Stocks v Estate – Which Investment is better in the long run

Post on: 12 Июль, 2015 No Comment

The ownership of land is deeply rooted in the minds of people all over the globe. Land is seen as the one investment that is solid and permanent, and for most people it is the single largest investment they would make during their entire lives. The American Dream has long included the ownership of Real Estate, but when you move beyond this natural impulse to own property, and look at Real Estate purely from an investment opportunity, how does the picture change? Have the historical returns on Real Estate Investment measured up to the confidence it has received.

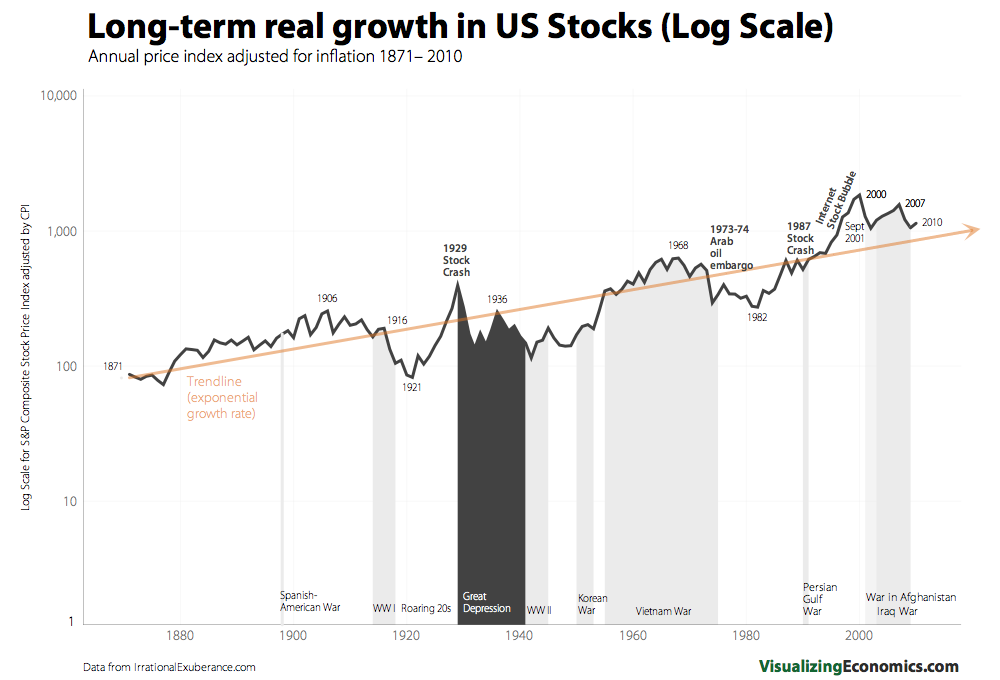

The answer is not clear. The annual average Rate of Return (ROR) on Real Estate between the years 1900-2012 (Including the housing bubble of 2008) was around 7.2% as shown in the US housing price index chart below. During the same period, the average rate of inflation was around 3.2%, so it was obviously a better investment to buy Real Estate than to keep cash below the mattress. (The Real Estate average ROR was around 7.6% between 1900-2008). The rate of return for the Dow Jones Industrial Average (DJIA) for the same period was around 9.2% as shown in the Dow Long Range Trend chart below. These figures would suggest that Real Estate investments closely track the Stock Market returns.

Real Estate Investors might want to make the claim that land ownership and its value as an investment predates the Stock Market by thousands of years. This is true; however the new global economy has created a whole new playing field, and Return on Investment (ROI) must be determined within the framework of a rapidly changing, internet age, global economy. It is all well and good to study the past, but in investment strategy, the past only offers clues and does not provide clear predictions for future investments.

A look at the historical ROI for Real Estate investments shows that they tend to be more stable and less likely to spike up and down in erratic and unpredictable fashion like the Stock Market (with the exception of the housing bubble of 2008). Many financial advisors recommend the inclusion of 10%-20% in Real Estate investment in any portfolio as a hedge against market fluctuations. Real Estate investments, however, tend to have high transaction costs and require large sums of cash for down payments. They also carry maintenance fees and other auxiliary expenses and are not easily liquidated.

These negative factors have led to the popularity of investments in Real Estate through Real Estate Investment Trusts (REITs). REITs are mutual funds of Real Estate which enable investors to invest in Real Estate without the complications of high transaction costs or property expenses.