Sustainable Competitive Advantages Definition Types Examples

Post on: 1 Апрель, 2015 No Comment

by KenFaulkenberry

Sustainable Competitive Advantages

Sustainable competitive advantages are required for a company to thrive in todays global environment. Value investors search for companies that are bargains. In order to avoid purchasing a value trap one of the factors we search for is sustainable competitive advantages.

Without one or more sustainable competitive advantages a company may not be able to recover from whatever caused the stock to become a bargain. We only want to buy the stocks of companies that are real value investments, not value traps. In other words, we want to buy stocks trading below their intrinsic value and will grow cash flow for shareholders.

Definition: Sustainable Competitive Advantages

Sustainable competitive advantages are company assets, attributes, or abilities that are difficult to duplicate or exceed; and provide a superior or favorable long term position over competitors.

Types and Examples of Sustainable Competitive Advantages

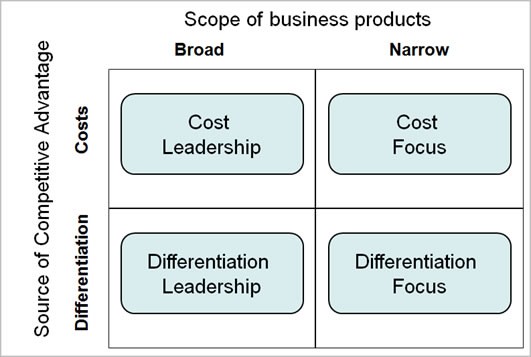

Low Cost Provider/ Low pricing

Economies of scale and efficient operations can help a company keep competition out by being the low cost provider. Being the low cost provider can be a significant barrier to entry. In addition, low pricing done consistently can build brand loyalty be a huge competitive advantage (i.e. Wal-Mart).

Market or Pricing Power

A company that has the ability to increase prices without losing market share is said to have pricing power. Companies that have pricing power are usually taking advantage of high barriers to entry or have earned the dominant position in their market.

Powerful Brands

It takes a large investment in time and money to build a brand. It takes very little to destroy it. A good brand is invaluable because it causes customers to prefer the brand over competitors. Being the market leader and having a great corporate reputation can be part of a powerful brand and a competitive advantage.

Strategic assets

Patents, trademarks, copy rights, domain names, and long term contracts would be examples of strategic assets that provide sustainable competitive advantages. Companies with excellent research and development might have valuable strategic assets.

Barriers To Entry

Cost advantages of an existing company over a new company is the most common barrier to entry. High investment costs (i.e. new factories) and government regulations are common impediments to companies trying to enter new markets. High barriers to entry sometimes create monopolies or near monopolies (i.e. utility companies).

Adapting Product Line

A product that never changes is ripe for competition. A product line that can evolve allows for improved or complementary follow up products that keeps customers coming back for the “new” and improved version (i.e. Apple iPhone) and possibly some accessories to go with it.

Product Differentiation

A unique product or service builds customer loyalty and is less likely to lose market share to a competitor than an advantage based on cost. The quality, number of models, flexibility in ordering (i.e. custom orders), and customer service are all aspects that can positively differentiate a product or service.

Strong Balance Sheet / Cash

Companies with low debt and/or lots of cash have the flexibility to make opportune investments and never have a problem with access to working capital, liquidity, or solvency. The balance sheet is the foundation of the company.

Outstanding Management / People

There is always the intangible of outstanding management. This is hard to quantify, but there are winners and losers. Winners seem to make the right decisions at the right time. Winners somehow motivate and get the most out of their employees, particularly when facing challenges. Management that has been successful for a number of years is a competitive advantage.

Value Investing and Sustainable Competitive Advantages

Companies with one sustainable competitive advantage might be successful. Finding companies with multiple sustainable competitive advantages will greatly improve the chances you have found a real value stock.

Can you think of any sustainable competitive advantages I may have missed?