Tactical Allocation

Post on: 25 Июль, 2015 No Comment

After a very turbulent third quarter, investors hoping for a peaceful summer vacation season were left largely disappointed with the market. Concerns about the sovereign debt crisis in Europe along with softening economic data here in the US sent the market on a volatile ride that at times was similar to the ups and downs seen in 2008.

Investors are disenchanted with the market and think the game is rigged. The retail investor has been largely on the sidelines, too disillusioned with the environment to put money to work. An overwhelming majority agrees the state of the world is bleak. But from the ashes of our many current issues comes tremendous opportunity for those who persevere.

Toward the end of a bear market, everyone comes to understand and believe the mess theyre in. The media fuels a vicious cycle of negativity, which flushes out the market and creates new buying opportunities. The more pessimistic the mood becomes, in reality, the closer we are to the start of the next bull phase.

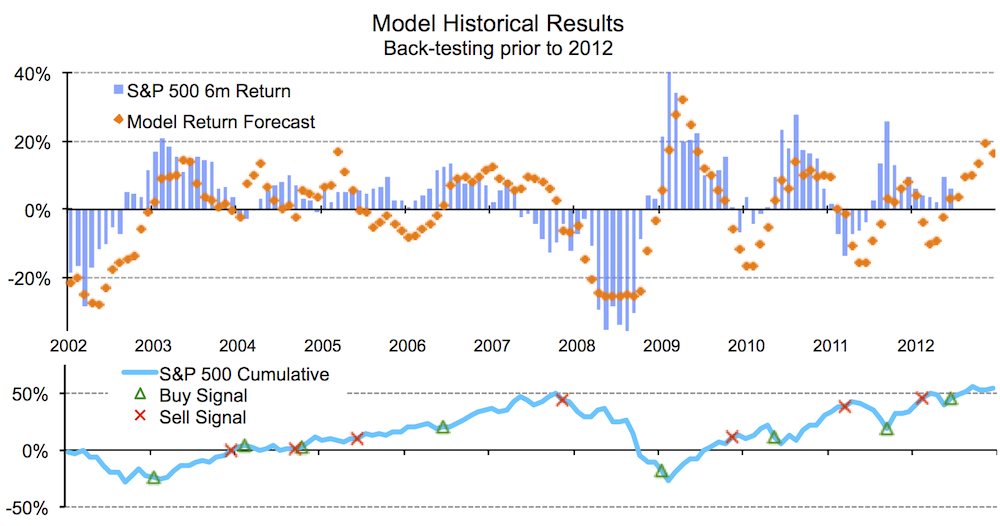

Weve learned through hard experience that the market really does move in cycles the tides flow in and out and the market moves up and down. As it does, the world will be full of opportunity. It always is. We never know exactly when opportunity will reveal itself but it will. But to benefit from opportunity, you have to be there to seize it when it emerges. The flexible nature of our investment methodology and tactical allocation process is perfectly suited to do just that.

Our risk management approach strives to limit losses early on by getting out of harms way, but is nimble enough to recognize when the environment has improved and important investment trends are developing.

We hear it a lot. I know when to get out, but I have a hard time knowing when to get back in. Our investment process handles moving in and out of the market for you.

CLICK HERE to read the entire Portfolio Manager Commentary for Third Quarter, 2011

www.ncm.net/new_portfolio.php .

The financial services industry is cluttered with so much technical language that I often wonder how much of it is really understood by everyday investors. Being that I’m a “tactical allocation” portfolio manager, I thought I would ask some friends what they thought tactical allocation meant.

I got a variety of responses. One friend said, “It’s military maneuvering to gain a strategic advantage.”

“That makes sense,” I said.

Another friend told me he thought the way he combs his hair to cover up his bald spot was an example of tactical allocation. “Each hair gets strategically placed for maximum coverage. That’s everyday tactical allocation,” he said.

“Thanks, Steve. Good luck with the defensive combing,” I replied.

Franz, the owner of a nearby bakery, said tactical allocation to him is the strategic placement of his baked goods in the glass display case. “I put the chocolate croissants by the cash register because they’re our most popular item and we can complete the transaction faster if they’re within reach of the register,” said Franz.

Franz is a smart man. He’s maximizing his sales.

With these three random tactical allocation examples in mind, I could see that no matter how practical or outlandish tactical allocation might be, the term is invariably associated with the “strategic placement” of something to gain an advantage or protect. And that’s basically what tactical allocation means in the investment world, too.

Investopedia’s definition of tactical allocation is: “An active management portfolio strategy that rebalances the percentage of assets held in various categories in order to take advantage of market pricing anomalies or strong sectors.”

That’s a good general definition, but there’s more you should know. For instance, there are two main tactical allocation processes. One is called discretionary and the other is systematic.

Discretionary tactical allocation is a style of management that gives the portfolio manager freedom to decide what should be done in a particular situation. For example, the manager might adjust the portfolio in anticipation of where the market’s strength will be after a government policy decision is made. This type of analysis tends to be “why and how” based, or qualitative. The process can be more predictive in nature and less disciplined than a “systematic” approach.

Systematic tactical allocation is more structural and mathematical or quantitative. Systematic approaches customarily use relative strength or trend following techniques to allocate assets towards the market’s top-performing asset classes and sectors. If it’s a global strategy, top-performing countries are tracked as well.

Another important point about tactical allocation is that it is an active management process instead of the widely accepted passive management counterpart. “Active” means the portfolio manager is actively moving assets around to try to find the best opportunities for growth, and in some cases, to reduce risk or play defense (remember Steve’s bald head).

To reduce risk or play defense, some tactical allocation strategists will go to cash in risky markets. But to do this, the manager has to consider cash to be an asset class to begin with. And believe it or not, most money managers do not consider cash to be an asset class. As such, it’s not an option. They will never go to cash. Instead they use diversification as the main form of risk control. In our opinion, this can be dangerous.

Diversification tends to reduce risk best when the general trend of the market is up. Long-term up trends are known as secular bull markets (1982-2000 was a secular bull) and long-term down trends are known as secular bear markets (1966-1982 was a secular bear). In long-term down trends, diversification may not be sufficient risk control. Why? Almost all asset classes fall during severe corrections. And cash is the only one that doesn’t. In fact, cash is the only asset class that has zero correlation with the market.

Ironically, strategists who use diversification to control risk build their portfolios with uncorrelated investments, but they never invest in the one asset class that has zero correlation with the market!

At Niemann Capital Management, we believe cash is perhaps the most important asset class investors can use to reduce risk. We use a systematic tactical allocation approach with relative strength, trend following and technical analysis to find the best opportunities for growth in low-risk markets. But when risk is high, we go to cash. We believe it’s a better risk management strategy for investors who need growth, but cannot afford to ride the markets down and then hope they recover fast enough.