Supply and Demand How Stock Prices Are Set

Post on: 16 Март, 2015 No Comment

Supply and Demand Key to Understanding Stock Prices

Grant Faint/ The Image Bank/ Getty Images

You may read and hear many explanations about stock prices and why they rise and fall like they do.

You will hear about the influence of earnings on stock prices or the economy or the credit market. While all of these factors figure into price changes. they have little direct impact on prices.

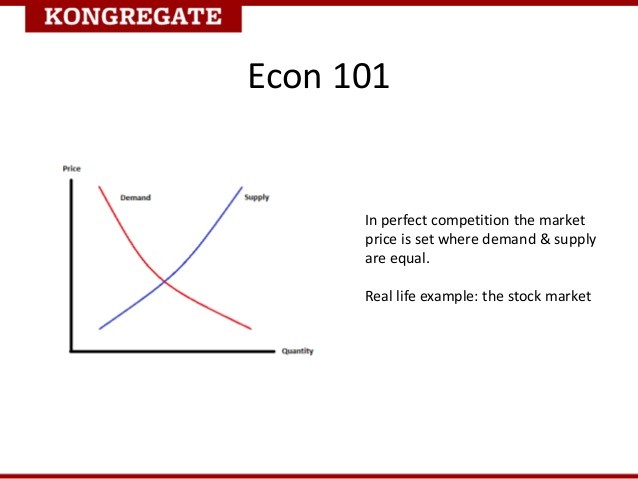

What these and other factors do is change the balance of supply and demand.

Stock prices are a function of supply and demand. Other influences such as earnings, the economy and so on may affect the desirability of owning (or selling) a stock.

If a company reports surprisingly low earnings, demand for the stock may wither. As it does, the balance between buyers and sellers is changed.

Buyers will demand a discount off the existing price and many motivated sellers will accommodate. More sellers than buyers means there is more supply than demand. so the price falls.

Prices Drop

At some point, the price drops to a level buyers find it attractive or some other factor changes the dynamic. As buyers move into the market, demand grows faster than supply and the price goes up.

Some times supply and demand find a balance, which is a price that buyers accept and sellers accommodate. When supply and demand are roughly equal, prices will bounce up and down, but in a narrow price range.

It is possible for a stock to stay in this range for days or months, before something else disrupts the supply/demand balance.

There is a delectate inter-relation ship with supply and demand and a stock’s price.

If demand for a stock exceeds the supply, its price will rise. However, it will only rise to point where buyers suspect demand is waning.

At that point, holders of the stock will sell. Some may have ridden the price up and believe a reversal is coming so they take their profits and sell.

As more owners sell (for whatever reason), the price begins to fall, since there is now more supply than demand. To entice a buyer, the holder of the stock lowers the price.

The same dynamic works on the other side, but in reverse. As the price falls, it will reach a level that buyers find attractive.

As buyers acquire shares, the stock’s price rises since sellers must be enticed to let go of their shares.

This dynamic of supply and demand is the most important truth investors need to learn about stock prices. While investors may want to assign a value to a stock, it is the market and the give and take between supply and demand that sets the price.