Stock Valuation Methods and How to Invest Intelligently

Post on: 29 Апрель, 2015 No Comment

In case you are new to investing in stocks, you might not know what stock valuation is. much less which stock valuation methods you should use as part of your investment toolbox .

At the very basic level, stock valuation is a method of calculating values of stocks. You are trying to figure out what individual stocks are worth before you invest in them. Yep, that’s it.

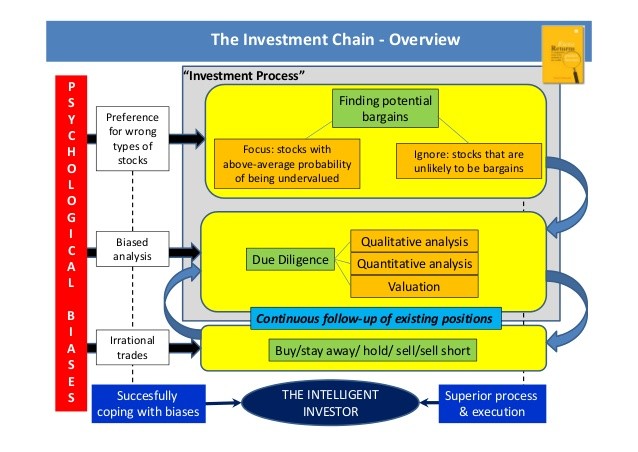

Even though the definition of stock valuation is fairly straightforward, the actual process is critically important to investors. You need to employ various stock valuation methods to help predict future market prices. As you probably know, the key to a successful investment is to buy low and sell high.

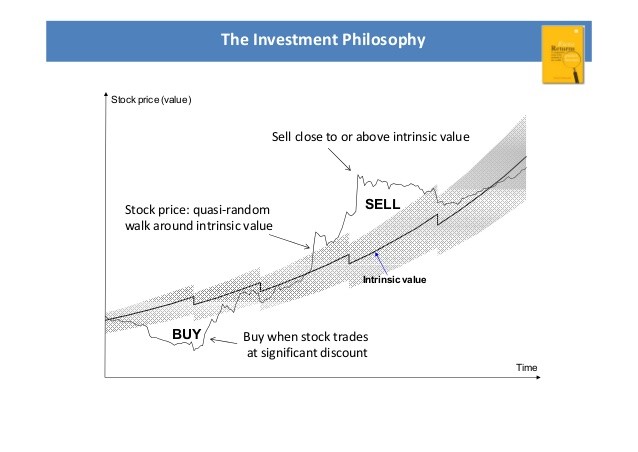

Stock valuation strategies allow you to determine which stocks are undervalued so you can buy them and which stocks are overvalued so you can sell them.

Understanding the Basic Stock Valuation Methods:

There are many different stock valuation methods available to investors, but the two most common methods are ratio analysis and discounted cash flow. The rest of this article will focus on these methods and how they can help you determine what a stock is worth before investing your hard-earned money into one that is not going to help you meet your investment goals.

Ratio Valuation:

Many investors use ratio valuation to determine the potential value of a stock. This method relies on financial statements that provide informative financial ratios, including price-to-earnings ratio (P/E), price-to-book ratio (P/B), price-to-sales ratio (P/S), price earnings to growth ratio (PEG) and return on equity ratio (ROE).

To determine the stock’s value, you compare its calculated ratios to threshold values, historical values, competitors and the overall market. For instance, if a stock has a historical value average of 15 and the price-to-earnings ratio is currently at five, it might be a good time to buy the stock because it appears to be undervalued. However, you should not use only a single ratio to determine the value of a stock. It is important to compare it with other ratios to get more information on its potential value.

Discounted Cash Flow:

The second stock valuation method investors often use is called the discounted cash flow (DCF) method. The concept of this strategy is to determine how much a company is currently worth based on how much cash it is going to potentially generate in the future. For example, if a company is able to make $1 per share each year and it is going to continue this pattern in the future, you are able to determine what the future cash flow is valued at today.

To better understand this method, you need to understand how present value relates to future value. Most people would rather have $100 today rather than $100 after a few years because they can invest that $100 today and have it work more than $100 in the future. Confused yet? Probably so, but the basic idea is that you want a company’s value to be more today than it is in the future because you can invest the value now to make more money later.

Once you calculate the stock’s intrinsic value, you then compare it with the current stock market price. This will allow you to determine whether it is overvalued or undervalued, which will influence your decision to buy or sell. Again, the goal is to buy the stock when it is undervalued and sell when it is overvalued, so understanding the DCF method is a way to make meeting this goal easier.

There are several different types of the DCF stock valuation method based on the kind of cash flow you use in your calculation. For instance, you would use the dividend discount model or DDM if your analysis is focused on the dividends the company pays to its shareholders. If your cash flow focus is on the equity of a company after all expenses, debts and reinvestments are taken into account, you would use the discounted equity model. All of these different types of stock valuation methods work on the same premise and use the same logic as the DCF model.

The main drawback of the DCF stock valuation strategy is that you have to make several assumptions and estimates before you can determine a stock’s intrinsic value. This makes it more complicated than ratio valuation, even if it does pinpoint value a little more accurately.

The stock valuation methods you use will ultimately be based on your preferences and financial goals. It is recommended you learn more than one so that you can use whichever method is more appropriate to the action you want to take with a particular stock. And, don’t feel dumb if you don’t yet understand either of these methods. Both of them take time to learn, just as investing itself does. Just don’t give up and keep trying to lessen your risks associated with investing by learning these techniques.

More Good Reads:

Comments

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D100&r=G /% Mel @ brokeGIRLrich says