Sum of the Parts SOTP Valuations

Post on: 7 Май, 2015 No Comment

This is part 3 of the equity valuation series and we will cover the following

For understanding the below discussion on Sum of Parts, you should be aware of common valuation techniques like Enterprise Value and Equity Value Multiples and Comparable Company Analysis. You may wish to revise these concepts here-

What is Sum of Parts SOTP Valuation?

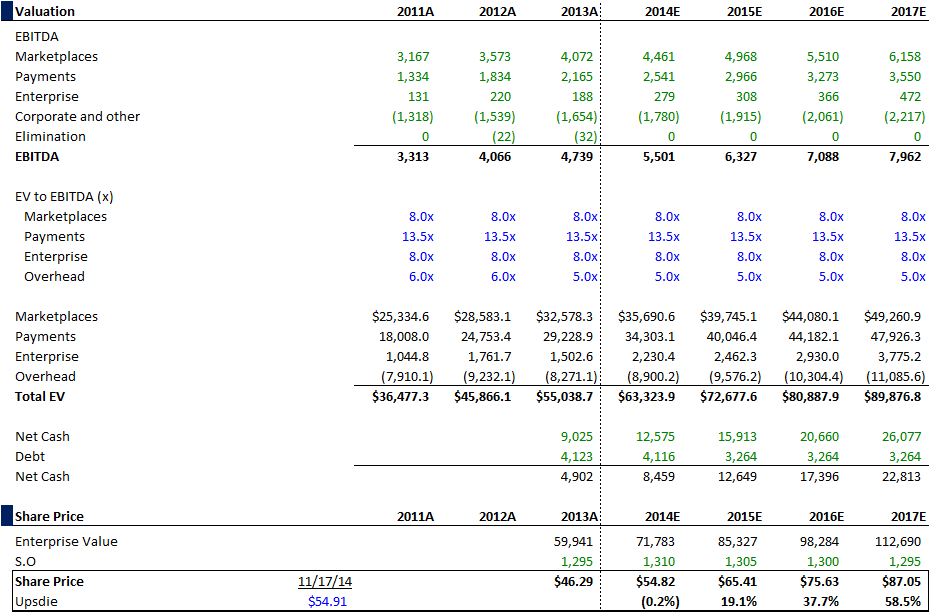

Most large companies operate in more than one business. Valuing a diversified company requires separate valuations for each of its businesses and for the corporate headquarters. This method of valuing a company by parts and then adding them up is known as Sum-Of- Parts (SOP) valuation and is commonly used in practice by stock market analysts and companies themselves. (Simple :-))

Investopedias definition of Sum of Parts -

Valuing a company by determining what its divisions would be worth if it was broken up and spun off or acquired by another company.

Sum of Parts SOTP Valuation simplified

Let us understand Sum of Parts valution using an example of a large conglomerate company (ticker MOJO) operates the following business segments

Valuing MOJO Corp

The common valuation techniques are Relative Valuations, Comparable Acquisition Analysis and the Discounted Cash Flow approaches. These techniques can be applied to value MOJO Corp, however, before we do so, let us answer the questions below -

Should you apply Relative Valuation approach to value MOJO?

- Yes, you can do so. But do you think a single valuation methodology like PE, EV/EBITDA, P/CF, P/BV etc is appropriate to value all the segments. Obviously, this would again be technically INCORRECT.

- Reason - If Ecommerce segment is unprofitable, applying a blanket PE multiple for valuing all segments will not make much sense. Likewise, banks are correctly valued using Price to Book value approach than the other available multiples.

The solution is to value the different parts of the business separately and add the values of the different parts of the business together. This is a sum of parts or SOTP valuation.

How do we apply Sum of Parts valuation in the case of MOJO?

In order to value the conglomerate like MOJO, one can use different valuation tools to value each segment.

- Automobile Segment Valuation - Automobile Segment could be best valued using EV/EBITDA or PE ratios.

- Oil and Gas Segment Valuation - For Oil and Gas companies, the best approach is to use EV/EBITDA or P/CF or EV/boe (EV/barrels of oil equivalent)

- Sotware Segment Valuation - We use PE or EV/EBIT multiple to value Software Segment

- Bank Segment Valuation - We generally use P/BV or Residual Income Method to value Banking Sector

- E-commerce Segment - We use EV/Sales to value E-commerce segment (if the segment is not profitable) or EV/Subscriber or PE multiple

If you are new to Relative valuation methodologies, you can read the following articles to enhance your learning on valuations -

Sum of Parts SOTP Valuation Case Study ITC Ltd

Let us apply SOTP on ITC Ltd, which is a large conglomerate based in India. ITC has a diversified presence in Cigarettes, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, Packaged Foods & Confectionery, Information Technology, Branded Apparel, Personal Care, Stationery, Safety Matches and other FMCG products.

While ITC is an outstanding market leader in its traditional businesses of Cigarettes, Hotels, Paperboards, Packaging and Agri-Exports, it is rapidly gaining market share even in its nascent businesses of Packaged Foods & Confectionery, Branded Apparel, Personal Care and Stationery.

As each of ITCs businesses is vastly different from the others in its type, the state of its evolution and the basic nature of its activity, the challenge for analysts, therefore, lies in fashioning a model that addresses value for each of its unique businesses and then arrive at a value for the Company as a whole.

Below are the segment details of ITC

(p.s. The data taken is from 2008-09 annual reports and does not reflect the current performance of breakup of ITC Ltd Segments. This case study of ITC valuation should only be used for educational purpose and does not be construe any kind of an Investment advise)

Let us apply Sum of Parts SOTP Valuation approach here

Segment 1 Cigarette Segment Valuation

Cigarette is the core business of ITC and the major revenue contributor. It contributes more than 65% to the total revenues generated and 68% of profits is generated by this segment only.