Subscriber guide Wagner Daily swing trading newsletter

Post on: 27 Июнь, 2015 No Comment

The Wagner Daily Subscriber Guide

- market timing model - The core basis of our swing trading strategy is based on following our disciplined, rules-based market timing model. Doing so typically keeps us on the right side of the market (long or short), and positioned with the right amount of capital exposure in the markets that is proportionate to risk. As such, this first section of the newsletter indicates our current overall market bias, based on our proprietary market timing model. Whether you follow our individual trade picks, or just use the newsletter as a market timing guide for your own investments, this section aims to keep you out of trouble when conditions have reversed, while enabling you to maximize profits when all the signals are lining up. Following is an explanation of each of the four modes of our market timing model that will be listed here at all times:

- confirmed buy -

- High odds of the broad market following through to the upside and staging (or remaining in) a meaningful rally

- Positions sized at full (maximum) risk

- No short positions

- Market conditions have improved (when coming from prior decline) and are beginning to show signs that stocks are ready to launch a meaningful rally

- Positions typically sized at 25% — 50% of maximum position sizing

- May still have 1-2 short positions in the portfolio if the buy signal is weak and the prior decline was significant

- Buy signal was recently generated as market was attempting to form a bottom, but the buy signal fails (false buy signal)

- Rather than immediately switching back to sell mode, we adjust the model to neutral.

- In this mode, we can be positioned either long or short

- Position size of all new trade entries will be lighter than usual, in order to reduce risk

- Only a limited number of positions are initiated in order to reduce risk. Substantial cash position recommended.

- Current intermediate-term market rally is over and odds of the market pulling back are very high (when the broad market is extended from a multi-month rally)

- We immediately get off margin

- Will be focused on taking winners off the table, tightening stops on long positions, and/or reducing long exposure significantly

- In some cases, we will sell all positions and quickly move 100% to cash.

- A few short positions initiated

- Broad market is breaking down and the odds of a significant decline are high

- No long exposure, as we do not trade against the market trend

- Short exposure (including inverse ETFs) is at its highest level, in order to profit from a downtrending market

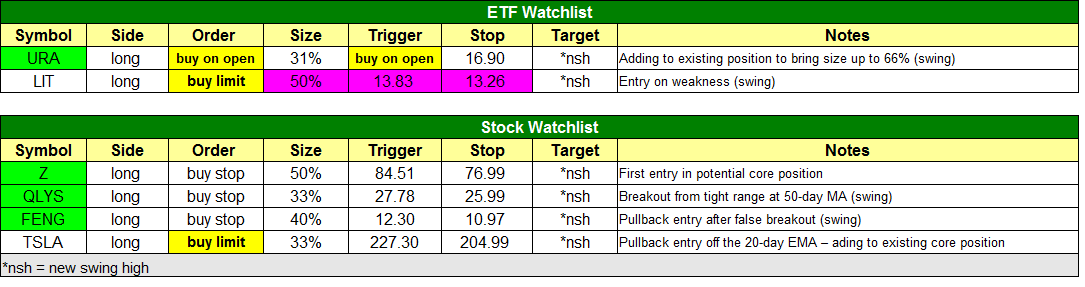

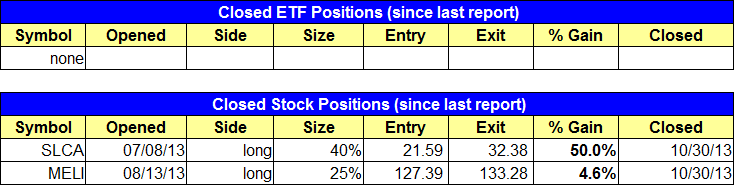

- today’s watchlist - When clear stock or ETF swing trade opportunities present themselves, this is where the specific details of the technical setup are listed. Specific share size, trigger, stop, and target prices are all provided. The frequency of setups provided is dependent on both market conditions and our current number of open positions, but we typically target several new stocks or ETFs for entry each week. Holding times vary, but average between 1 to 3 weeks.

Note that any cells shaded in green color indicate a new addition to the watchlist since the previous day’s report.

- Symbol -

Ticker symbol of the stock or ETF

Indicates whether the trade is a long entry (buy) or short entry (sell short)

This is the order type for the trade. If new to trading, a basic explanation of order types can be found here .

The share size we are targeting for trade entry, listed as a percentage of your maximum risk per trade. Read on for further explanation.

How to quickly and easily determine your ideal share size

The first step is to establish your personal maximum capital risk per trade. This is the amount of real cash in your trading account you personally are comfortable losing if any individual trade hits its stop loss.

For experienced traders, a safe and typical risk level is 1% to 2% of account equity per trade. New traders should initially risk no more than 0.5% until they become more comfortable with the trading system.

For the examples below, let’s assume you are trading with a $20,000 account, with a personal maximum risk per trade of 1% ($20,000 X 1% = $200).

Account size = $20,000

Maximum risk per trade = 1% of account equity

Maximum dollar risk per trade = $200

Again, your actual maximum percentage risk per trade will depend on your account and your personal risk parameters, which must be established before trading. In no case do we ever recommend a trader risks more than 3% of account equity per trade because just a string of losing trades could quickly cause you to dig a substantial hole that would take a while to recover from.

In the Wagner Daily watchlists, under the Share Size column, we display size as a percentage of a full position. A full position will be listed as 100%, and a half position 50%.

So, for example, if we list stock stock XYZ as a buy stop entry with the following trade details:

XYZ

Share size = 75%

Entry = 30.12

Stop = 28.62

Actual share size =.

