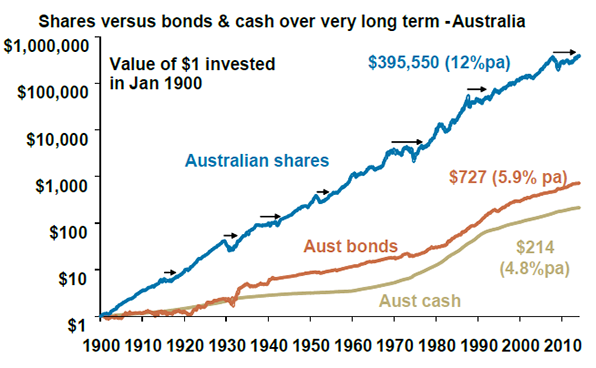

One of the most important aspects of value investing is comparing valuation to the price available. Historical data proves that in the long run rebalancing your portfolio based on valuation can lower your risk and increase your investment returns.

Mr. Market

Benjamin Graham used the parable of Mr. Market to illustrate that the price of an asset can be substantially different from the real value. Markets are volatile because people allow their emotions to affect their buy and sell decisions.

The intelligent investor will take advantage of the market by buying assets that are offered substantially below their intrinsic value, and selling assets that are bid above their intrinsic value. A tactical asset allocation allows the flexibility to take advantage of mis-priced assets.

Is a Tactical Asset Allocation the Same as Market Timing?

Short term market timing is a recipe for disaster. Many investors destroy their portfolios attempting to trade short term trends. There are several reasons for their lack of success. First, there is no magic formula for short term movements in the market that works for long periods of time. Secondly, investors inevitably let their emotional triggers (fear and greed) cause them to make mistakes.

Long term market timing for the value investor is really valuation timing. We want to buy assets when they are out of favor because the price will be low. The value investor understands that buying assets with a margin of safety requires purchasing investments at a price below the fundamental or intrinsic value of the asset.

If you buy a great asset for a price far above its real or intrinsic value you might wait decades to get your money back (i.e. INTC, MSFT, CSCO in 2000). These are outstanding companies who have produced earnings and grown dividends for many years. However if you bought these stocks near their peak price in 2000 you still have lost money thirteen years later! This is not because they werent great companies, it is because the investor paid a price that was too high.

A tactical asset allocation allows an investor to reduce risk by avoiding assets that are overpriced. It also allows an investor to greatly increase returns by investing more heavily in quality assets that are trading at bargain prices.

Valuation is the only reliable long term determinant of whether an investor can beat the market on a risk adjusted basis. You must be able to change your asset allocation at different valuation levels.

Make Your Big Bets Based on Asset Classes

Legendary value investor Jeremy Grantham teaches “Big asset classes drive success and are very inefficiently priced amazingly inefficiently priced.” Instead of spending a majority of your efforts on which individual stock or ETF to own, put more of your efforts into investment allocation. Focus on which asset classes offer the greatest risk/reward opportunities based on current prices.

The equity markets tend to make big swings over long periods of time. In most ten year periods the market will usually have one or two periods where prices are excessively over priced and one or two periods where they are extremely under priced. The successful investor takes advantage of “Mr. Market”.

Rebalancing to Probabilities

A tactical asset allocation is rebalancing a portfolio based on probabilities. It is possible to scale in and scale out in between valuation extremes and take relatively larger positions when markets are near historical highs or lows in valuation. It only makes sense to hold a higher percentage of assets when valuations are low and higher levels of cash when valuations are high.