Suitability What Investors Need to Know

Post on: 18 Июнь, 2015 No Comment

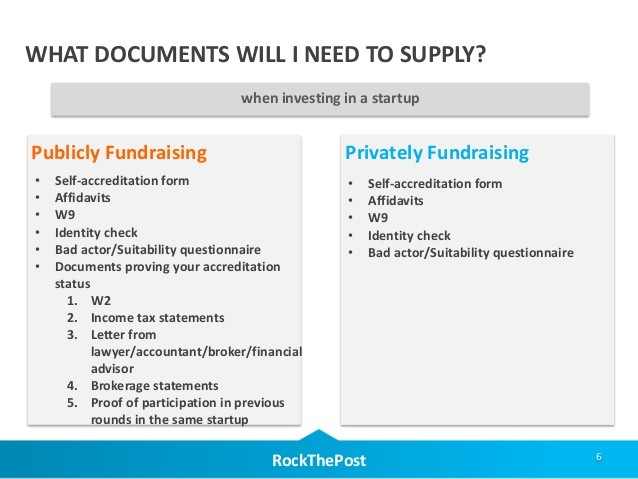

Did you ever wonder why investment professionals ask questions about your investment experience, risk tolerance and more? FINRA’s suitability rule (FINRA Rule 2111) is based on a fundamental FINRA requirement that brokerage firms and their associated persons (sometimes referred to as brokers, financial advisers or financial consultants) deal fairly with their customers. FINRA has prepared this document to educate investors about our suitability rule—and to explain the reasons why firms and their associated persons may ask their customers questions about their financial situation.

Understanding Your Investment Profile

FINRA’s suitability rule states that firms and their associated persons “must have a reasonable basis to believe” that a transaction or investment strategy involving securities that they recommend is suitable for the customer. This reasonable belief must be based on the information obtained through the reasonable diligence of the firm or associated person to ascertain the customer’s investment profile. The rule requires firms and associated persons to seek to obtain information about the customer’s

- age;

- other investments;

- financial situation and needs, which might include questions about annual income and liquid net worth;

- tax status, such as marginal tax rate;

- investment objectives, which might include generating income, funding retirement, buying a home, preserving wealth or market speculation;

- investment experience;

- investment time horizon, such as the expected time available to achieve a particular financial goal;

- liquidity needs, which is the customer’s need to convert investments to cash without incurring significant loss in value; and

- risk tolerance, which is a customer’s willingness to risk losing some or all of the original investment in exchange for greater potential returns.

To help ensure that customers receive suitable investment advice, firms and their associated persons are required to learn as much about a customer’s investment profile as possible before recommending a securities transaction or investment strategy. The rule thus places an obligation on a firm and associated person to seek information from customers. Customers are not required to provide this information; therefore, the suitability rule provides some flexibility when information is unavailable despite the fact that the firm or associated person asked for it.

In this case, when some customer information is unavailable despite a firm’s request for it, the firm may narrow the range of recommendations it makes. The rule does not prohibit a firm from making a recommendation in the absence of certain customer-specific information, if the firm has enough information about the customer to have a reasonable basis to believe the recommendation is suitable based on what the firm knows. The significance of specific types of customer information will depend on the facts and circumstances of the particular case. Of course, the firm itself may require, in order for customers to receive recommendations, that customers provide certain types of information.

Other Rules, Further Questions

FINRA’s Know Your Customer Rule (FINRA Rule 2090) may also cause firms to ask questions to open and service your account. In addition, the SEC requires firms to attempt to obtain a customer’s name, tax identification number, address, telephone number, date of birth, employment status, annual income, net worth (excluding primary residence), and investment objectives regarding certain accounts. Firms also are required to put procedures in place to verify the identity of any person seeking to open an account. Before opening an account, a firm must obtain, at a minimum, the name, date of birth, address and identification number (for example, a social security number) of a customer.