First, we must establish the dollar risk of the trade. This trade calls for 75% of our maximum risk. We already know that our maximum risk per trade is $200 (1% of a $20,000 account), so we simply multiply our maximum risk per trade by 75% to arrive at $150 risk:

$200 x 75% = $150 (dollar risk of this trade)

The next step is to calculate the width of the stop by taking the entry price ($30.12) minus the stop price ($28.62):

30.12 — 28.62 = 1.50 points (stop width)

Once we have our maximum capital trade risk ($150) and stop width (1.5 points), we now divide trade risk ($150) by stop width (1.5) to arrive at our share size:

$150 / 1.50 = 100 shares (you can optionally round down if not a round lot share size)

As you can see, once you have established your maximum risk per trade (which should not change from trade to trade), there are only two simple steps to calculate your size.

Here is another example for you:

Your actual trading account size is $50,000 and your maximum risk per trade (established personally by you) is 2%:

ABC

Share size = 25%

Entry = 60.20

Stop = 58.95

Actual share size =.

First, we must establish the dollar risk of the trade. This trade calls for 25% of our maximum risk. We already know that our maximum risk per trade is $1,000 ($50,000 x 2%), so we simply mutliply our maximum risk per trade by 25% to arrive at $250 risk:

$1,000 x 25% = $250 (dollar risk of this trade)

The next step is to calculate the stop width by taking the entry price (60.20) — stop price (58.95):

60.20 — 58.95 = 1.25 points (stop width)

Once we have our maximum trade risk ($250) and stop width (1.25 pts), we now divide trade risk ($250) by stop width (1.25) to arrive at our share size.

$250 / 1.25 = 200 shares entry

Exact price that the stock or ETF must trade through before we will enter the trade. For a long setup, the stock or ETF must trade at or above the trigger price (for buy stop) or the maximum price we will pay for the trade (for buy limit). For a short setup, it must trade at or below the trigger price (sell stop). Note that we will only enter the position if the trigger price is hit during the trading day. Entering a trade before it trades through its pre-determined trigger price substantially increases the risk of loss, and is not recommended.

IMPORTANT NOTES:

- 5-minute rule - Market makers can and do manipulate the opening price action of stocks and ETFs. To avoid false triggers for trade entry, we have a very simple rule in place in which we do not take any entries (long or short) that trigger within the first five minutes of trading. After 5-minutes have passed (9:35 am ET), we mark the 5-minute high (or low if short entry) and add (or subtract) 10 cents to that number as the new entry price.

Buy setup example:

The night before the market opens, we list stock ABC as a buy with a trigger price of $40.00. During the first 5 minutes of trading, ABC stock hits our buy trigger price at $40.00. Because our entry triggered before 9:35, we ignore the entry and apply the 5-minute rule. After 5-minutes have passed, we see that the 5-minute opening high was $40.20, so we add 10 cents to the 5-minute high, giving us a new buy trigger price point of $40.30.

The process is the same for a short selling setup, but we use the 5-minute low and subtract 10 cents from that number as the new short entry.

Short selling setup example:

The night before the market opens, we list stock XYZ as a short setup (betting the price will go down), with a short trigger price of $50.00. During the first 5-minutes of trading, XYZ stock trades below our short entry at price of $50.00. Because our entry triggered before 9:35, we ignore the entry and apply the 5-minute rule. After 5-minutes have passed, we see that the 5-minute low was $49.75, so we subtract 10 cents from the 5-minute low, giving us a new short entry point of $49.65.

If you are unable to watch the market during the open (such as if you have a daytime job), we highly recommend opening a trading account with a brokerage firm that allows the placement of conditional orders. This means you can set your order to automatically not go live until 9:35 am, rather than immediately on the market open. Two brokers we recommend for this are Interactive Brokers and TradeStation. both of which offer very cheap commissions and high technology for active traders.

With regard to opening gaps, if the 5-minute high of the gap is more than 1.3% above the trigger, then the setup is cancelled. See below for details.

If the setup triggers for entry, this is the initial price at which we will have a protective stop market order (we always use stop market, not stop limit orders). As a position becomes profitable, this stop price will often be trailed higher in order to lock in profits. Any new adjustments to the stop price are also reported in the next day’s newsletter, under the open positions section. Note that trades are automatically closed if they hit their predetermined stop prices during the next trading session.

This is the roughly anticipated price we expect the stock or ETF will move to. Note that we automatically close trades as soon as they hit their target prices (unless the stop price is hit first). However, this does not mean we will always hold the stock or ETF to that price. When conditions warrant, we will take profits before the predetermined target price. Again, any overnight changes to the target price are reported under the open positions section.

As always, please feel free to e-mail us with any questions, comments, or feedback on The Wagner Daily newsletter. Enjoy your subscription and good trading to you!

DISCLAIMER: There is a risk for substantial losses trading securities and commodities. This material is for information purposes only and should not be construed as an offer or solicitation of an offer to buy or sell any securities. Morpheus Trading, LLC (hereinafter The Company) is not a licensed broker, broker-dealer, market maker, investment banker, investment advisor, analyst or underwriter. This discussion contains forward-looking statements that involve risks and uncertainties. A stock’s actual results could differ materially from descriptions given. The companies discussed in this report have not approved any statements made by The Company. Please consult a broker or financial planner before purchasing or selling any securities discussed in The Wagner Daily ( hereinafter The Newsletter). The Company has not been compensated by any of the companies listed herein, or by their affiliates, agents, officers or employees for the preparation and distribution of any materials in The Newsletter. The Company and/or its affiliates, officers, directors and employees may or may not buy, sell or have a position in the securities discussed in The Newsletter and may profit in the event the shares of the companies discussed in The Newsletter rise or fall in value. Past performance never guarantees future results.

© 2002-2013 — Morpheus Trading, LLC

Duplication without written permission is strictly prohibited